Will ADA Price Crash to $0 in the next 30 days?

Cardano price has been sliding for weeks, and the fear is obvious. Every time the market gets spooked by macro uncertainty, ADA becomes one of the first altcoins to feel the pressure. With the Federal Reserve stuck between rising wages, a shaky unemployment trend, and a delayed stream of economic data due to the government shutdown, traders are reacting emotionally. But fear is not analysis. When you look closely at the ADA price daily chart, this isn’t a coin heading to zero. It’s a coin stuck in a heavy downtrend that is still structurally intact.

Cardano Price Prediction: A Clean Downtrend, Not a Death Spiral

ADA/USD Daily Chart- TradingView

ADA/USD Daily Chart- TradingView

Here’s what the daily chart is actually showing. ADA has been locked in a consistent downward sequence since early October. The Heikin-Ashi candles confirm one thing clearly: momentum is still with the sellers. The bodies are long, upper wicks are weak, and ADA hasn’t produced a meaningful reversal pattern yet. But for a coin supposedly “heading to zero,” this structure is far too controlled. A true collapse is chaotic. This is orderly downward pressure, shaped by macro uncertainty, not protocol failure.

The Bollinger Bands make this even clearer. ADA is stuck against the lower band, riding it for several sessions. That usually means two things: the trend is strong, but a volatility snapback is brewing. Coins rarely hug a lower band indefinitely. When they do, it hints at exhaustion — not a freefall.

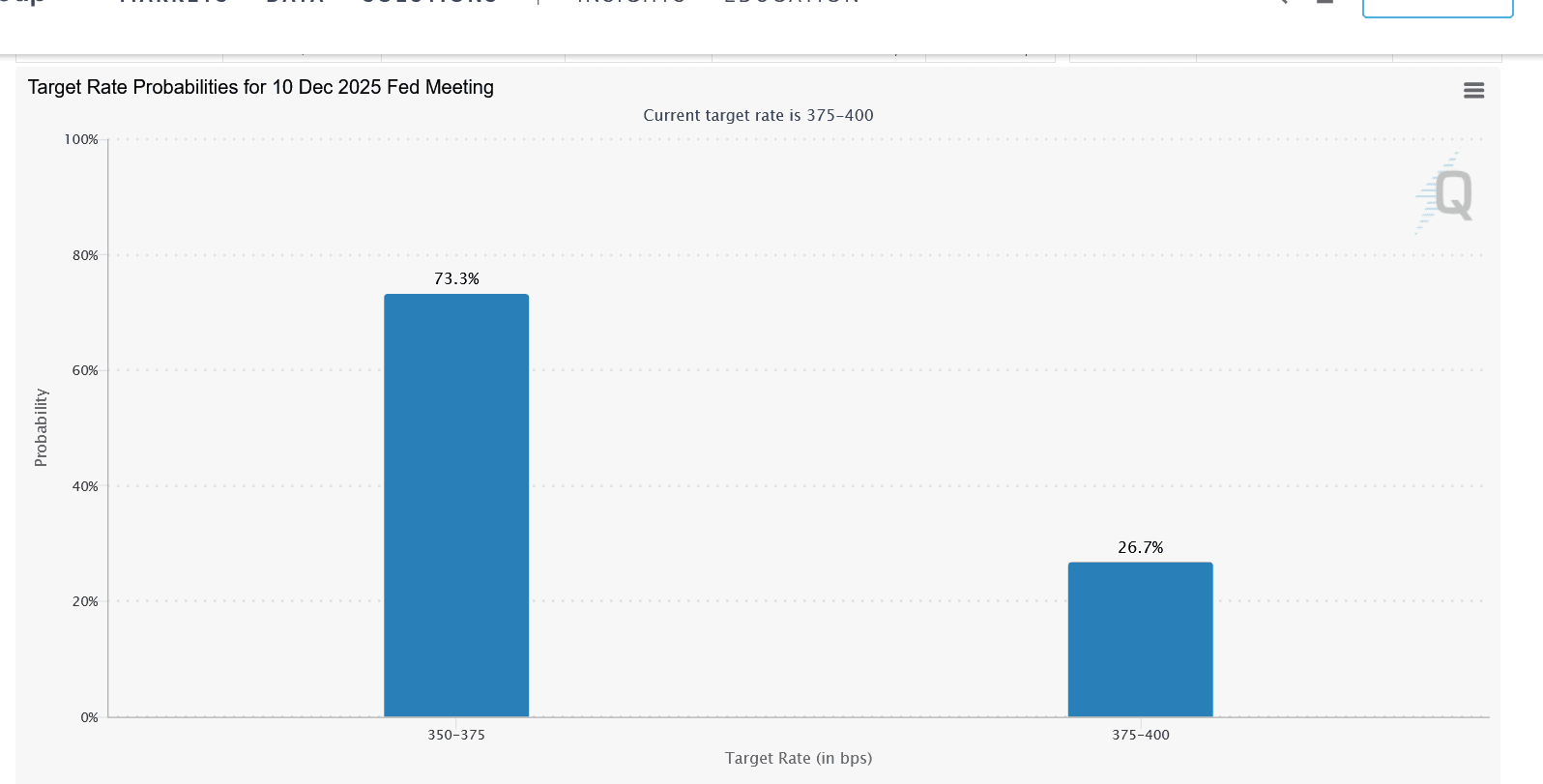

The Fed’s Dilemma Is Driving ADA Price, Not ADA’s Fundamentals

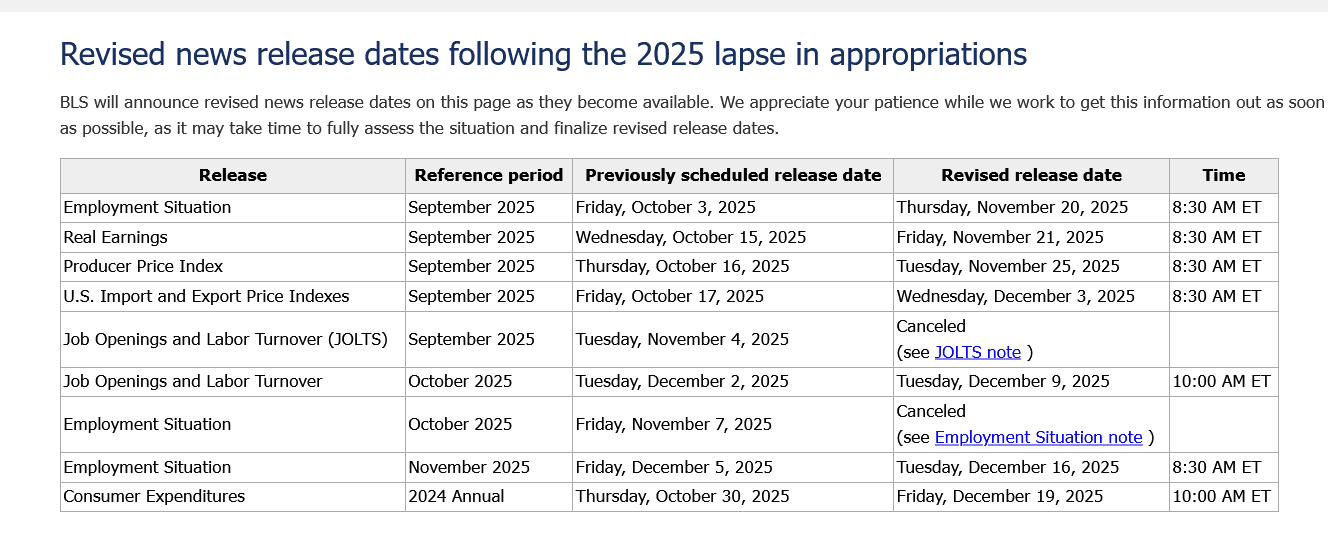

The September jobs report showed rising wages and rising unemployment at the same time. To hawks, this means inflation is still alive. To doves, this means the labor market is deteriorating. And because much of the government’s data pipeline was frozen during the shutdown, the Fed is operating half-blind.

That uncertainty bleeds directly into crypto . When markets don’t know whether December brings a rate cut or another month of restrictive policy, capital pulls back from volatile altcoins. ADA isn’t crashing because something is wrong with Cardano price. ADA is dropping because traders want clarity before they take on risk.

And right now, there’s none.

Key Technical Levels Showing ADA Price Is Still Structurally Sound

Despite the selling, the chart shows some very important signs that Cardano price isn’t anywhere close to a catastrophic breakdown . The long red liquidity wick formed in October was classic panic selling, but buyers immediately stepped in and prevented a new lower low. If ADA price were truly spiralling toward zero, the market would have pushed aggressively lower from that point. Instead, it stabilized.

Support around 0.41–0.42 is still active. The dotted lines beneath the current price point toward the next logical structure levels around 0.33–0.35, which is where a deeper correction could land — but even those zones are normal retracement regions, not existential threats. Nothing here aligns with a zero-bound trajectory.

Could ADA Price Fall More? Yes. Could It Go to Zero? No.

A drop toward the 0.30 zone is possible if the Fed signals that rate cuts are off the table. That would drag liquidity out of the altcoin market and force ADA price lower. But falling doesn’t equal extinction. A blockchain goes to zero when the network collapses, developers disappear, stakers withdraw, and exchanges delist the coin. None of that is happening here. Cardano remains liquid, widely supported, and heavily staked.

If the Fed leans dovish in December, ADA could quickly reclaim the middle Bollinger band and start pushing back toward 0.50–0.55. The chart isn’t predicting a crash to zero. It’s reflecting uncertainty ahead of a major macro decision.

Cardano Price Prediction: ADA Is Weak, Not Finished

ADA’s downtrend is steep, and the candles don’t lie. The market is nervous. But this is a macro-driven selloff, not a protocol collapse. The chart shows a controlled decline, predictable support zones, and no structural evidence of a zero-bound meltdown. With the Fed meeting in December and data still incomplete, ADA is simply waiting for clarity.

So the answer is straightforward:

No, $ADA is not heading to zero. It’s correcting under macro stress and positioning for whatever comes next from the Federal Reserve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat