BitMine (BMNR) Stock Jumps 15% But Misses Critical Recovery Signal By Inches

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January. The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January.

The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Continues To Accumulate ETH

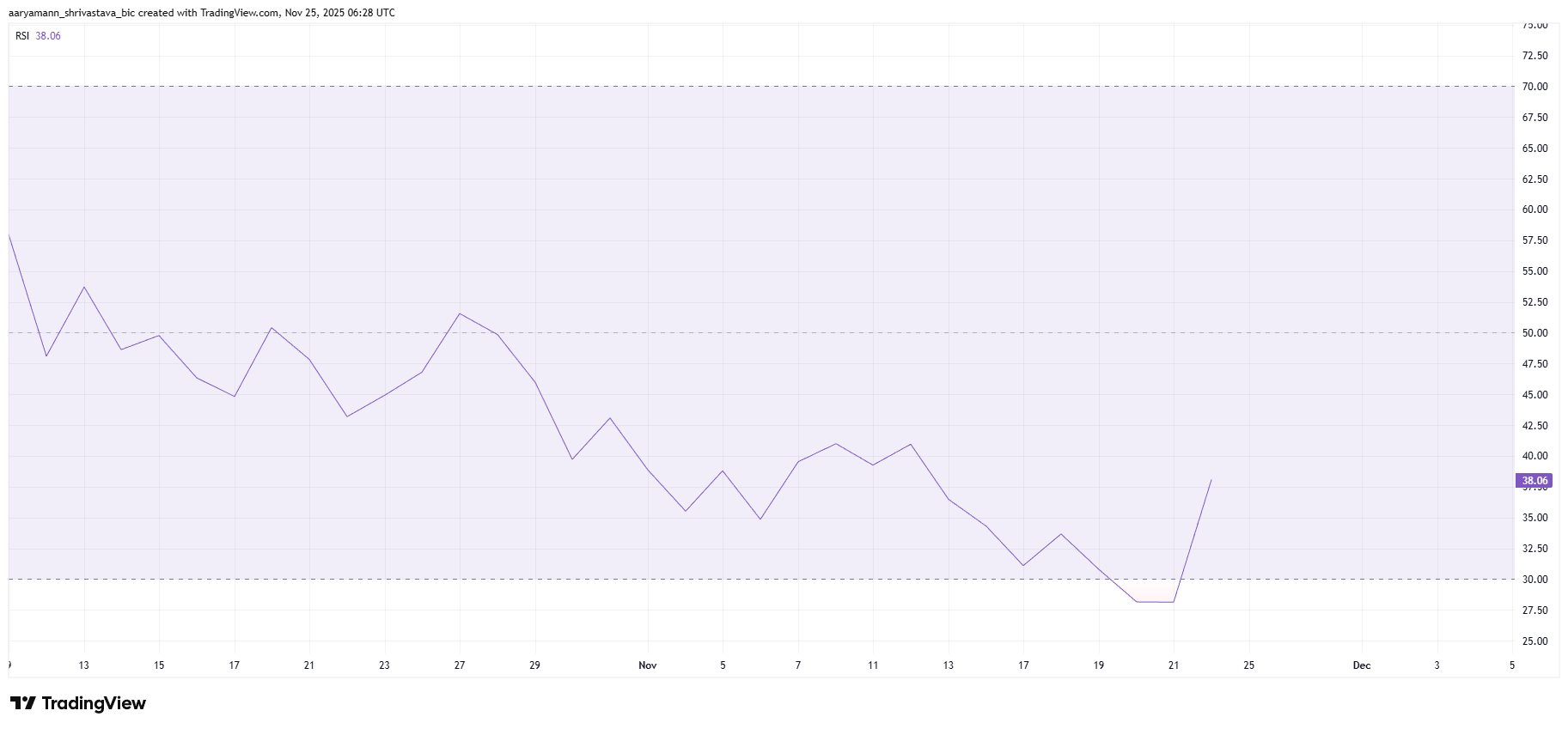

The relative strength index is showing a sharp uptick following BitMine’s major ETH acquisition. The purchase, equivalent to roughly 3% of Ethereum’s total circulating supply, sent a clear signal of confidence from the company. This triggered widespread optimism among investors and lifted the RSI out of oversold territory, a zone that typically precedes trend reversals.

