HBAR Price Needs A Near 40% Rally To Recover November Losses

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation. However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation.

However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is not helping its case.

Hedera Traders Are Placing Shorts

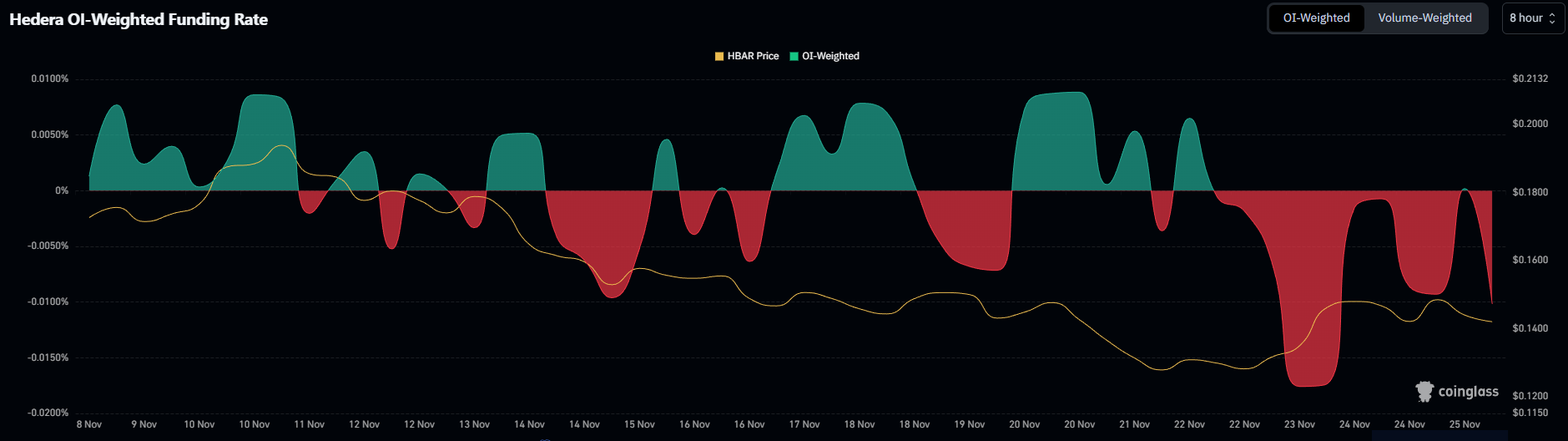

Funding rates across major exchanges indicate that traders remain hesitant. The current negative funding rate suggests that market participants expect more downside and are opening short positions to profit from a potential decline. This type of sentiment often emerges during extended consolidation phases, where traders lose confidence in the asset’s ability to rebound.

However, funding rates are highly reactive and can shift quickly. Their frequent fluctuations signal volatility and uncertainty rather than a firmly bearish trend. If sentiment flips and traders begin to unwind shorts, HBAR could benefit from a sudden surge in buying pressure, helping it regain lost ground.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

