Date: Fri, Nov 21, 2025 | 05:56 AM GMT

Ethereum is grappling with intense downside pressure as the broader crypto market remains deeply volatile. Over the past 24 hours, both Ethereum (ETH) and Bitcoin (BTC) have plunged nearly 7%, accelerating a painful correction that has now pushed ETH down more than 30% in the last 30 days. The sell-off triggered massive liquidations across derivatives markets, wiping out $954 million in positions, including $835 million in long side liquidations alone. The cascade flushed out over-leveraged traders and amplified panic-driven selling.

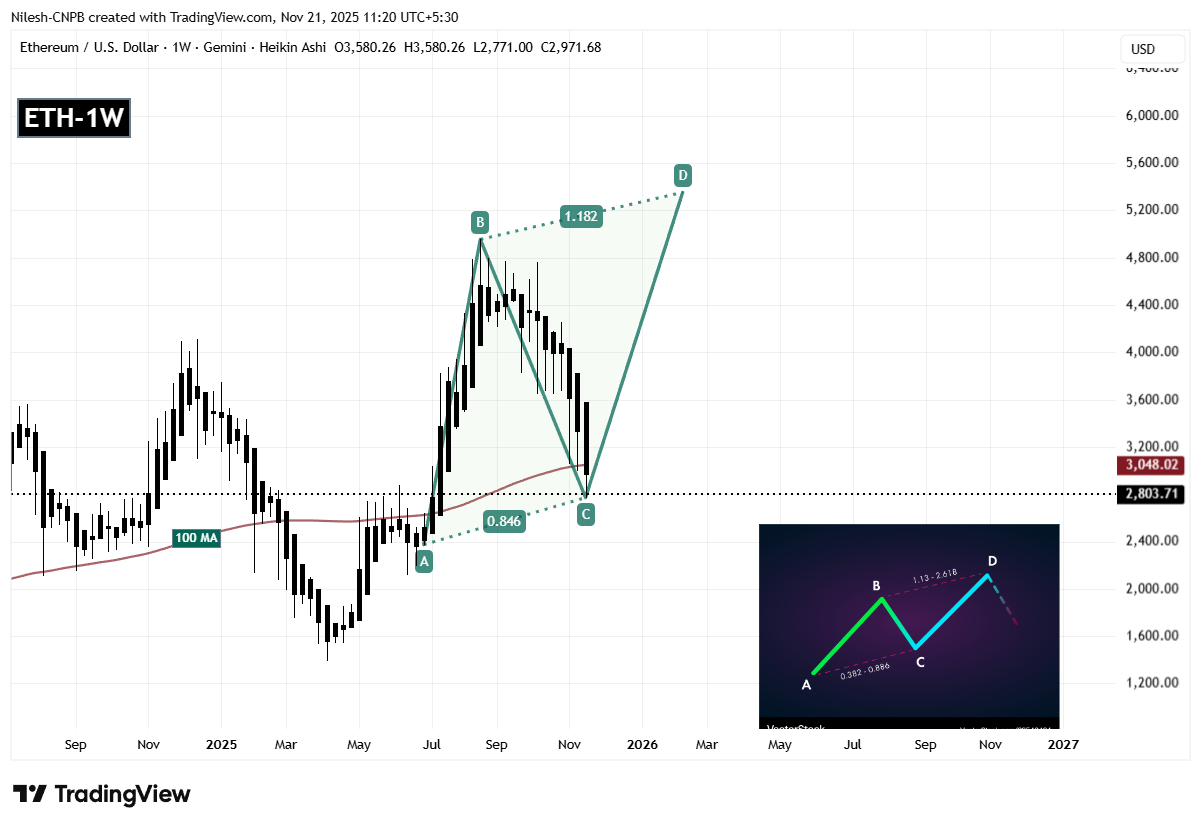

Yet despite the severe drop, the weekly chart of ETH reveals a developing harmonic structure that may hint at an upcoming recovery attempt.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Bounce

On the weekly timeframe, ETH is shaping a potential Bearish ABCD harmonic pattern, a classical structure where the CD-leg typically offers a strong recovery rally before completing the final turning point at the Potential Reversal Zone.

The formation began at Point A near $2373.00, followed by a sharp surge into Point B, which marked a significant swing high. Price then retraced heavily into Point C at $2771.00, where sellers have started losing momentum and early buying interest is emerging. This C-level now acts as a critical support region, keeping the harmonic structure valid and suggesting that the CD-leg could be in its early development phase.

Ethereum (ETH) Weekly Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) Weekly Chart/Coinsprobe (Source: Tradingview)

A reclaim above the 100 week moving average at $3048 would be a major signal that bullish momentum is strengthening.

What’s Next for ETH?

If buyers successfully defend the $2771.00 support and push ETH back above the 100-week moving average, the next key target sits near the Potential Reversal Zone at the 1.18 Fibonacci extension, estimated around $5353.00. This zone represents the completion point of the ABCD pattern and indicates nearly a 90% upside potential from current levels.

However, risks remain elevated. If ETH fails to sustain the C-leg support and breaks below $2771.00, the harmonic structure could be invalidated or postponed, opening the door to deeper downside exploration before bullish momentum can rebuild.

For now, the market’s next decisive move hinges on whether buyers can prevent further breakdown and reclaim lost technical levels.