This Is How Aster Whales Can Save Price From Its First Bearish Crossover

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses. However, whale behavior suggests that a full breakdown may still be avoided if their support continues. Aster Whales Stand Firm Aster’s

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses.

However, whale behavior suggests that a full breakdown may still be avoided if their support continues.

Aster Whales Stand Firm

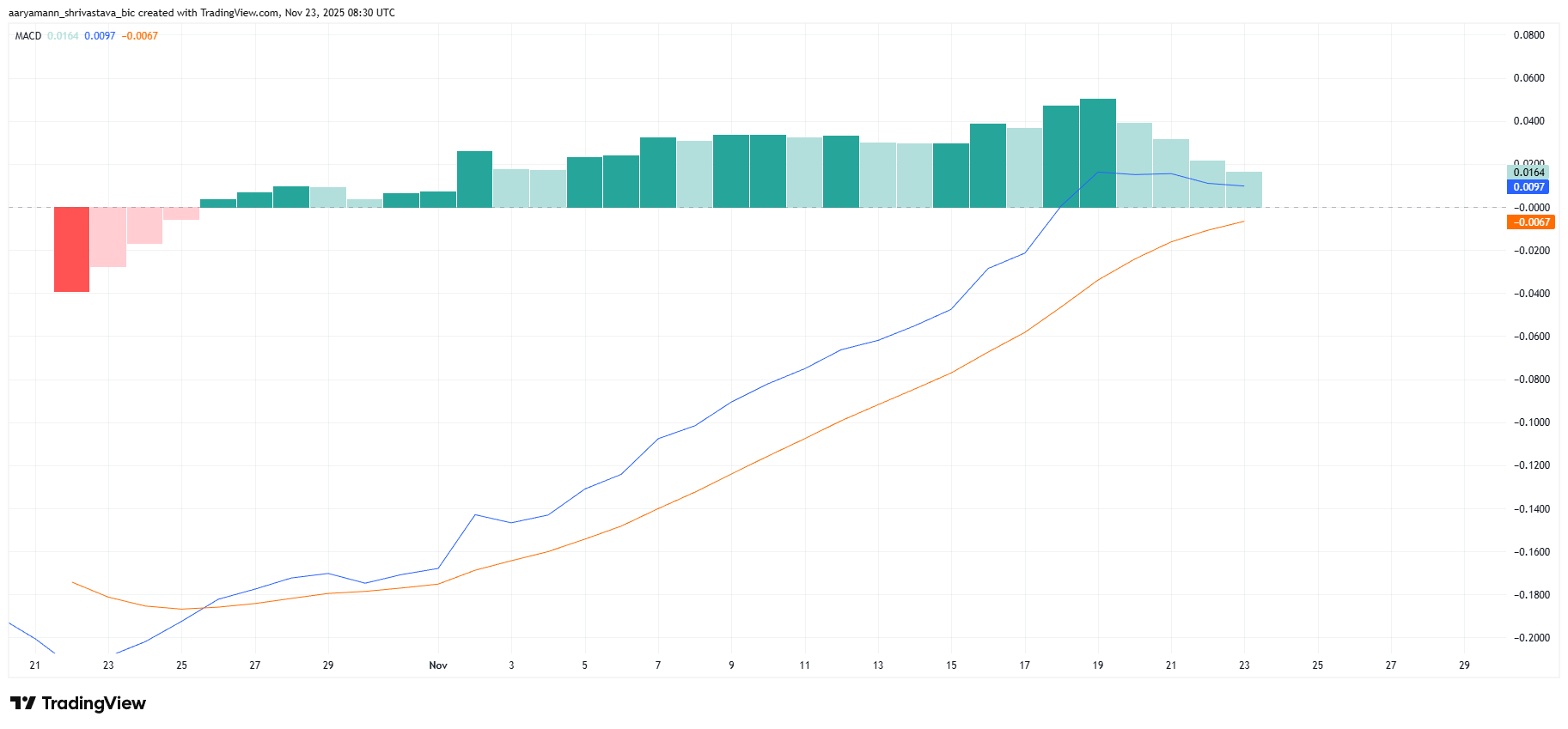

Aster’s MACD indicator is signaling a potential shift in momentum.

For the first time, the altcoin is nearing a bearish crossover as the signal line edges closer to moving above the MACD line. This alignment typically marks a transition from bullish to bearish momentum and raises caution among traders.

The histogram reinforces this warning with shrinking bars that indicate fading bullish strength.

