Ethereum Updates: MegaETH Launches $250M Bridge to Address DeFi Liquidity Challenges

- MegaETH launches $250M USDm deposit channel and cross-chain bridge to boost Ethereum-Mega liquidity, capping deposits at $250M. - Platform requires Sonar verification for transparency, aligning with DeFi's need to address underutilized capital and security risks. - Rewards campaign incentivizes early participation, mirroring trends like Mutuum Finance's $18.9M raise and security audits. - Initiative targets 95% inactive DeFi liquidity, aiming to enhance cross-chain efficiency amid sector-wide challenges

MegaETH has unveiled a $250 million USDm deposit channel along with a cross-chain bridge for

The USDm deposit channel, scheduled to go live at 22:00(UTC+8) on November 25, enables users to swap Ethereum USDC for USDm on Mega’s mainnet, up to a total of $250 million. Those who participate will obtain USDm tokens in December, provided they pass Sonar verification—a safeguard to promote transparency and reduce the dangers of unverified transactions. The cross-chain bridge, also launched on the same day, is designed to boost liquidity efficiency by allowing smooth asset transfers between Ethereum and Mega’s network.

MegaETH’s plan also features a rewards program to encourage early adopters. Users who deposit USDC will accumulate allocation points based on their deposits, supporting the ecosystem’s expansion through token rewards. This approach is similar to strategies used by other DeFi platforms, such as Mutuum Finance, which

The timing of MegaETH’s release comes as the DeFi industry faces ongoing difficulties. In March 2025, monthly spot trading volume on Ethereum-based platforms

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether’s Bitcoin Investment Compared to Stability: S&P Raises Concerns Over Unstable Peg

- S&P Global Ratings downgraded Tether's USDT to "weak" due to 5.6% Bitcoin exposure exceeding its 3.9% overcollateralization threshold and limited reserve transparency. - Tether CEO defended the model, citing no redemption refusals and $10B 2025 net profit, while S&P warned Bitcoin/gold price drops could trigger undercollateralization risks. - Market turbulence saw $3.5B Bitcoin ETF outflows and $9.9B Bitcoin holdings, with Tether expanding into gold producers and crypto lending despite regulatory scrutin

Ethereum Updates Today: Blockchain’s Cleanliness Transformation: Privacy Moves from a Choice to a Necessity

- Ethereum co-founder Vitalik Buterin donated to privacy-focused projects Aztec Network and Kohaku, signaling blockchain's shift toward data protection as a core priority. - The Ignition Chain and Kohaku framework aim to address data breaches like SitusAMC by enabling private transactions via zero-knowledge proofs and protocol upgrades. - Ethereum's Fusaka upgrade (2025) and growing $1.2 trillion blockchain messaging market highlight privacy's rising economic and technical importance in decentralized syste

Australia’s Cryptocurrency Regulations Set to Unlock $24 Billion in Value While Enhancing Investor Protections

- Australia introduces 2025 Digital Assets Framework Bill to unlock $24B productivity gains while imposing strict client asset safeguards. - Legislation creates two new crypto financial product categories under Corporations Act, requiring AFSL licensing for platforms and tokenized custody services. - Exemptions for small operators (<$10M volume) balance innovation with regulation, aligning with global trends like U.S. GENIUS Act and SEC's Project Crypto. - Industry debates regulatory proportionality as Aus

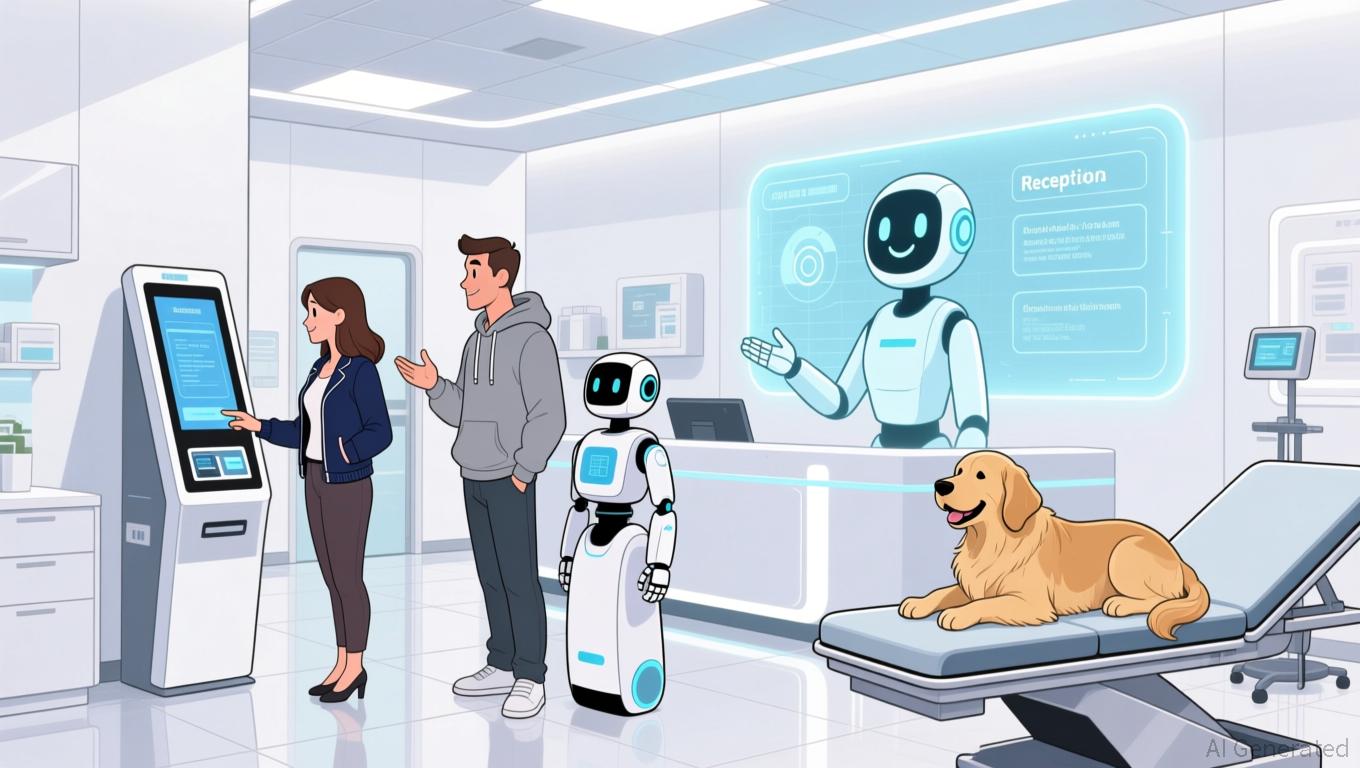

Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.