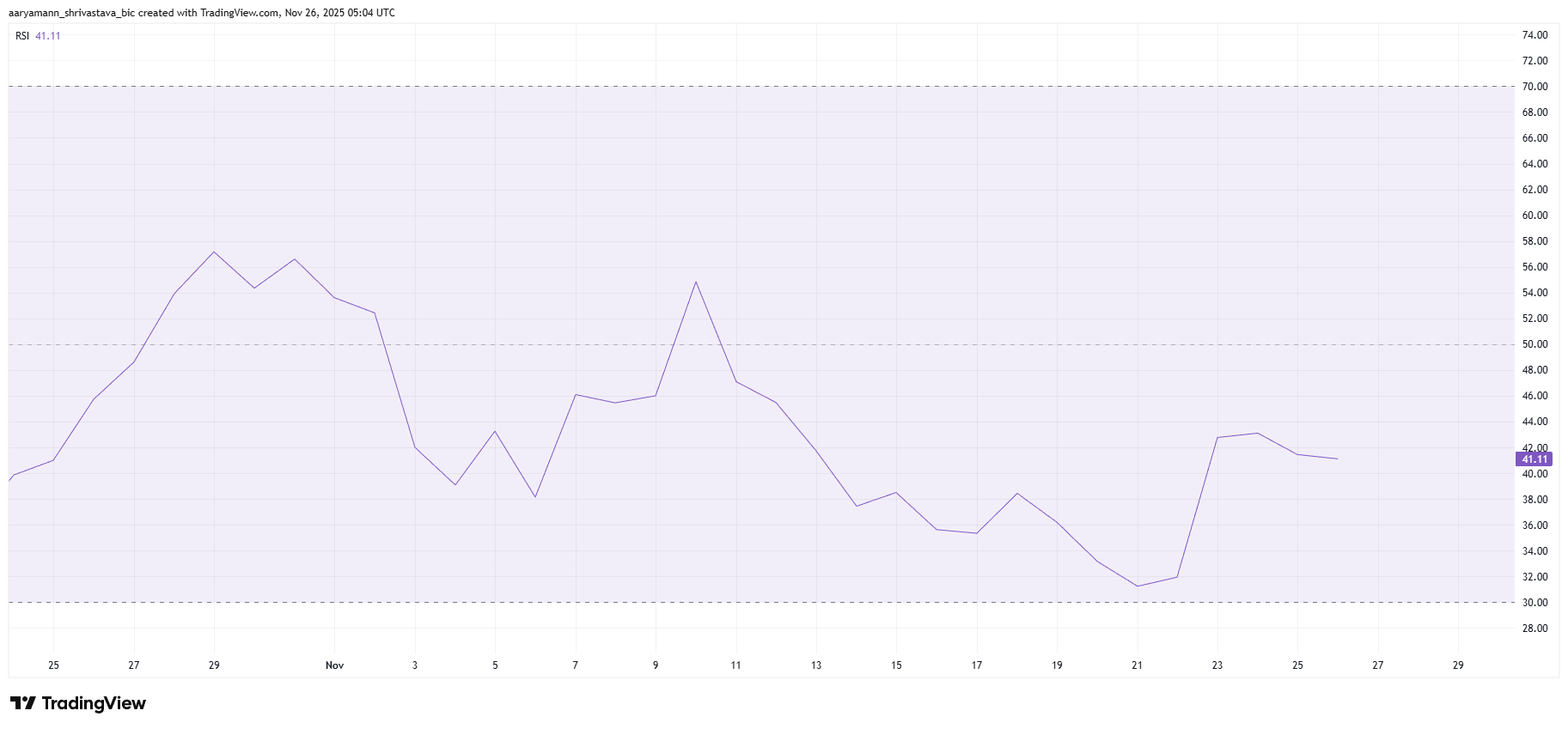

The broader momentum picture remains weak. Hedera’s relative strength index is sitting below the neutral 50.0 level, firmly in bearish territory. This positioning reflects ongoing market pressure and a lack of strong bullish conviction. When the RSI holds in the negative zone, price action often struggles to form higher highs or generate sustainable rallies.

The persistent market-wide caution also weighs on HBAR’s ability to mount a recovery. Unless momentum indicators shift upward, the altcoin could remain stuck in its current range.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Has A Long Way To Go

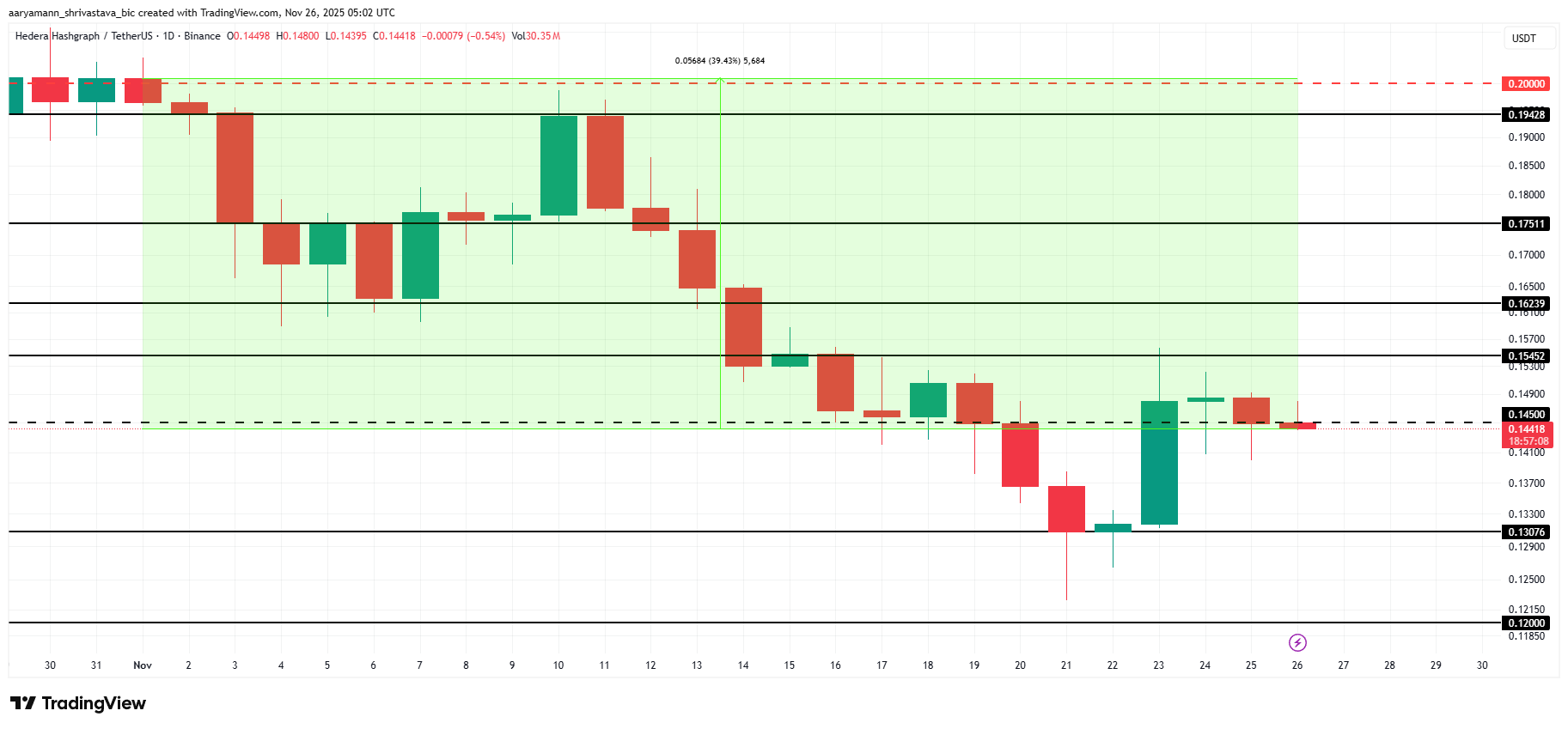

HBAR is trading at $0.144, sitting just under the important $0.145 resistance level. To begin a meaningful climb, the altcoin must flip this resistance into support. This would allow it to move toward $0.154 — a level that has previously acted as a ceiling.

Based on current indicators, HBAR may continue consolidating between $0.154 and $0.130. Bearish sentiment and weak macro signals suggest the altcoin could remain trapped in this zone unless a strong catalyst emerges.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

To recover its November losses, HBAR needs roughly a 40% rally, pushing it toward the $0.200 region. This requires breaking through several resistance levels, starting with $0.154. If HBAR can reclaim that barrier, a move to $0.162 and higher becomes possible, giving the altcoin a chance to invalidate the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Texas Bitcoin Holdings Could Set Example for Statewide Crypto Integration

- Texas became the first U.S. state to invest $5M in Bitcoin via BlackRock's IBIT ETF under the SB 21 law, establishing a $10M strategic reserve. - The ETF purchase serves as a temporary measure while Texas develops infrastructure for self-custodied Bitcoin holdings by 2026. - This move signals growing institutional adoption, with Texas planning to shift to direct custody and potentially influence future state crypto strategies.

Fed Faces Rate Challenge: Robust Employment Meets Consumer Gloom

- U.S. jobless claims fell to 220,000 in late November, signaling labor market resilience despite broader economic uncertainty. - Consumer confidence dropped to 88.7, with pessimism over business conditions and income growth raising recession risks. - Treasury Secretary Bessent emphasized economic strength and 2026 growth optimism, downplaying trade policy impacts on inflation. - Fed faces conflicting signals: strong jobs data vs. weak consumer sentiment and 4.8% inflation expectations complicate December

ALT5 Sigma Faces Fraud Investigation After Delayed SEC Filing Amid Growing Financial Troubles

- ALT5 Sigma faces SEC scrutiny over delayed disclosure of CEO suspension, potentially violating 4-day reporting rules. - Financial distress deepens with 57.9% revenue decline, -74.89% net margin, and 0.73 Altman Z-Score signaling bankruptcy risk. - $1.5B WLFI token purchase linked to Trump-connected entities raises fraud concerns amid circular transactions and delayed disclosures. - Market indicators show oversold conditions (RSI 36.91), weak liquidity (0.88 current ratio), and 1.65 beta amplifying volati

XRP Price Prediction: Can XRP Break Out From This Key Consolidation Zone?