Polish Crypto Analyst Apologizes After Bitcoin ‘Santa Rally’ Forecast Fails

Polish analyst Robert “El Profesor” Ruszała issued a rare public apology after Bitcoin broke his forecast within weeks. He published a detailed breakdown of the errors in his model, sparking debate among traders about transparency in crypto analysis.

A well-known Polish market analyst has publicly apologized after his latest Bitcoin outlook collapsed within weeks, sparking debate across social media.

Robert Ruszała, known online as El Profesor, admitted his plan was wrong and published a detailed breakdown explaining the mistakes behind his failed scenario.

Analyst Breaks Industry Norm by Owning His Error

Crypto commentators often highlight their wins and stay silent when predictions miss. Ruszała took the opposite approach.

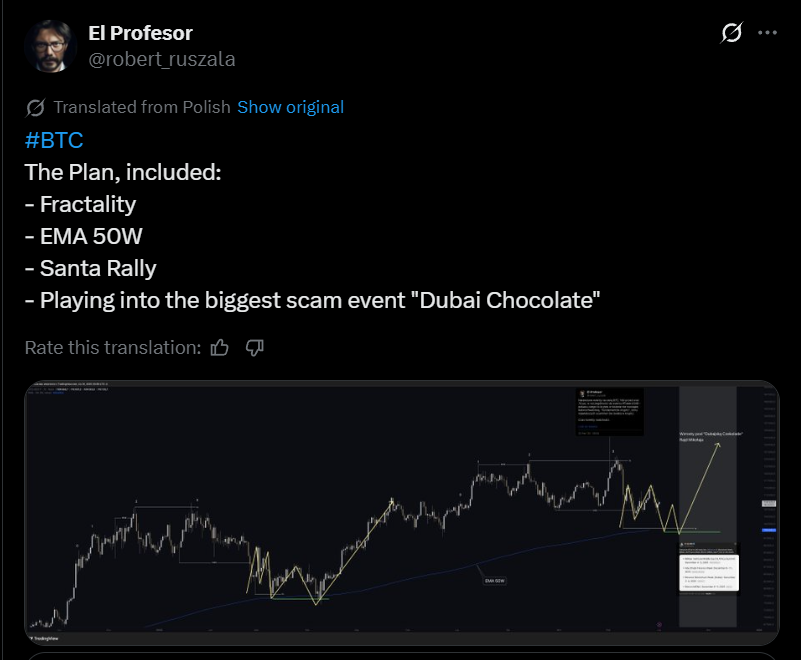

He originally released a forecast called “The Plan,” outlining a bullish path for Bitcoin based on market fractals, the 50-week EMA, and a seasonal move often described as the “Santa Rally.”

Original Post From the Analyst

Original Post From the Analyst

According to his model, Bitcoin was expected to hold its uptrend and provide opportunities to take long positions at specific technical levels.

Market Reversal Forces a Reassessment

However, it took the market only three weeks to dismiss that vision. Bitcoin dropped below key zones and invalidated the entire bullish structure.

On 21 November, Ruszała addressed the failed call directly, writing:“I failed… I’m sorry to everyone who followed this plan. I know where I made the mistake.”

He later explained that he always prepares two scenarios — bullish and bearish. The first one worked from roughly $116,000 down to $94,700. The deeper decline activated his bearish outlook.

He stressed that reacting to market changes matters more than sticking to a single direction.

What Went Wrong in “The Plan”

Ruszała then published a technical breakdown of the error. He pointed to several indicators that he ranked incorrectly in terms of probability.

That mis-ordering, he said, led him to misjudge Bitcoin’s potential movement.

The Analyst Later Explains Why His Prediction Failed

The Analyst Later Explains Why His Prediction Failed

The post did not spark major controversy, but it prompted discussion among traders. Several users praised him for his transparency, noting that few analysts publicly dissect their own mistakes.

His response highlights a broader reality in crypto markets: even well-constructed scenarios require constant revision, and the market can still surprise the most seasoned experts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat