Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

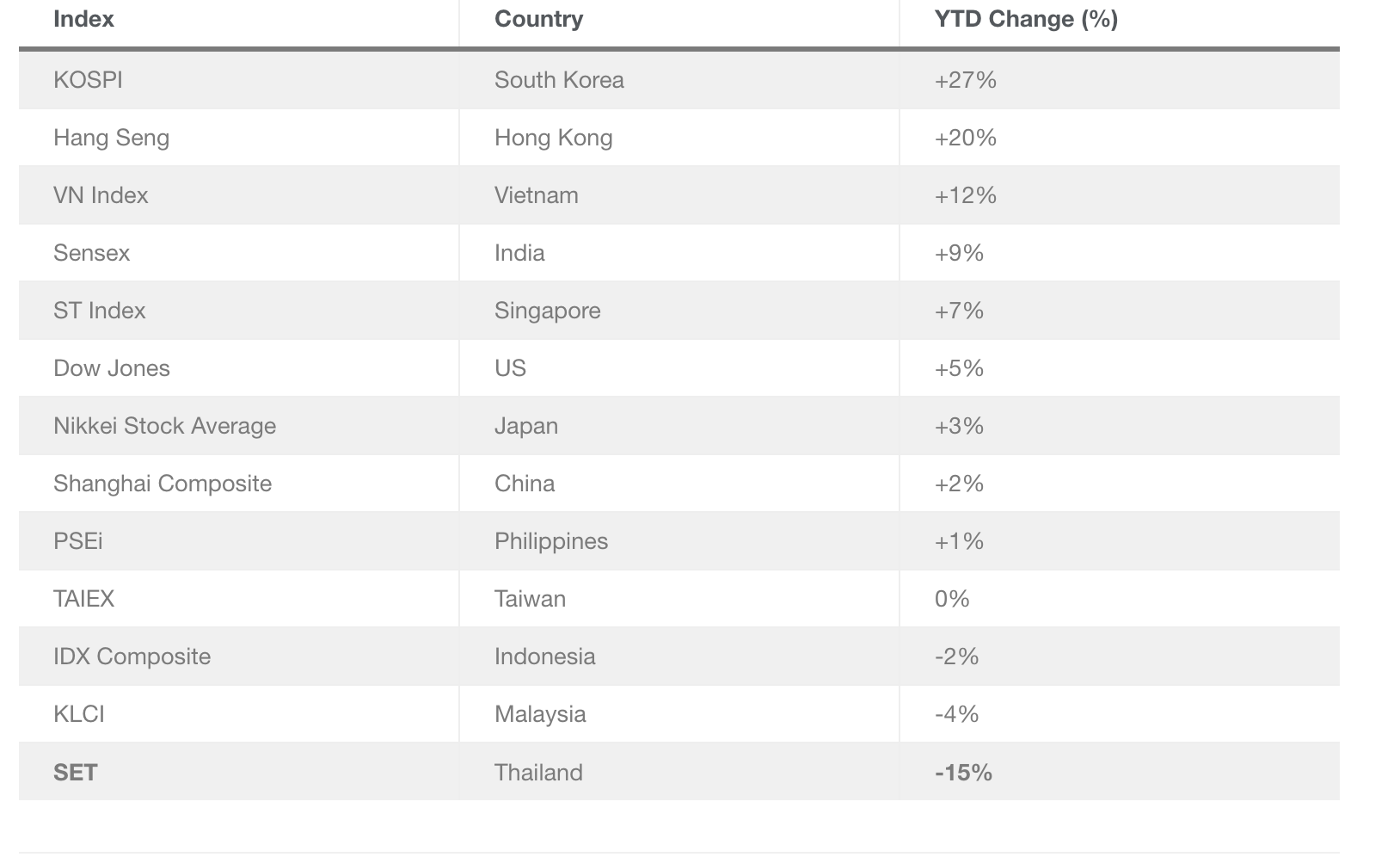

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Abu Dhabi’s Green Light Establishes UAE as a Pioneer in Stablecoin Development

- Ripple's RLUSD stablecoin gains Abu Dhabi regulatory approval as UAE advances digital finance leadership. - ADGM's "Accepted Fiat-Referenced Token" designation enables institutional use for lending and cross-border payments. - RLUSD's $1.2B market cap growth reflects institutional demand, backed by USD reserves and dual blockchain operations. - UAE's ADGM-DIFC regulatory synergy attracts global fintechs , with Ripple expanding partnerships across Africa and Asia. - Regulatory milestones position RLUSD to

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti