Bitcoin’s 9% Bounce Faces a Bearish Wall — Why Moving Past $88,000 Becomes Critical Now?

Bitcoin price is up about 2% today and has already gained almost 9.4% from this week’s lows near $80,400. The move looks solid, and the rebound was expected because of a technical signal that has worked before. But a major risk is building at the same time, near a key level. It could decide whether

Bitcoin price is up about 2% today and has already gained almost 9.4% from this week’s lows near $80,400. The move looks solid, and the rebound was expected because of a technical signal that has worked before.

But a major risk is building at the same time, near a key level. It could decide whether this bounce continues or fails at the next barrier.

Why The Bounce Happened — And What Could Cap It Next

The first sign came from momentum.

Between April 8 and November 22, Bitcoin’s price made a higher low, but the Relative Strength Index (RSI) made a lower low. RSI measures whether momentum is rising or falling by comparing recent gains and losses. This pattern is called hidden bullish divergence. It shows sellers losing strength even while the chart looks weak.

The same setup appeared between April 8 and October 26, and that move created an 8.53% rebound. This time, Bitcoin has already climbed 9.38%, which means the signal played out again.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin’s Rebound Was Expected:

Bitcoin’s Rebound Was Expected:

But the rebound now runs into a clear problem.

A bearish exponential moving average (EMA) crossover is forming. An EMA reacts faster than a simple moving average because it gives more weight to recent prices. Right now, the 100-day EMA is close to dropping under the 200-day EMA.

Traders treat this as a bearish crossover because it often points to downward pressure lasting for weeks. There is also BTC supply sitting overhead.

Building Bearish Wall:

Building Bearish Wall:

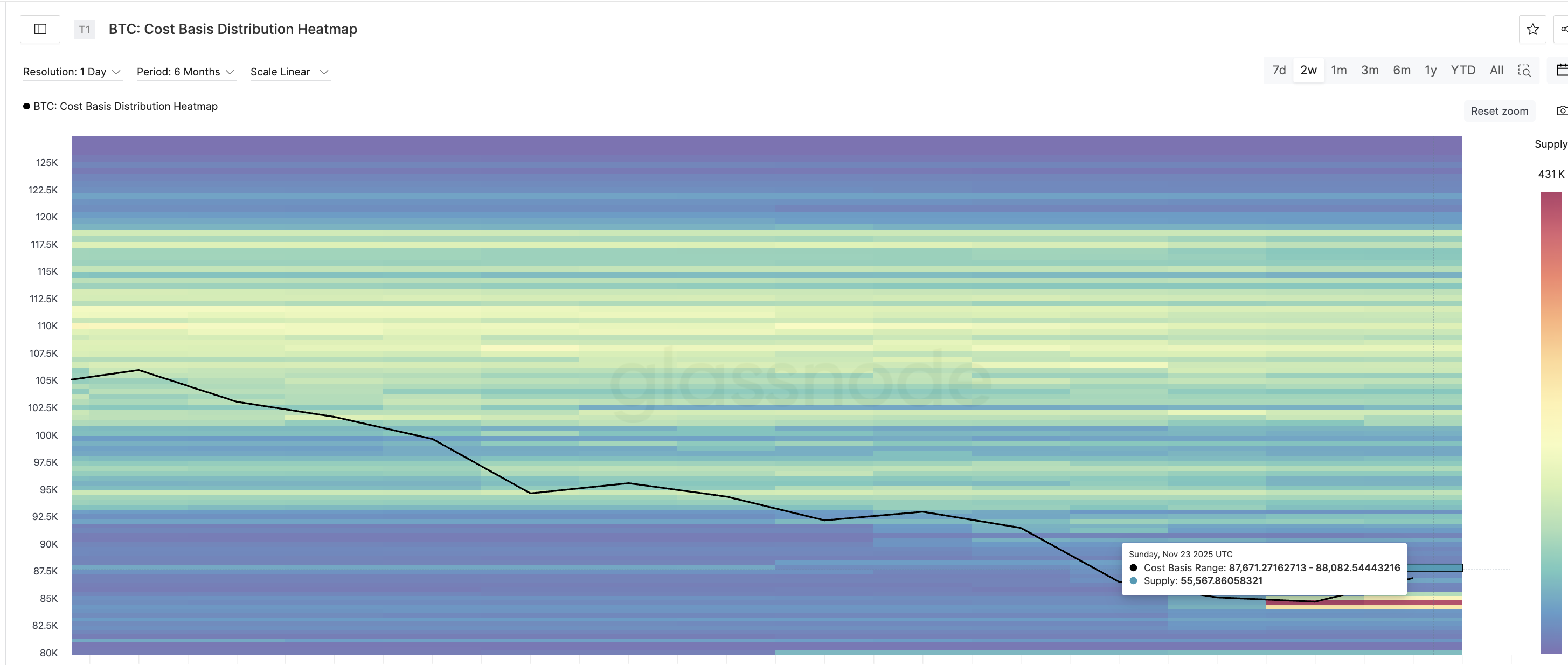

A heavy cluster now sits above the price between $87,671 and $88,082 — the level where many holders are waiting to sell at breakeven. This cluster holds about 55,567 BTC, currently worth almost $4.83 billion.

BTC Supply Wall:

BTC Supply Wall:

Most rebounds slow down when they hit these supply zones. So the bounce has momentum behind it, but it also faces its first major test almost immediately.

Bitcoin Price Levels That Decide Whether the Rebound Continues (Or Fails)

