Pi Coin Price Rises 10% As Capital Inflows Jump to 6-Week High

Pi Coin rallies 10% as inflows spike sharply, RSI rises, and investors push the asset toward a potential breakout above key support.

Pi Coin is gaining strong traction after a sharp 10% price increase that lifted the token to a weekly high. The recent rise reflects renewed investor confidence and improving market conditions.

Strengthening demand and accelerating inflows continue to support Pi Coin’s upward movement, signaling momentum that could extend in the near term.

Pi Coin Is Picking Up Capital

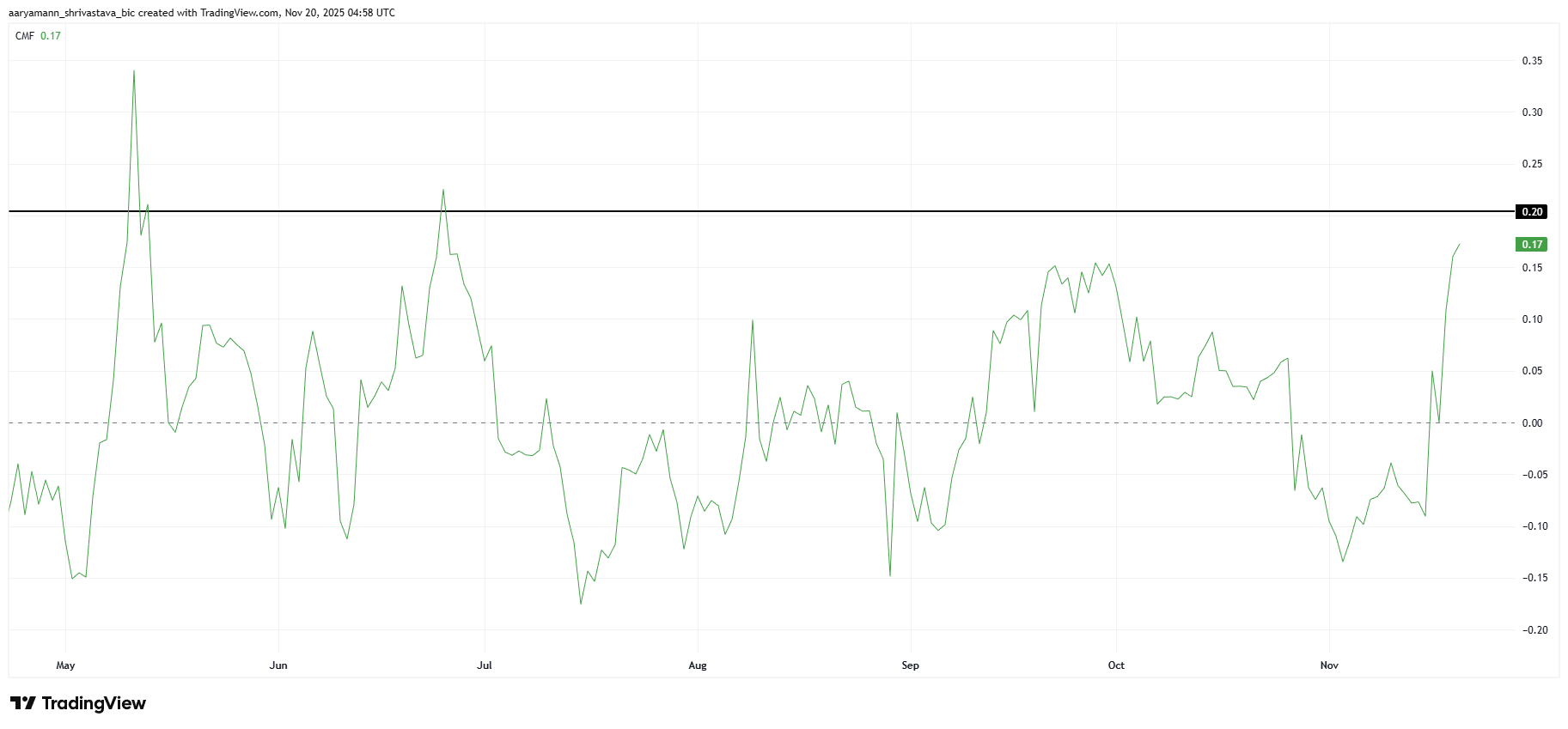

Market sentiment has strengthened notably, with the Chaikin Money Flow showing a sharp rise over the past few days. CMF measures capital flows, and a move into positive territory signals increasing inflows. Pi Coin’s CMF is climbing quickly, suggesting that investors are actively adding liquidity to the asset.

