Irys Launches With Big Swings: Can the New Token Hold Its Early Gains?

Irys launched only a few hours ago, and the price is already showing a wide, early trading range. It is a Layer 1 data chain built to merge on-chain data storage and smart-contract execution, which has made it one of the more anticipated launches this cycle. A possible airdrop-related supply unlock also means early IRYS

Irys launched only a few hours ago, and the price is already showing a wide, early trading range. It is a Layer 1 data chain built to merge on-chain data storage and smart-contract execution, which has made it one of the more anticipated launches this cycle. A possible airdrop-related supply unlock also means early IRYS price volatility is expected.

Now the chart shows the first real test: both upside and downside remain open, and volume signals will decide the first trend.

Early Strength Holds, but Volume Signals a Cautious Start

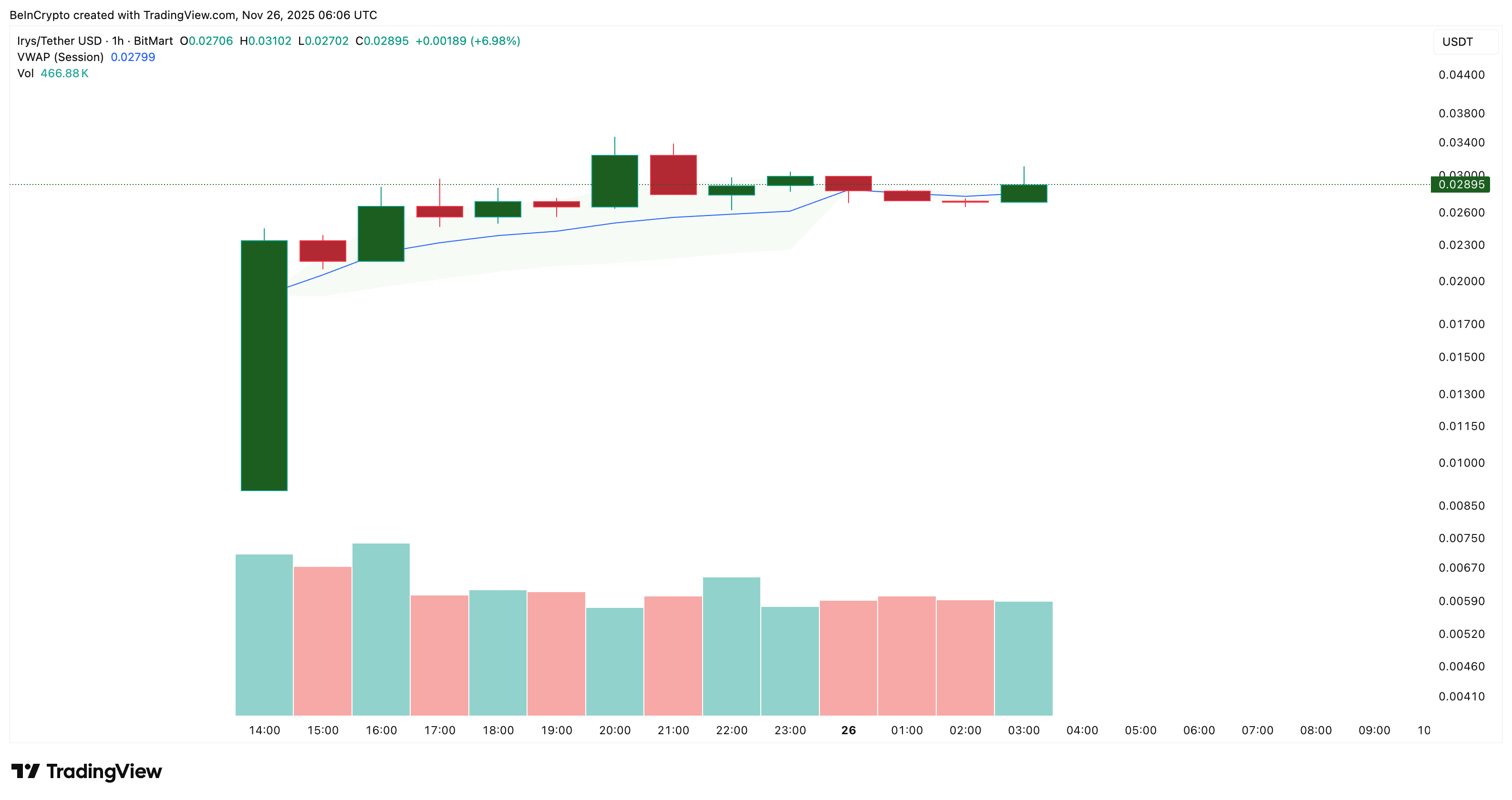

On the 1-hour chart, the IRYS price is using the volume-weighted average price (VWAP) as its main guide. VWAP tracks the average trading price in a session, but weights each trade by its volume, so it shows where the “real” bulk of trading is happening.

Since launch, the first large green candle closed above the VWAP line, which kicked off the initial move.

Standard volume bars back this up: early candles came with heavy volume, then activity cooled but stayed stable while price held near or slightly above VWAP.

The last two candles briefly closed below the line, but the next candle quickly reclaimed it. That shows dips below VWAP are being bought for now, even though no clear volume spike has appeared to confirm a strong trend yet.

VWAP Shows Active Buying:

TradingView

VWAP Shows Active Buying:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

OBV on the 1-hour chart presents the other half of the picture. On-Balance Volume (OBV) tracks whether real trading volume is flowing in or out.

Since launch, the IRYS price has made a higher low. Yet, the OBV has made a lower low, meaning buyers are in control of price but not yet of volume. OBV sits in negative territory near –389,970, and the first level it must reclaim is 70,960. Clearing that level and then the next band at 583,600 would mark a proper higher-high formation.

It would then confirm a volume-supported reversal on the one-hour chart.

Buyers Gaining Control:

TradingView

Buyers Gaining Control:

TradingView

A possible IRYS airdrop distribution earlier could also explain the initial negative OBV print, as early holders likely claimed and sold small amounts.

Together, VWAP and OBV show the full picture. VWAP tells us where most trading took place, but OBV shows who is actually controlling that volume. Right now, price is holding above VWAP, but OBV still lags. That is why the next move depends on whether volume flows back to buyers.