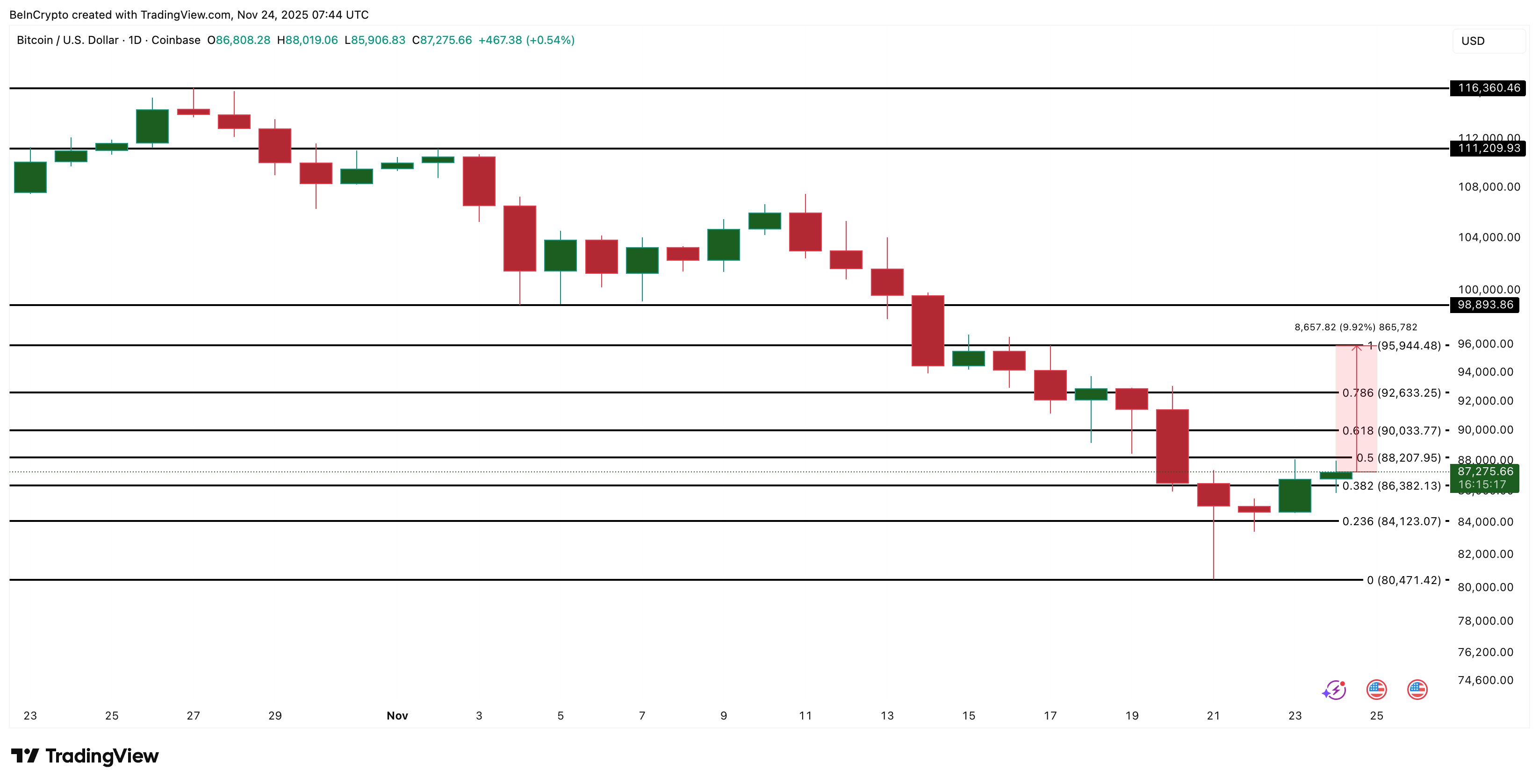

The zone around $88,000 now decides everything. Bitcoin must clear $88,200 to turn this bounce into something real. This area lines up with both the heatmap supply band and the 0.5 Fibonacci level from the recent drop.

A clean daily close above this range opens the path toward $92,600.

If buyers stay active, the next extension sits near $95,900 — the same region where the last major BTC price breakdown began.

Bitcoin Price Analysis:

Bitcoin Price Analysis:

A stronger move only becomes possible if two things happen together:

- BTC Price rises above the $88,000 supply band, and

- The EMA crossover fails to complete.

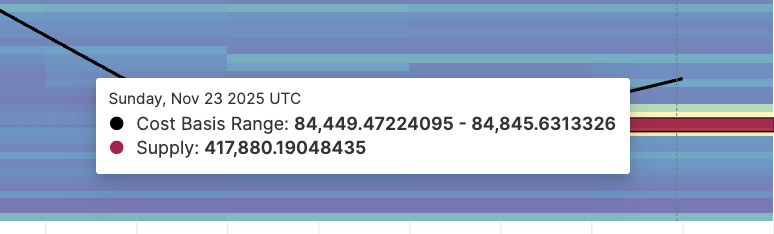

If the crossover finishes first, it usually caps the rebound and pushes the BTC price lower. On the downside, the $84,449–$84,845 band remains the strongest support, per the cost basis heatmap. That zone holds almost $35.38 billion worth of BTC.

BTC Supply Zone Acting As Support:

BTC Supply Zone Acting As Support:

On the price chart, the synonymous level sits at $84,100. Bitcoin flipped this cluster into a protective floor after breaking above it.

As long as this zone holds, deeper downside stays limited. If it breaks again, Bitcoin can drop toward the $80,000 region again, invalidating the rebound theory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Steep Price Drop: Opportunity for Contrarian Investors or Red Flag for Junior Gold Mining Stocks?

- COAI refers to both ChainOpera AI and junior gold miners' index, with this analysis focusing on the latter's market dynamics. - Junior gold miners (GDXJ ETF) fell 27% in six months amid dollar strength, inflation fears, and overbought conditions after a 128.8% rally. - Technical indicators show bearish signals: broken trend channels, negative volume balance, and RSI divergence, though long-term bull trends persist. - GDXJ's 163.9% surge outpaced gold bullion gains, creating valuation gaps, while ChainOpe

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac