A 300% Spike in Selling Pressure Could Threaten the Ethereum Price Bounce

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last. Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows. Holder Selling Surges 300% as a Death Cross Forms

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last.

Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows.

Holder Selling Surges 300% as a Death Cross Forms

Two connected signals now point to deeper weakness.

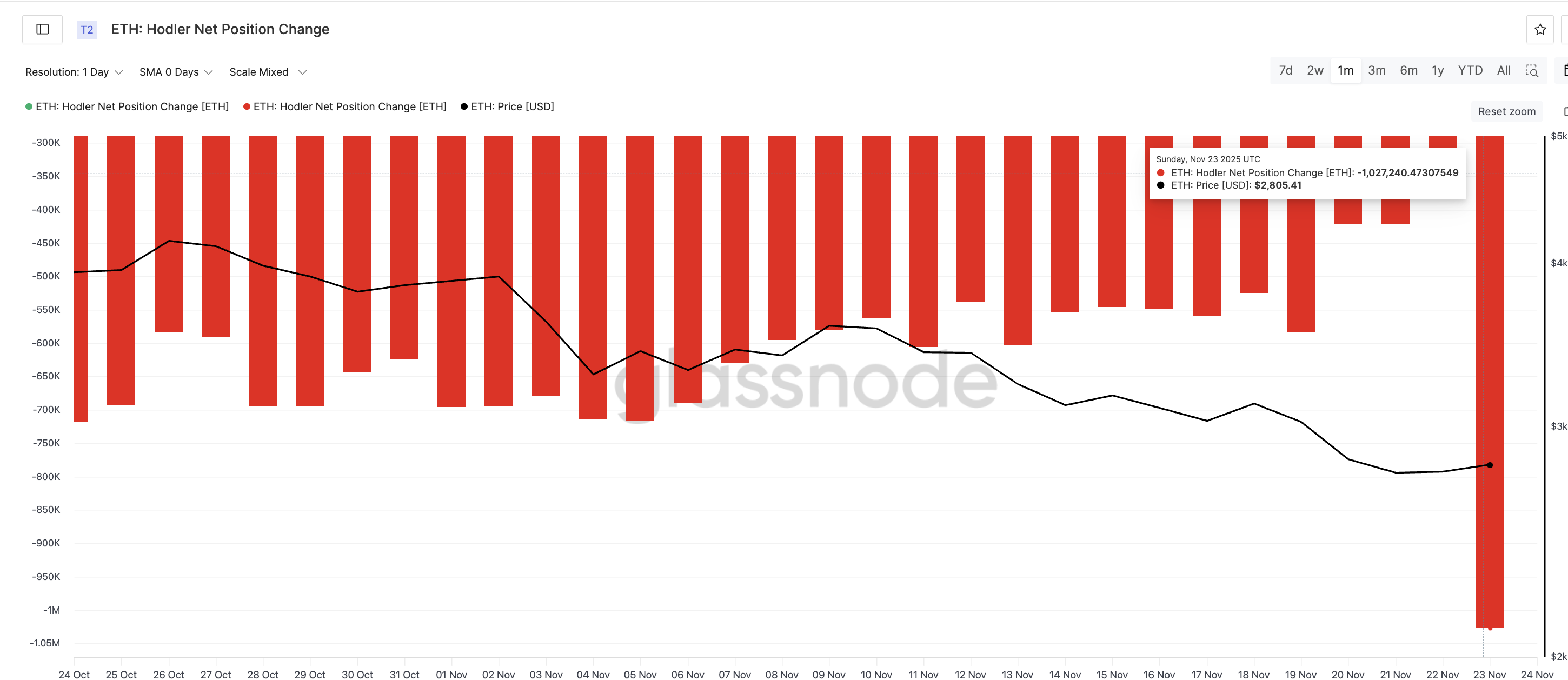

The first comes from long-term investors, often called hodlers. These are wallets that usually hold ETH for more than 155 days. When hodlers increase their selling, it usually shows fear or a shift in long-term belief.

On November 22, net selling from these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH — a 300% spike in one day. This is a major exit from long-term holders and adds heavy supply at a time when ETH already trades in a broader downtrend.

ETH Sellers Have The Upper Hand:

Glassnode

ETH Sellers Have The Upper Hand:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