As momentum recedes, investor sentiment may shift, making Aster more vulnerable to additional declines. The potential crossover could be Aster’s first major momentum reversal since the uptrend began.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER MACD. Source:

ASTER MACD. Source:

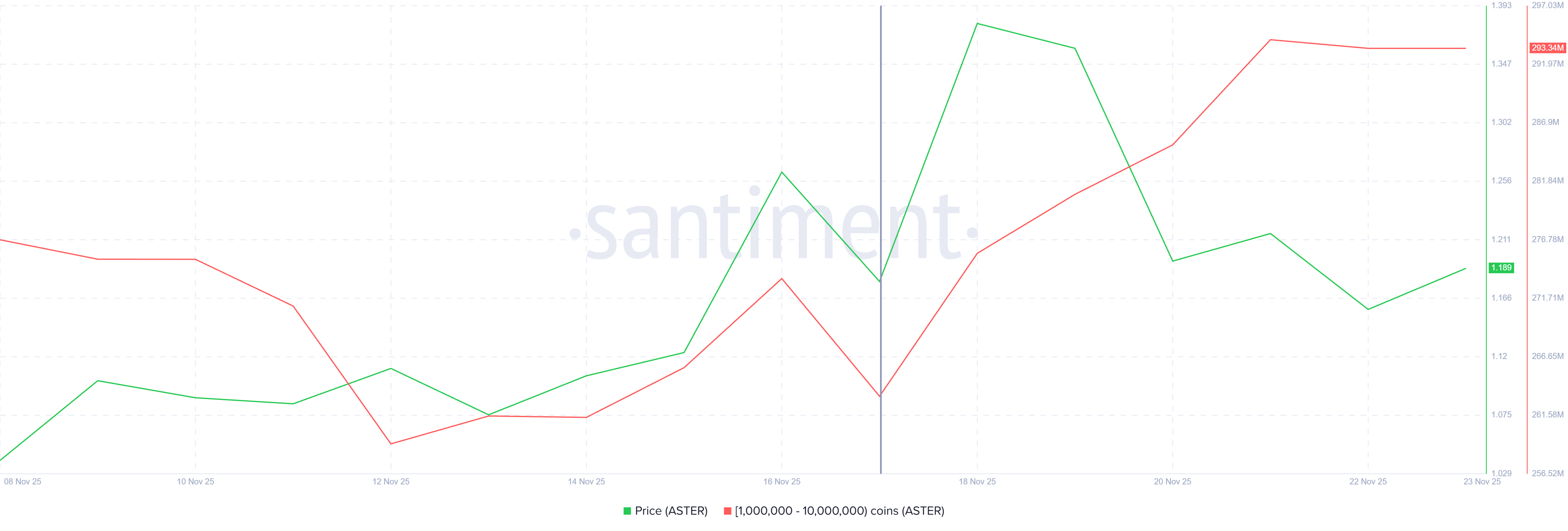

Despite weakening indicators, whale activity has remained surprisingly supportive. Over the past week, addresses holding between 1 million and 10 million ASTER accumulated 30 million tokens, worth more than $35 million. This consistent buying helped stabilize price action during earlier volatility.

Although whale accumulation has paused, these holders have not shifted to selling. Their willingness to hold despite market turbulence provides a critical cushion against sharper losses.

If whales maintain their positions, Aster may avoid a deeper decline, even if market conditions deteriorate further.

Aster Whale Holding. Source:

Aster Whale Holding. Source:

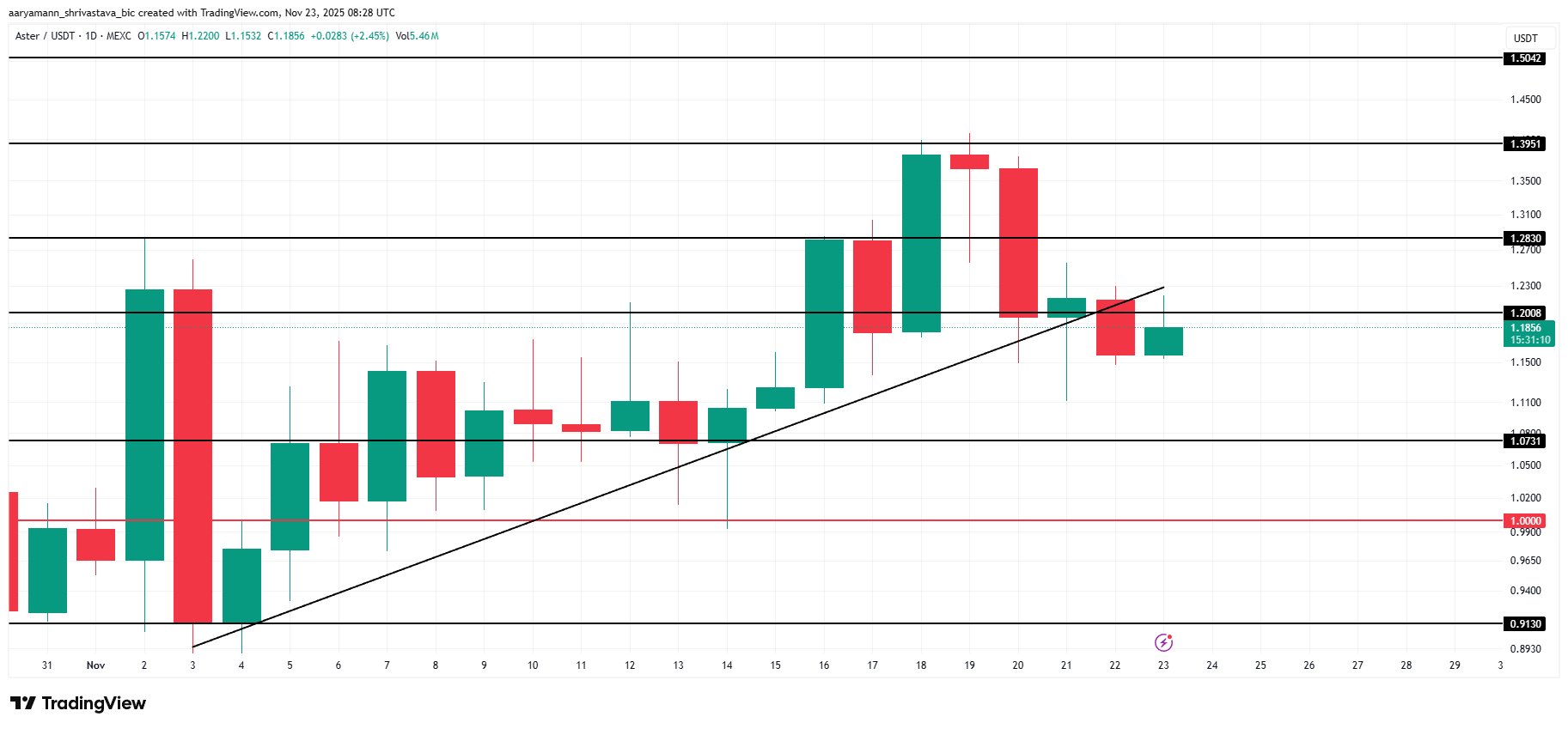

Aster trades at $1.18, sitting just below the $1.20 resistance level. The altcoin’s nearly three-week uptrend broke in the last 24 hours, creating uncertainity about the trajectory ahead.

Given the current indicators, Aster could reclaim $1.20 as support and either consolidate below $1.28 or climb toward $1.39. This outlook relies heavily on bullish stability and continued backing from accumulation-heavy investors.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if whales reverse course and begin to sell, Aster’s price could fall to $1.07. Losing that level would invalidate the bullish thesis.

This would confirm that bearish momentum has taken control, potentially leading to a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: IMF Cautions That Tokenized Markets Could Face Collapse Without International Cooperation

- IMF warns tokenized markets risk destabilizing flash crashes due to rapid growth and interconnected smart contracts. - XRP highlighted as potential cross-border payment solution but not endorsed, alongside Stellar and Bitcoin-Lightning hybrid models. - Global regulators intensify oversight of tokenized assets, with ESMA, SEC, and central banks addressing governance and liquidity risks. - IMF stresses urgent need for coordinated policy frameworks to prevent fragmentation and systemic vulnerabilities in ev

Solana News Today: Avail's Nexus Mainnet: A Borderless Blockchain Ecosystem

- Avail launches Nexus Mainnet, a cross-chain infrastructure unifying liquidity across Ethereum , Solana , and EVM-compatible chains. - The platform uses intent-solver architecture and Avail DA verification to replace bridges, enabling seamless asset movement and shared liquidity. - Integrations with major chains and partners like Lens Protocol aim to streamline DeFi and trading, while $AVAIL token coordinates cross-chain transactions. - With Infinity Blocks targeting 10 GB blocks, Nexus addresses liquidit

Cardano News Today: ETFs Turn to Alternative Coins While ADA Stumbles and XLM Gains Momentum with ISO Compliance

- Franklin ETF expands holdings to include ADA , XLM, XRP , and others, reflecting institutional altcoin diversification driven by ISO 20022 compliance and SEC-approved rules. - Cardano faces short-term bearish pressure with 31% monthly decline, contrasting Stellar's bullish 2025/2030 price projections ($1.29–$6.19) fueled by RWA and cross-border payment demand. - ISO 20022 adoption (97% payment instructions) positions ADA/XLM as bridges between DeFi and traditional finance, with Ripple's ILP enhancing XLM

AI Crypto Faces a Pivotal Turn: Regulatory Demands Surpass Aspirations in 2025