BTC Market Pulse: Week 48

Bitcoin extended its decline, breaking below the prior $90K support region and trading down toward $80K before staging a modest rebound.

Overview

The move last week deepened the ongoing drawdown and carried the asset further into a zone where historical demand has tended to strengthen. While the prevailing trend remains decisively to the downside, the recent defence of the mid-$80K range suggests potential stabilisation should selling pressure continue to moderate.

Momentum indicators remain stretched, with the 14-day RSI holding in oversold territory before turning higher, signalling sustained pressure but emerging signs of exhaustion. Derivatives data echo this: Futures and Perpetual CVD remain deeply negative, while stable Open Interest suggests the decline is being driven by position unwinds rather than new leveraged shorts.

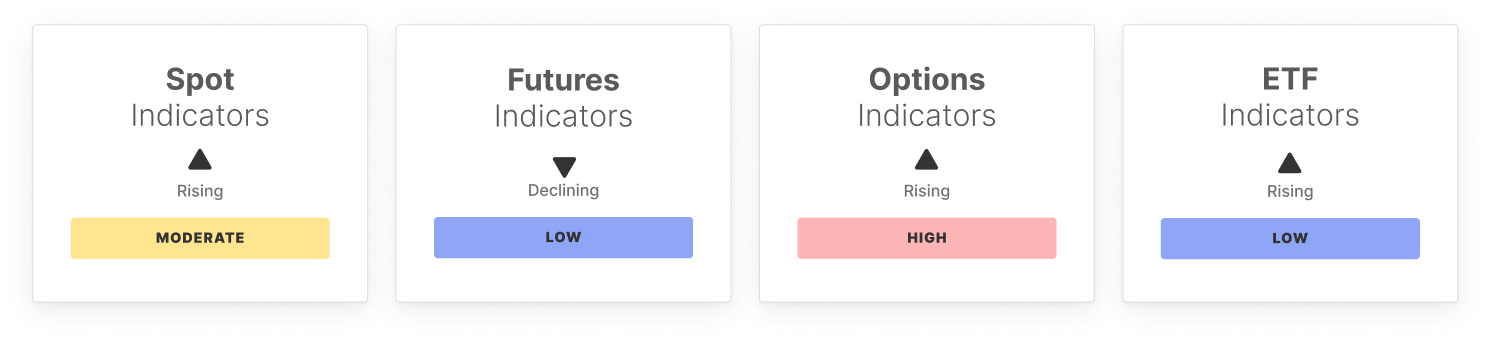

Spot activity stayed muted as volumes softened and ETF outflows persisted, indicating a shift from aggressive selling to a more orderly de-risking phase. Options markets remained defensive, with elevated skew and a tightening volatility spread pointing to expectations of further turbulence but reduced signs of panic.

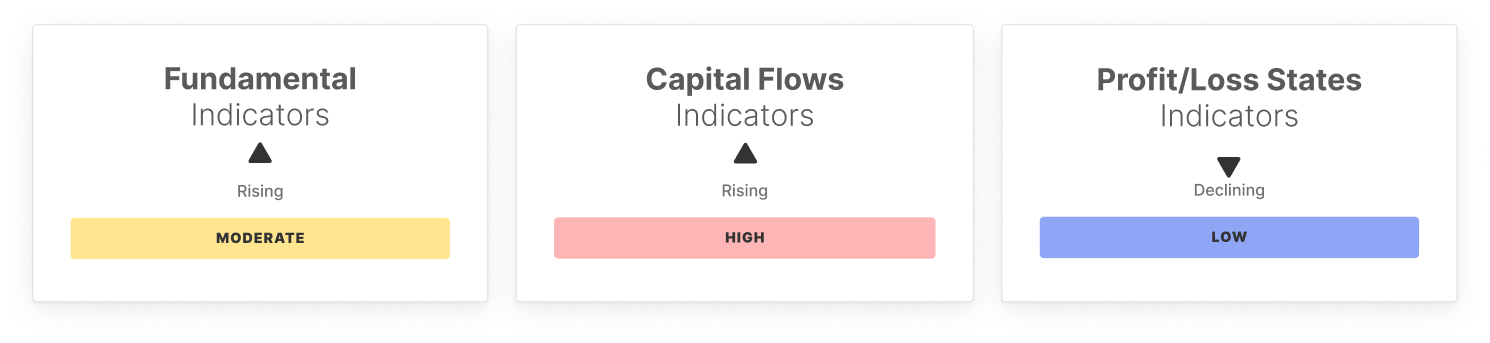

On-chain activity remained muted as well. Transfer volumes, fee revenue, and Realized Cap Change all softened, pointing to quieter network conditions. Profitability metrics deteriorated further: NUPL and Realized P/L reflect deeper unrealized losses and a rising concentration of short-term holder supply, a pattern consistent with late-stage corrections.

In sum, Bitcoin continues to navigate a controlled drawdown into deeply oversold and high-stress conditions. While profitability remains under pressure, the moderation in outflows, stabilisation in momentum, and lack of speculative leverage build-up suggest the market may be forming an early bottoming structure within the $84K–$90K range.

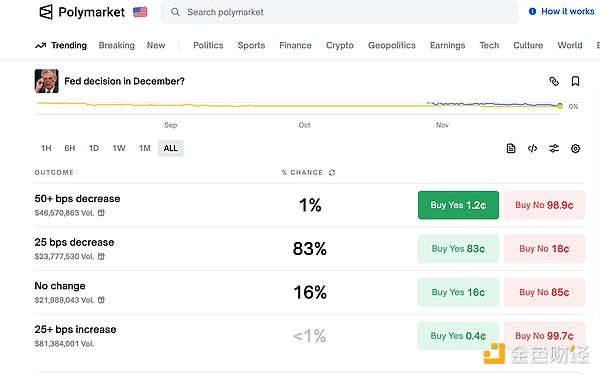

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Please read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street's "most optimistic bull" JPMorgan: Driven by the AI supercycle, the S&P 500 Index is expected to break through 8,000 points by 2026

The core driving force behind this optimistic outlook is the AI supercycle and the resilient US economy.

The most profitable application in the crypto world starts to slack off

Why is pump.fun being questioned for "rug pulling"?

Interpretation of the Five Winning Projects from Solana's Latest x402 Hackathon

The Solana x402 hackathon showcased cutting-edge applications such as AI autonomous payments, model trading, and the Internet of Things economy, indicating a new direction for on-chain business models.

The crypto market takes a breather as Bitcoin rebounds to $91,000—can it continue?