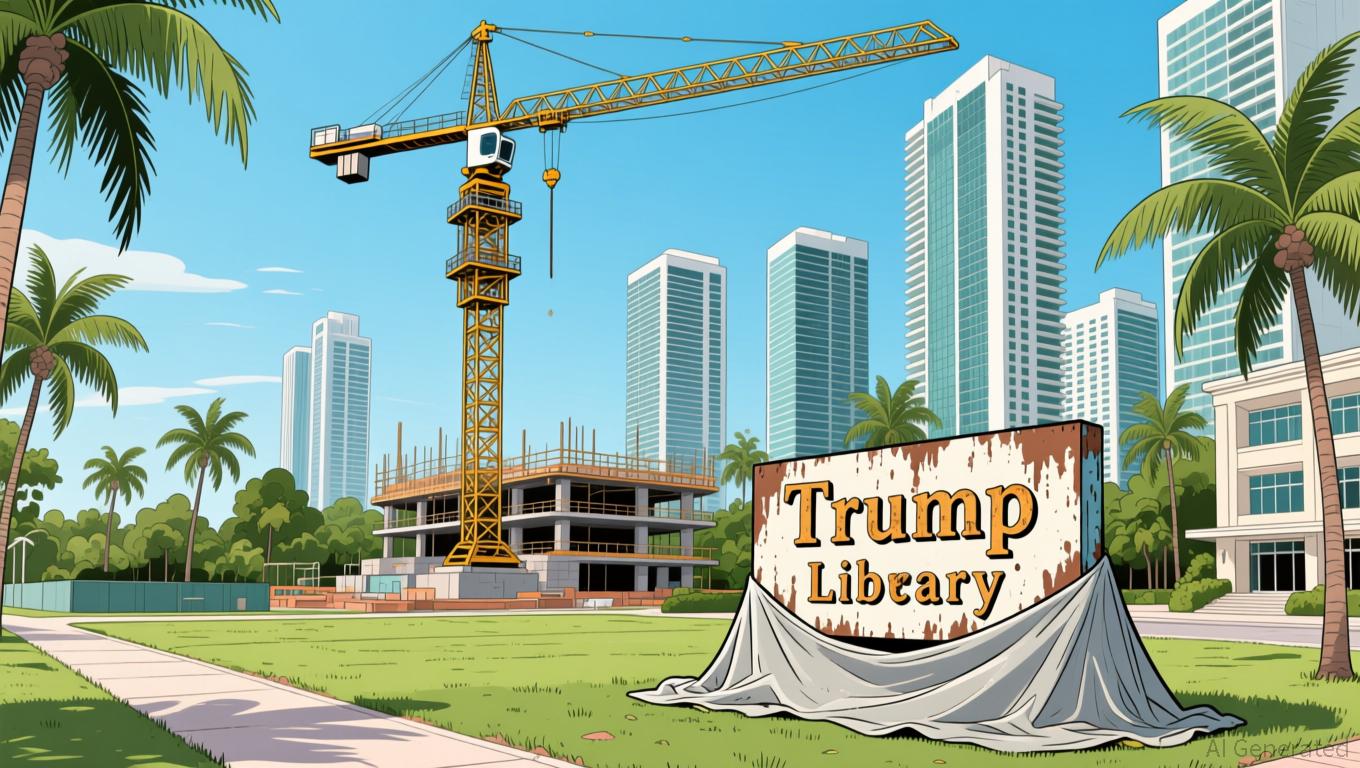

Court Case Challenges Florida’s Transparency Laws Amid Trump Library Controversy

- A 2026 trial challenges Miami Dade College's transfer of a $67M+ prime Miami property to the Trump Presidential Library Foundation, alleging violations of Florida's open-meeting laws. - Activist Marvin Dunn argues the college failed to provide sufficient public notice for the 2025 vote, with critics highlighting risks to transparency in politically sensitive land deals. - The property's high-value location and historical significance to Miami's Black community have intensified scrutiny over prioritizing

A trial date has been scheduled for August 2026 in a widely watched legal battle over the transfer of a prime piece of Miami real estate intended for President Donald Trump’s presidential library, adding new hurdles to the completion of the land agreement

Dunn’s lawsuit focuses on alleged procedural flaws in the property transfer. The college board’s move to hand the land to the state of Florida—with the intention of gifting it to the Trump Presidential Library Foundation—has come under fire for possibly sidestepping requirements for public transparency

The college’s attorneys tried to postpone the trial by asking for a stay while an appeal is considered, but Judge Ruiz denied the request. She cited Dunn’s age—he is in his seventies—as a reason to move the case forward quickly

At the same time, the Trump campaign has not yet issued a statement about the lawsuit, though the library project remains a key symbol for the . If the court ultimately rules in Dunn’s favor, the property’s future sale or development could face more obstacles, potentially delaying the library’s construction.

With the August trial on the horizon, the case has attracted national interest, and legal observers say it could set an important precedent for future disputes over public land transfers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Privacy Altcoins Surge While Crypto Markets Decline

In Brief Cryptocurrency markets faced a major downturn in recent weeks. Privacy altcoins like Zcash rise amidst stricter regulation concerns. Upcoming regulations pose liquidity risks for privacy-focused cryptocurrencies.

Solana News Today: Institutions Remain Confident in Solana Amid Security Concerns and Volatile Prices

- Solana's on-chain trading volume now exceeds centralized exchanges, driven by $510M in ETF inflows and institutional adoption of DeFi protocols. - Price volatility and security breaches, including Upbit's $36.8M Solana-based theft, highlight risks despite $3B+ in corporate treasury holdings. - Institutional capital continues to flow into Solana's ecosystem, with DWF Labs committing $75M to scalable DeFi infrastructure amid TVL recovery to $120B. - Forward Industries reports $668M unrealized losses as Sol

XRP News Today: XRP ETFs See Rapid Growth, Price Remains Flat—Will Increased Inflows Overcome Technical Barriers?

- XRP ETFs saw $164M inflows on Nov. 24, 2025, with Grayscale and Franklin Templeton launching new products amid rising institutional interest. - Price rebounded to $2.20 but remains range-bound below key technical levels, forming descending patterns despite ETF-driven liquidity gains. - Ripple's RLUSD stablecoin surged 56% in 30-day volume to $3.5B, now third-largest GENIUS Act-compliant stablecoin after USDC and PYUSD. - Analysts predict $5.05 by 2025 and $26.50 by 2030, but XRP's 16.95% drop from 30-day

SEC Considers Blockchain Stock Advancements as Concerns Over Conventional Market Stability Persist

- SEC plans to discuss tokenized stock regulations with major firms like Coinbase and BlackRock , aiming to modernize securities rules for blockchain-based finance. - Proposed "innovation exemption" seeks to fast-track crypto products but risks destabilizing traditional markets by creating valuation gaps and eroding investor protections. - WFE warns tokenized shares could disrupt market structure, while Nasdaq proposes unified order books with shared CUSIP identifiers to align with existing systems. - Regu