SEC Grants Fuse No-Action Letter, Boosting Regulatory Clarity for Crypto Token Incentives

Quick Breakdown:

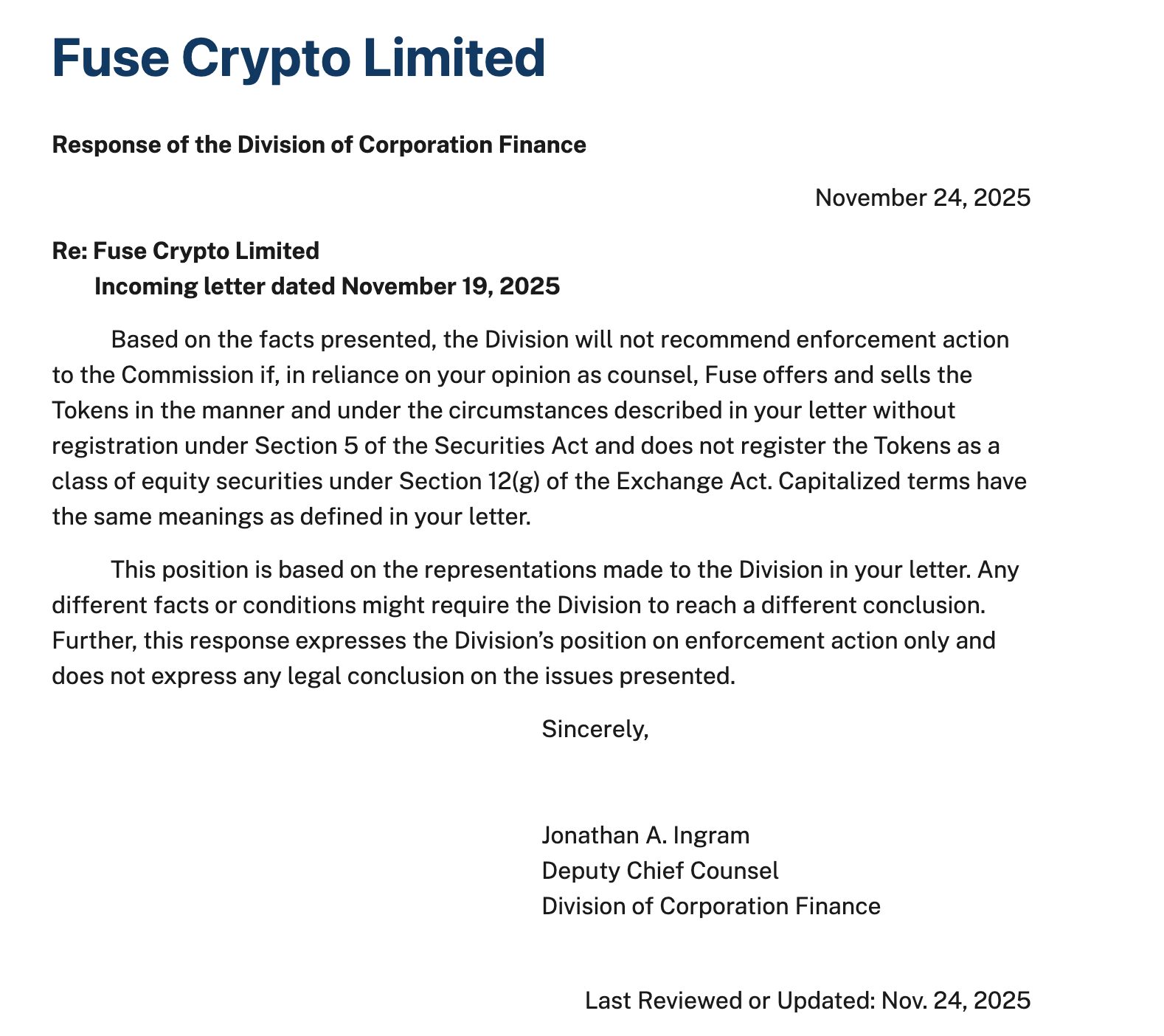

- The U.S. SEC issued a rare no-action letter granting regulatory protection for Fuse’s FUSE token.

- The no-action letter is contingent on the FUSE token being used strictly for network utility and distributed as an incentive for infrastructure maintenance, rather than sold for public speculation.

- The decision is seen as a sign of broader changes and increased openness to crypto projects under the new SEC Chairman.

SEC endorses Utility-Driven token models

The U.S. Securities and Exchange Commission (SEC) has issued a rare no-action letter to the decentralized physical infrastructure network (DePIN) project Fuse, which operates on Solana. The SEC’s decision confirms that it will not pursue enforcement actions related to the project’s FUSE token so long as it is used strictly for network utility and distributed as an incentive for infrastructure maintenance, rather than sold to the public. This regulatory stance allows Fuse to proceed without fear of immediate legal challenge and offers a precedent for similar token-based ecosystem rewards.

Source:

SEC

Source:

SEC

Fuse’s submission detailed how FUSE tokens are essential to network operations, consumed strictly for technical functions rather than speculation. According to the SEC, as long as Fuse continues to follow this model, network contributors can expect regulatory “cover,” marking a significant shift from earlier periods of regulatory uncertainty.

