AI and Bitcoin Now Shape a Shared Market Trend

The global trading landscape continues to shift as investors watch a surprising new link form between digital assets and advanced technology stocks. Analysts now argue that Bitcoin and artificial intelligence no longer stand apart in market behaviour. This evolving trend keeps growing as new liquidity flows move across both sectors at the same time. The AI Bitcoin correlation has now become a leading narrative for traders who track volatility and capital rotations.

Recent statements from top investors suggest that AI stocks and Bitcoin shape each other’s momentum. This happens because liquidity now moves through ETFs that hold major AI companies along with firms exposed to digital assets. When Bitcoin gains strength, money often shifts in a direction that supports tech valuations. When Bitcoin cools, the pressure can reach AI names that depend on strong risk sentiment. This raises the stakes for traders who once viewed each asset class as separate lanes.

This trend strengthens as one major point becomes clear. AI is no longer just a tech story, and Bitcoin is no longer only a crypto story. Both assets now influence each other more than ever before. Their shared movement reflects new investor behaviour shaped by global innovation cycles and rapid shifts in liquidity. The AI Bitcoin correlation now guides portfolios, risk models, and growth strategies for many funds.

AI and Bitcoin Move in Sync as New Liquidity Flows Dominate Markets

Academy Securities strategist Peter Tchir explains that AI stocks and Bitcoin now share a tight financial link. He observes how large passive ETFs pour billions into AI giants that also hold positions in companies exposed to crypto. These holding patterns create a structure where Bitcoin’s price can influence tech valuations through liquidity shifts. This pushes the AI Bitcoin correlation into the spotlight as more analysts track these parallel movements.

Tchir notes that crypto-driven flows now reach AI stocks through multiple channels. Many tech firms invest in blockchain, hold digital assets, or manage exposure to crypto infrastructure. When Bitcoin rises, these companies benefit from improved sentiment, stronger balance sheets, or enhanced market confidence. When Bitcoin struggles, traders reduce risk, and AI names can feel the pressure. These trends explain why crypto-driven flows play a major role in shaping tech momentum.

This link grows stronger as ETFs expand their reach. Large passive vehicles do not separate AI from crypto-related firms because their indices group these companies together. Investors buy AI portfolios, yet they also buy exposure to firms influenced by digital assets. This creates a unified ecosystem where flows move across sectors without clear barriers. This dynamic fuels powerful movements that influence global markets every week.

Why AI and Bitcoin Will Keep Influencing Each Other

This growing relationship reflects a deeper global transition. Markets now respond to innovation-driven cycles rather than traditional sector boundaries. AI builds the future of computing, automation, and decision-making. Bitcoin shapes the future of decentralized finance, digital value, and global payments. Investors see both as pillars of long-term growth, and capital moves through them at the same time.

This shared movement will likely strengthen as more institutions adopt AI tools and digital assets. Funds now adjust strategies by tracking these linked indicators, and traders rely on them to gauge risk appetite. With crypto driven flows rising and AI market liquidity expanding, the connection becomes clearer each quarter. The combined force of both sectors can shape global valuations and investment trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

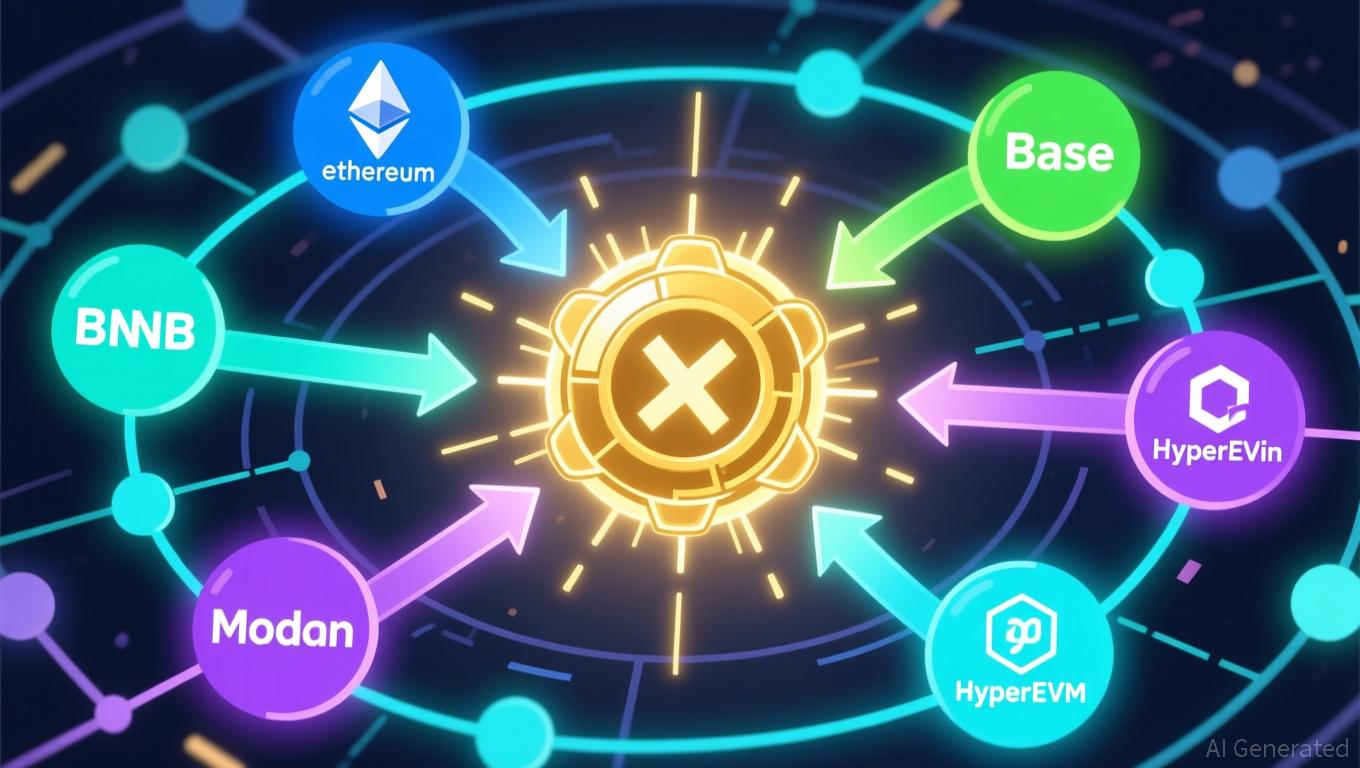

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo