Ethereum Drops Near $3,000, But On-Chain ‘Opportunity Zone’ Hints at Rebound

Ethereum price has faced sharp declines over the past few days, dropping to its lowest level in two months. ETH fell as market volatility increased and investor confidence weakened. Despite the downturn, historical patterns suggest the trend could reverse soon, offering a potential recovery path for the altcoin king. Ethereum Lands In The Opportunity Zone

Ethereum price has faced sharp declines over the past few days, dropping to its lowest level in two months. ETH fell as market volatility increased and investor confidence weakened.

Despite the downturn, historical patterns suggest the trend could reverse soon, offering a potential recovery path for the altcoin king.

Ethereum Lands In The Opportunity Zone

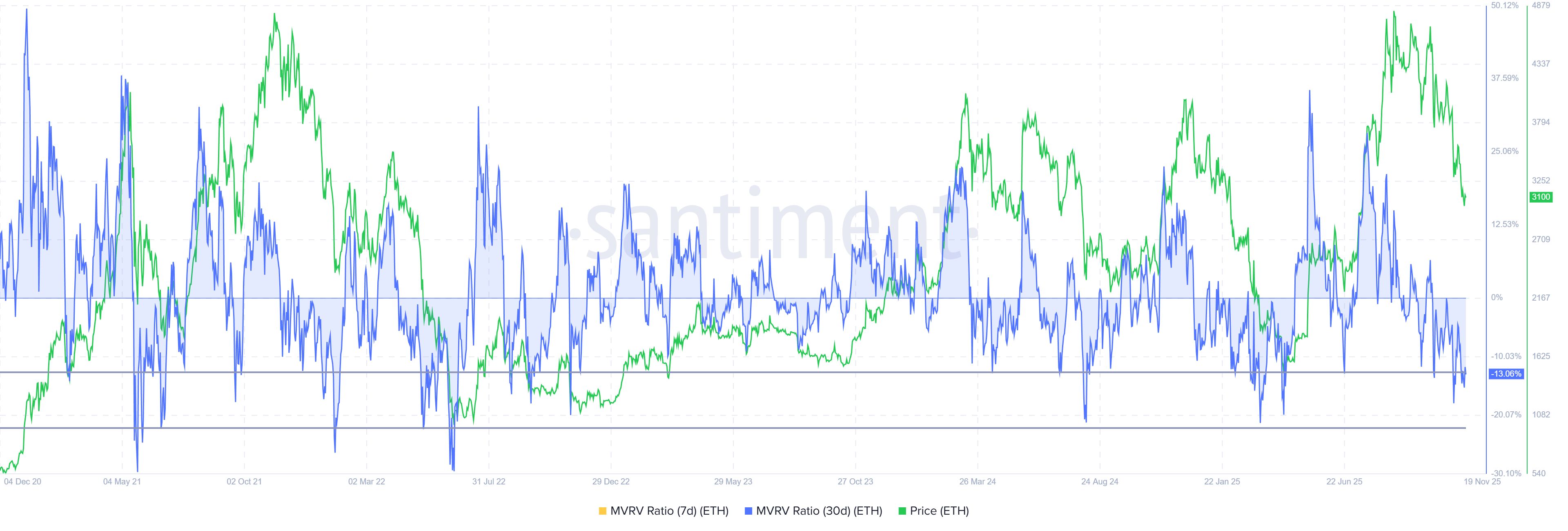

The MVRV Ratio is signaling a favorable setup for Ethereum. The metric sits at -13%, placing ETH firmly inside the opportunity zone between -12% and -22%. Historically, this range has marked points where losses reach saturation and selling pressure slows. Investors often view these levels as attractive entry points, supporting price rebounds.

As Ethereum enters this zone again, conditions resemble previous periods where strong recoveries followed. Reduced selling incentive and renewed accumulation typically help ETH stabilize.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum MVRV Ratio. Source:

Ethereum MVRV Ratio. Source:

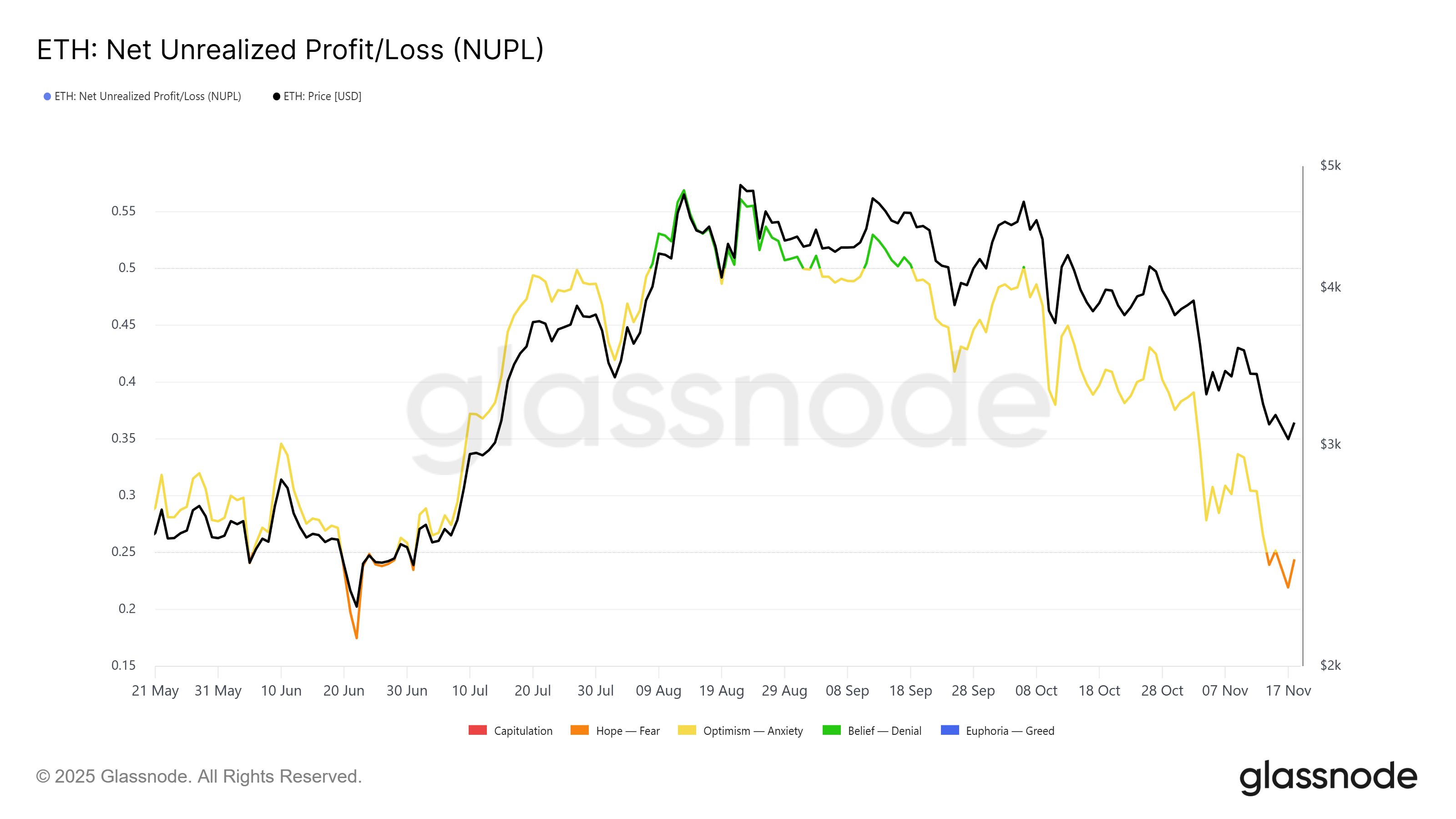

Macro momentum indicators further strengthen the case for a rebound. Ethereum’s Net Unrealized Profit/Loss, or NUPL, is slipping below the 0.25 threshold. This zone reflects rising fear among holders, a sentiment born out of the rising unrealized losses among ETH investors.

The last time this was seen, ETH bounced back into the Optimism zone. That shift marked a major reversal for the price.

A similar move now would indicate that fear-driven conditions are nearing exhaustion. If NUPL follows its historical trajectory, Ethereum could see renewed confidence and upward momentum.

Ethereum NUPL. Source:

Ethereum NUPL. Source:

ETH Price Could Bounce Back

Ethereum trades at $3,094, holding above the critical $3,000 support level after its sharp decline. This marks the first time in two months the asset has fallen this low. Maintaining support will be essential in preventing deeper losses and setting the stage for a potential recovery.

ETH is currently positioned below the $3,131 resistance level and is waiting for a catalyst to move higher. The supportive on-chain signals suggest that a push toward $3,287 is likely. If momentum strengthens, Ethereum could extend the rise and target $3,489 in the coming sessions.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

If bearish pressure increases, Ethereum could break below $3,000 and invalidate the current bullish outlook. A fall through support may expose ETH to a decline toward $2,814 as selling intensifies. This scenario would reflect broader weakness and delay any major recovery attempt.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin sees ‘significant step forward’ as $97K BTC price targets return

What’s behind the surge in privacy tokens as the rest of the market weakens?

Bitcoin Updates: Institutional Investors Drive Bitcoin ETF Boom Amid Growing Optimism for Rate Cuts

- Bitcoin ETFs saw $238M net inflows on Nov 21 after a record $903M outflow, signaling institutional stabilization amid volatile markets. - Fed rate cut expectations and Abu Dhabi's tripled IBIT holdings highlight Bitcoin's growing role as a macro-hedge and reserve asset. - Technical indicators suggest $90K-$92K resistance could be broken if daily inflows exceed $200M, potentially pushing BTC toward $100K by early 2026. - Asian institutional buyers consistently inject $150M weekly, contrasting U.S. retail

XRP News Today: Individual Investors Snap Up Last XRP Tundra Shares Ahead of Institutional Phase

- XRP Tundra emerges as a bear market hedge, leveraging dual-chain architecture on XRP Ledger and Solana to offer institutional-grade DeFi infrastructure. - Institutional acquisition accelerated its December 15 launch, establishing a $0.01 retail allocation window amid full KYC and smart-contract audits. - The project's structured yield model and cross-chain capabilities align with growing institutional interest in XRP, contrasting altcoins' struggles in a tightening crypto market. - Tundra's governance (T