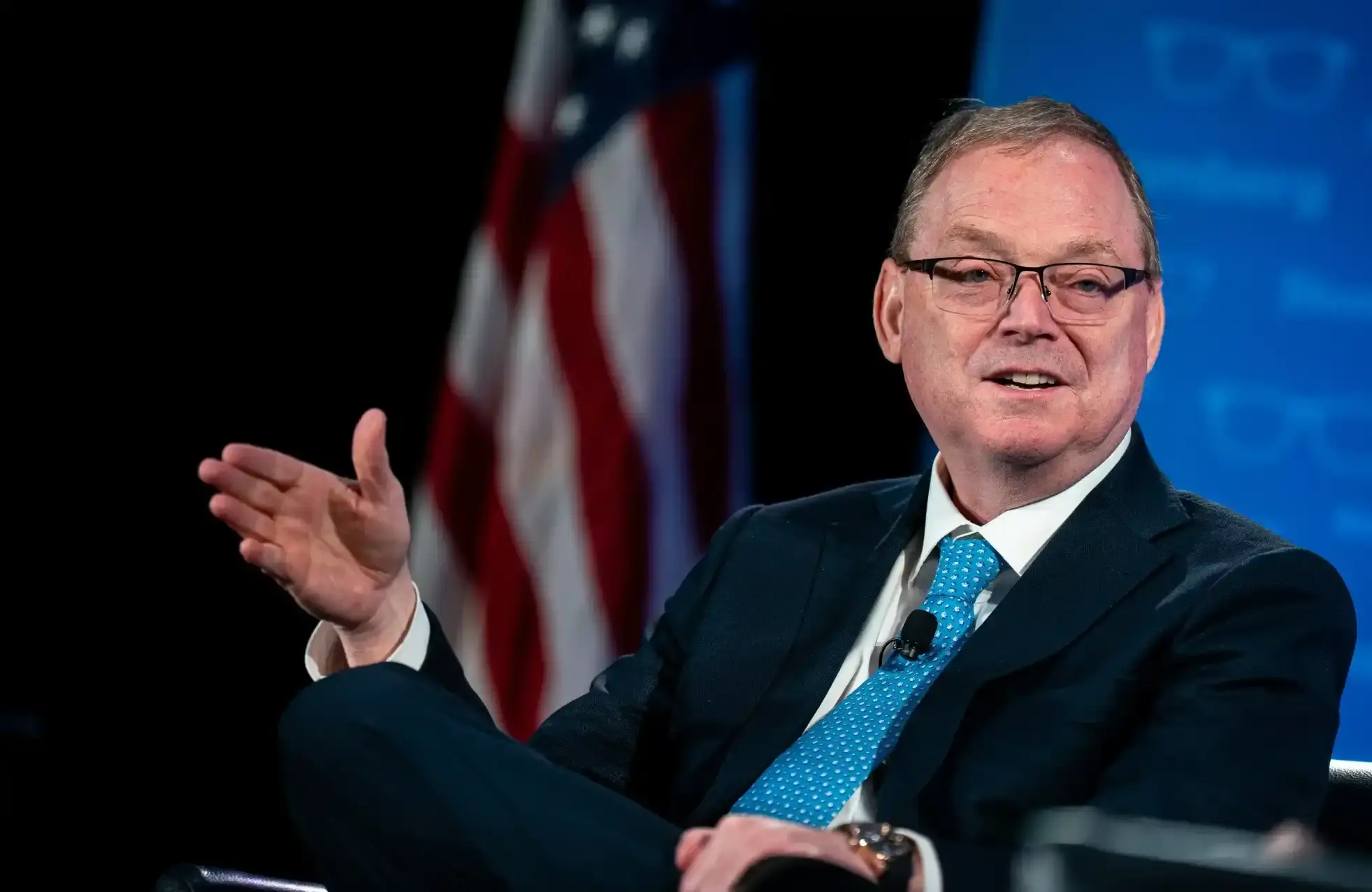

New SEC leadership signals greater openness to crypto

The no-action letter to Fuse comes amid broader changes at the SEC under new Chairman Paul Atkins, who took office in April. The leadership change has clearly shifted the SEC’s approach, leading to more open dialogue with crypto projects. In recent months, the agency has granted similar relief to DoubleZero , another DePIN project, as well as to crypto custodians that aren’t traditional banks, signalling a broader push toward clearer, more consistent guidance. Legal experts point out that the Fuse case was relatively straightforward from a regulatory standpoint, since the FUSE token is built for functional use within the network, similar to miner rewards in Proof-of-Work systems, rather than for passive investment.

Crypto lawyers and project teams have welcomed the SEC’s shifting stance, saying that no-action letters offer much-needed clarity and help cut down regulatory risk for blockchain startups. Industry observers emphasize that while these decisions do not establish sweeping precedents, they demonstrate a pragmatic shift and a baseline for what network-driven, utility-based tokens must meet to remain outside federal securities laws.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?

EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Exclusive: Revealing the Exchange’s New User Acquisition Strategy—$50 for Each New User

Crypto advertising has evolved from being barely noticeable to becoming pervasive everywhere.