This uptick reflects growing confidence in Pi Coin’s short-term outlook. As inflows increase, the buying pressure strengthens. Investors appear motivated by improving conditions and are positioning themselves for continued gains.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

Macro momentum indicators are also aligning with Pi Coin’s bullish trend. The Relative Strength Index is observing a steady uptick, showing rising demand and stronger upward momentum. A rising RSI often suggests that buyers are gaining control and driving sustained appreciation.

This strengthening momentum is crucial for supporting ongoing growth. As broader market sentiment improves, Pi Coin may continue benefiting from increased risk appetite across altcoins.

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

PI Price Could See Continued Rise

Pi Coin trades at $0.250 after rising 9.5% in the past 24 hours. The altcoin is preparing to flip $0.246 into a confirmed support level. Holding this range will be essential for maintaining upward momentum and preventing short-term pullbacks.

If Pi Coin secures the support, it could rise toward $0.260 and higher, recovering losses from late October. Such movement may attract new investors looking for momentum-driven opportunities, further sustaining the ongoing rally. Strengthening fundamentals and improving sentiment add to the bullish outlook.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if Pi Coin faces selling pressure, the price could slip below $0.246 and weaken current support. A decline may push the altcoin toward $0.234 or even $0.224, signaling a deeper retracement. This scenario would invalidate the bullish thesis and reflect fading confidence among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CryptoAppsy: Experience Instant Access—No Registration Needed, Perfect for Fast-Moving Markets

- CryptoAppsy offers real-time crypto price tracking and alerts via iOS/Android, requiring no account creation, targeting global users in Turkish, English, and Spanish. - Market volatility drives demand for instant data, contrasting with subscription-based models, as seen in GoPlus's 717M monthly API calls and WEEX's 100% APR promotions. - Competitors like BI DeFi emphasize security upgrades post-$15B breach, highlighting crypto's growing focus on risk mitigation alongside innovation. - CryptoAppsy's succe

Ethereum Latest Updates: Buterin's Railgun Transaction Ignites Privacy and Pre-Sale Discussion as ETH Reaches $3,000

- Vitalik Buterin transferred $2.9M ETH to privacy protocol Railgun as Ethereum surged past $3,000, triggering speculation about liquidity events. - On-chain analysts highlight Railgun deposits' historical link to pre-sale activity, though Buterin's 0.4% stake transfer doesn't inherently signal selling. - Buterin's $738.6M ETH holdings and recent privacy advocacy, including his "privacy is hygiene" stance, frame the transaction's strategic context. - Market reactions remain divided between regulatory hedgi

Thailand Closes Worldcoin Due to Unlawful Exchange of Biometric Data for Cryptocurrency

- Thailand ordered Worldcoin to halt operations and delete biometric data from 1.2 million users, citing PDPA violations involving iris scans for crypto tokens. - Authorities raided a Bangkok scanning center in October 2025, arresting employees for operating an unlicensed exchange and highlighting data leakage risks. - Worldcoin paused services in Thailand, denying wrongdoing, while the WLD token dropped to $0.6172 amid global regulatory crackdowns in Colombia, Spain, Brazil, and Kenya. - Regulators worldw

ALT5 Sigma’s Strategic Shift in Crypto: Regulatory Changes, Firm Belief, and Declining Investor Trust

- ALT5 Sigma's shift to a digital asset treasury model triggered an 80% stock plunge amid regulatory scrutiny and leadership turmoil. - U.S. regulators probed abnormal trading patterns while the CEO's suspension and Rwanda's money laundering conviction remained undisclosed. - Shareholders accuse the Trump-backed WLFI partnership of a "money grab," as the token dropped 34% post-listing. - The controversial DAT strategy faces skepticism for enabling large token holders to manipulate markets without direct pr