However, the RSI alone cannot confirm a sustained bullish shift. While the indicator’s rise suggests improving sentiment, BMNR still requires consistent buying pressure to support a full recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

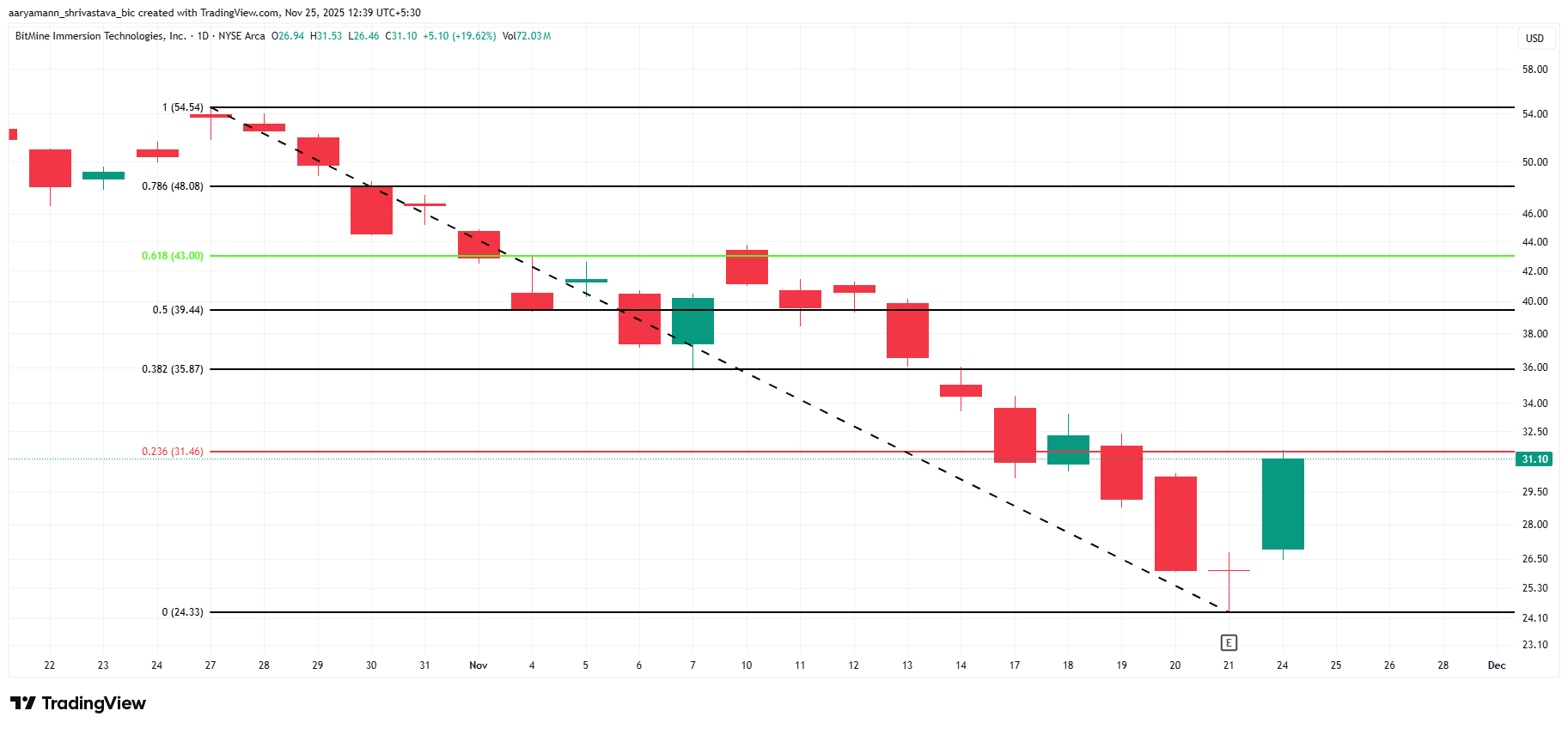

Macro momentum indicators highlight another critical area to watch. The Fibonacci Retracement tool shows that BMNR is approaching the 23.6% Fib line, a historically important support level during bearish phases. This threshold, positioned at $31.46, represents a potential pivot point for the stock.

Reclaiming this level as support would strengthen BitMine’s recovery outlook and enable a more convincing bounce. However, the stock remains just below this threshold and still requires stronger bullish participation to break through.

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Price Reclaims $30

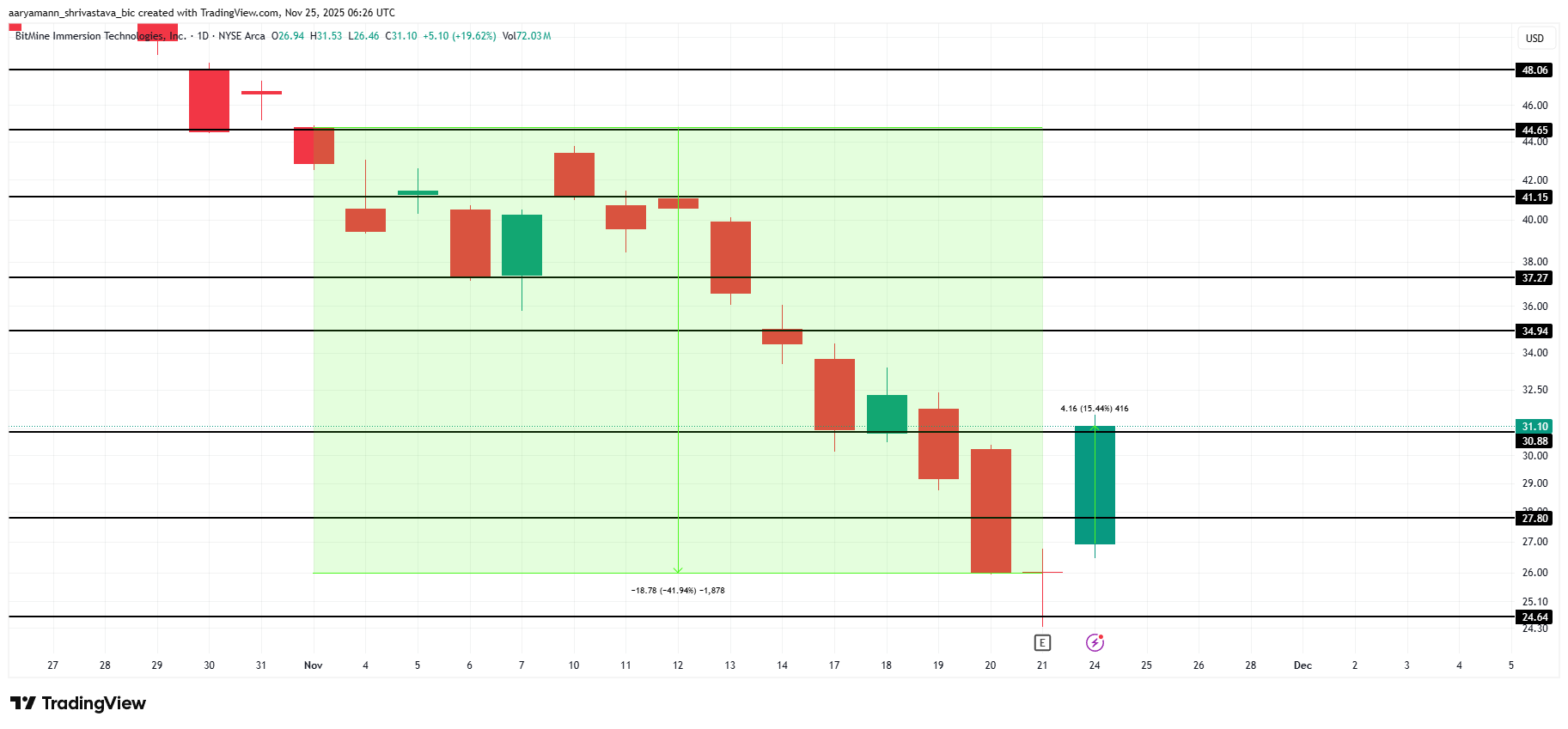

BMNR is trading at $31.10, hovering above the crucial $30.88 support zone. Despite the recent ETH-driven rally, the stock remains down nearly 42% for the month. This positions Monday’s surge as an important—but not yet decisive—step toward recovery.

If bullish momentum persists, BMNR could climb toward the $34.94 resistance level. A break above this barrier may pave the way for further gains toward $37.27 and beyond. This is especially true if investor confidence strengthens around BitMine’s aggressive accumulation strategy.

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

If uncertainty prevails and the company fails to capitalize on the excitement surrounding its ETH purchase, BMNR risks losing the $30.88 support. A breakdown could send the stock to $27.80 or even $24.64. This would invalidate the bullish thesis and signal continued weakness in the short term.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Institutional Investors Return and Soft Policy Hints Drive Bitcoin's Significant Recovery

- Bitcoin surged above $89,000 in late November 2025, reversing a six-month low amid institutional reentry and macroeconomic optimism. - Fed rate-cut expectations (84% for December) and $238M Bitcoin ETF inflows fueled dollar weakness and crypto demand. - Coinbase's 22-day negative premium reversed, signaling easing institutional selling pressure and potential trend reversal. - Solana's $145 slump highlighted crypto divergence, while Bitcoin's $100,000 support and open interest dynamics indicated bearish e

Artificial Intelligence Applications in Biomedical Studies and Their Impact on Investment

- AI is revolutionizing drug discovery by accelerating timelines and reducing costs in pharmaceutical R&D. - Companies like Insilico Medicine and Exscientia use AI to cut drug development cycles by 70% and reduce compound testing, advancing candidates to clinical trials rapidly. - The AI-driven biotech market is projected to reach $350–410 billion annually by 2025, offering investment opportunities in AI-native firms and infrastructure providers. - However, regulatory challenges and the lack of approved AI

Internet Computer’s Latest Rally: Driven by Network Enhancements and Growing Institutional Interest

- Internet Computer (ICP) surged in 2025 due to technical upgrades, institutional partnerships, and speculative trading. - Fission/Stellarator boosted capacity by 50%, while Meridian/Flux aim to enhance cross-chain interoperability and scalability. - Q3 2025 saw $1.14B trading volume but 22.4% DApp engagement drop, highlighting infrastructure-user adoption disconnect. - TVL discrepancies ($237B vs. $1.14B) and reliance on institutional capital raise sustainability concerns amid inflated metrics. - Partners

South Korean Firm Bitplanet Boosts Bitcoin Stack to 228.5 BTC