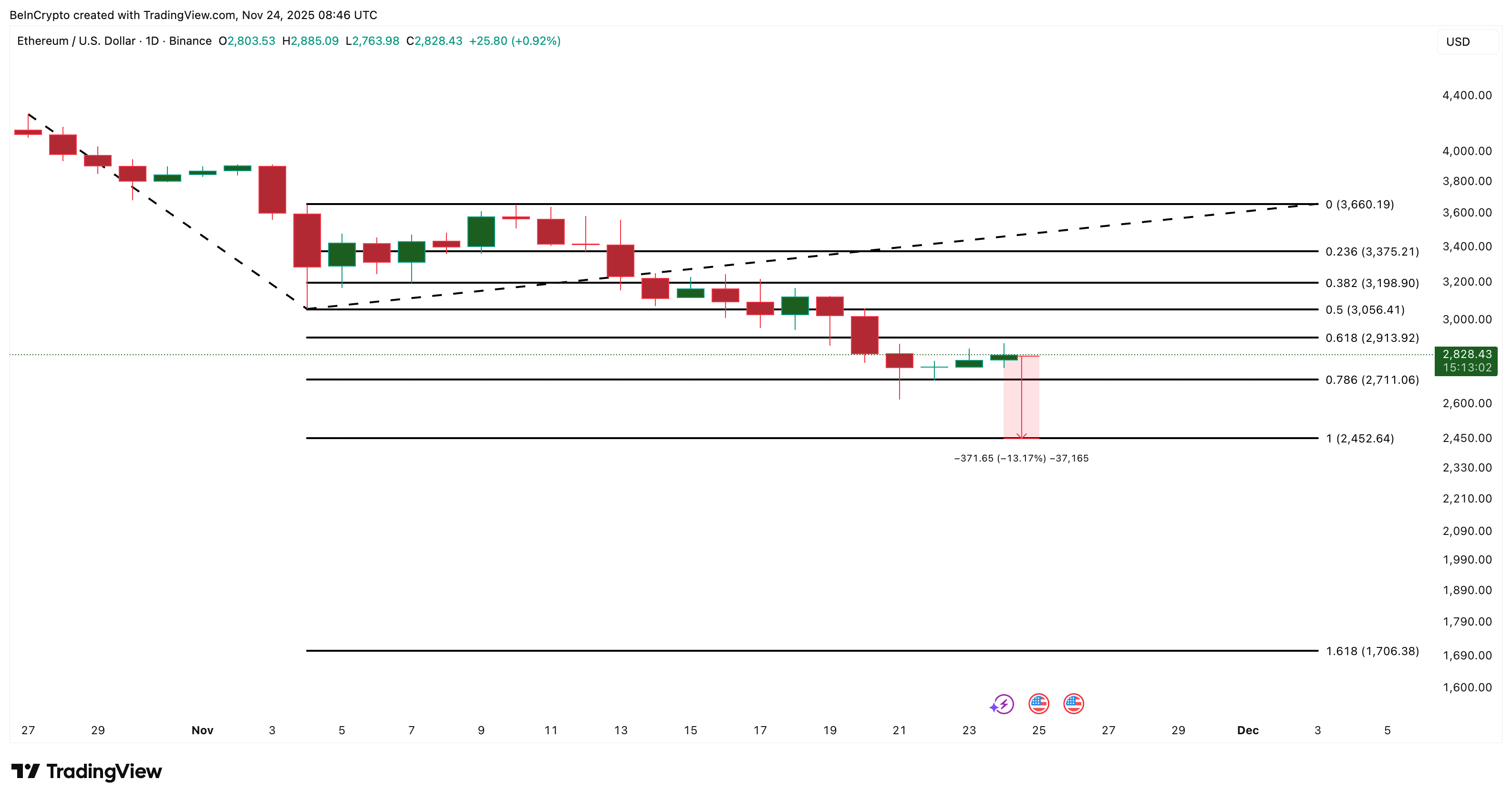

At the same time, a death cross has almost formed. A death cross appears when the 50-day exponential moving average (EMA) drops under the 200-day EMA. An EMA gives more weight to recent prices, so it reacts faster than a simple moving average.

When the 50-day EMA crosses below the 200-day, it signals strong downward momentum. That could hit the ETH prices significantly if the selling pressure continues to rise.

Bearish Risks Build:

TradingView

Bearish Risks Build:

TradingView

Here is the key connection:

Hodler selling is rising sharply at the exact moment the EMA structure is turning bearish. That means the selling pressure is reinforcing the death-cross signal instead of slowing it down. When these two appear together, recoveries usually fail and prices retest lower supports.

Ethereum Price Action: Downside Risk Still Outweighs the Bounce

Ethereum now trades near $2,820, but the chart shows more pressure above than support below.

The first level ETH must defend is $2,710, the 0.786 Fibonacci zone. Losing this level opens a drop toward $2,450, which marks roughly a 13% downside from current levels. If the death cross completes while hodler selling continues, ETH can fall directly toward this level and even under it if the market conditions weaken.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

Below $2,452, the next deeper support sits near $1,700 — the broader extension from the descending structure. This only activates if the trend accelerates and sellers remain dominant.

Upside remains limited unless the ETH price can reclaim:

- $3,190, the first meaningful resistance

- $3,660, the stronger ceiling that signals an early trend shift

Under current conditions, hitting these levels looks difficult because both bearish signals — the surge in hodler selling and the death-cross setup — remain active.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Aster's DEX Listing: Ushering in a New Era for Decentralized Finance?

- DASH Aster's hybrid AMM-CEX DEX model bridges CEX speed with DeFi transparency, achieving $27.7B daily volume and $1.4B TVL by October 2025. - Zero-knowledge Aster Chain and cross-chain liquidity routing eliminate intermediaries, enabling 400% YoY TVL growth through multi-chain price discovery. - Strategic partnerships with Binance and RWA integrations (gold, equities) attract institutional capital, with 2M+ users and $4B ASTER market cap by 2025. - Tokenomics include 7% staking rewards, 5-7% annual burn

Massive Rally Loading: 5 Altcoins Rebounding From Support With 2x–5x Potential Into Year-End

LTC Eyes $96 and $88 as Traders Watch $85 Support for New Move Setup

Arthur Hayes Says Bitcoin Found Its Floor, Meaning BTC Bottomed at $80,000 Last Week