Key Levels Show a Wide Early Range for IRYS Price

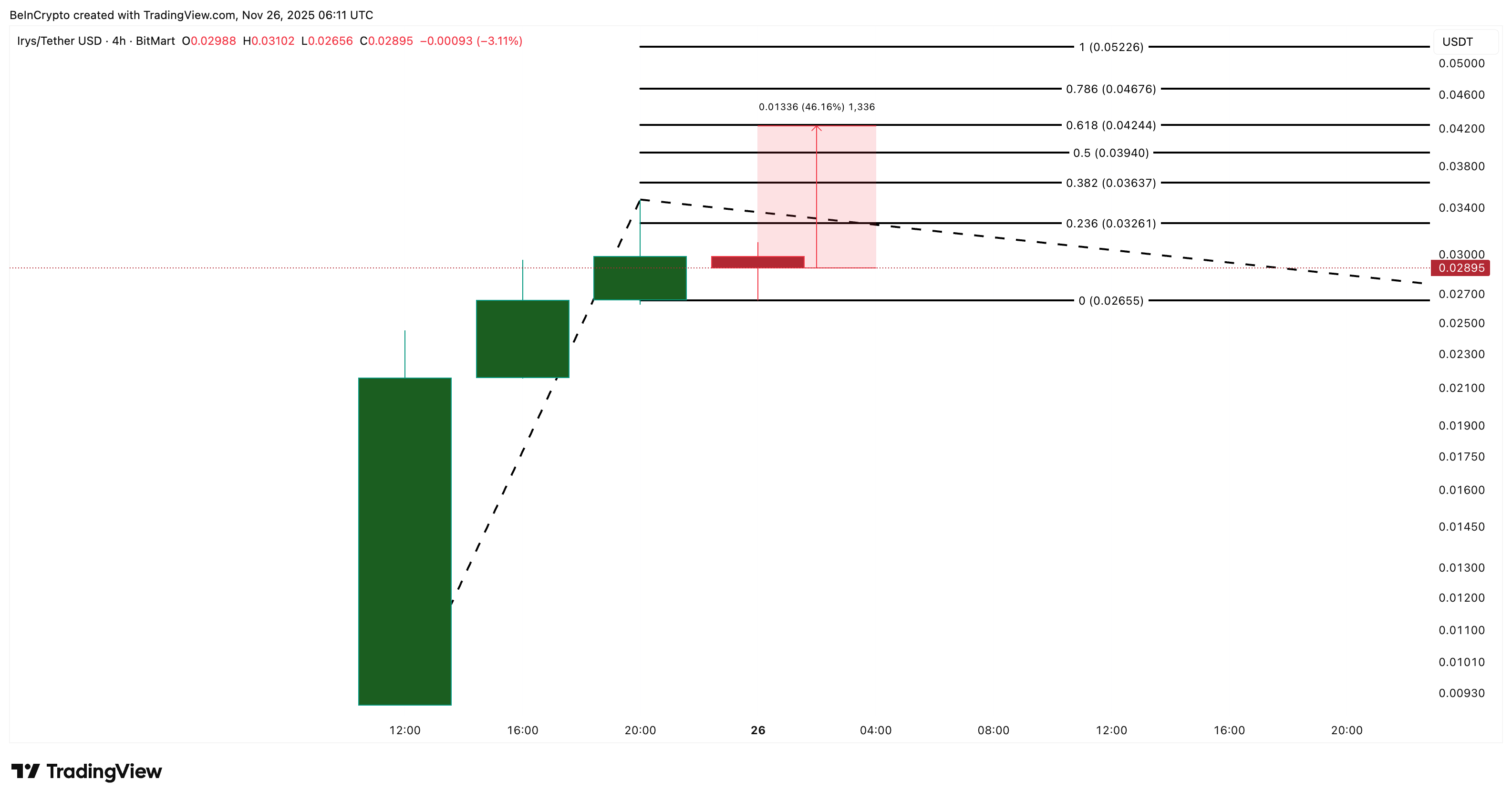

The 4-hour IRYS price chart shows a fresh trend-based Fibonacci layout. The immediate upside level is $0.032, followed by $0.039 and the strongest early resistance at $0.042. This last zone sits near the 0.618 Fib, often the level where early listings find their first real sell wall.

If momentum strengthens, $0.052 remains the top extension for the first leg.

IRYS Price Analysis:

TradingView

IRYS Price Analysis:

TradingView

But this requires OBV strength and a VWAP-supported expansion, not just isolated green candles.

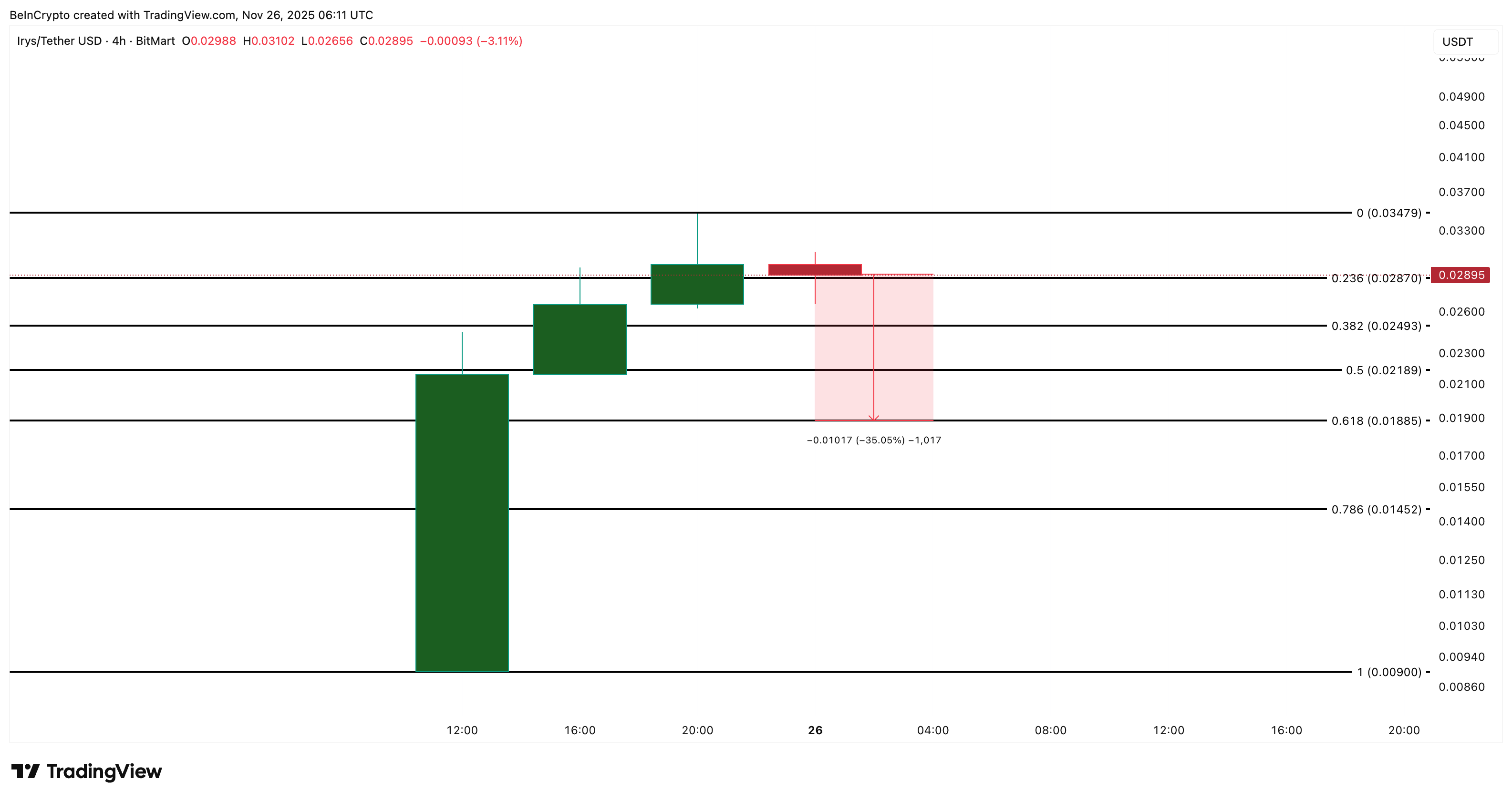

On the downside, the key support sits at $0.024, with deeper support at $0.018, followed by $0.014. A break below $0.018 even exposes $0.009. That would signal that the first post-launch IRYS price phase is turning into a full retracement.

However, that would mean that OBV might have broken down its ascending trendline, highlighted earlier on the 1-hour chart.

IRYS Price Analysis (Downside Projection):

TradingView

IRYS Price Analysis (Downside Projection):

TradingView

Right now, Irys trades in the middle of this wide band, and both outcomes remain possible. VWAP support and OBV improvement would open the upside. However, fading volume and a break under $0.018 would shift control to sellers.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dovish Hints Meet Fed Prudence: Prediction Markets Reflect 87% Probability of Rate Reduction

- Polymarket's prediction markets show 87% odds of a December Fed rate cut, driven by rising crypto and stock market optimism. - Fed officials like Waller and Williams signal potential easing, while Goldman Sachs and Bill Gross endorse the cut likelihood. - Rate-cut expectations surged as maintaining current rates dropped to 18%, with CME FedWatch and Kalshi aligning at ~84% probability. - Lower rates could boost economic activity and crypto adoption, though inflation risks and delayed jobs data remain key

ADGM's Endorsement of Animoca Establishes It as a Center for Web3 Innovation

- Animoca Brands secures in-principle approval from ADGM to operate as a virtual asset service provider, marking a key regulatory milestone. - The approval aligns with ADGM's strategy to position itself as a global fintech and blockchain innovation hub with flexible regulatory frameworks. - This endorsement enhances Animoca's credibility for institutional partnerships while reflecting growing mainstream acceptance of Web3 assets. - ADGM's balanced regulatory approach supports innovation in virtual economie

Hyperliquid (HYPE) Price Rally: How Infrastructure and Institutional Support Drive DeFi Expansion

- Hyperliquid (HYPE) gains DeFi traction with 70-80% market share via HyperEVM/Unit innovations and 78% user growth by Q4 2025. - SEC S-1 compliance and USDH stablecoin (backed by BlackRock/Stripe) strengthen institutional trust and $1B treasury partnerships. - $50 price target depends on absorbing $314M token unlock risks, maintaining technical resilience, and resolving governance controversies. - Macroeconomic factors including Bitcoin performance and Fibonacci level retests will determine HYPE's Decembe

The Transformation of the Xerox Campus and Its Impact on Property and Industrial Investments in Webster, NY

- Webster , NY, redevelops 300-acre Xerox brownfield with $9.8M FAST NY grant to create industrial hub by 2025. - EPA-compliant remediation and infrastructure upgrades align with tech-enabled manufacturing and renewable energy goals. - Project includes fairlife® dairy plant (250 jobs) and leverages low 2% vacancy rates to attract high-value industrial tenants. - State partnerships and zoning reforms position site as scalable platform for semiconductors , logistics, and mixed-use growth. - Initiative exempl