Date: Wed, Nov 19, 2025 | 07:25 AM GMT

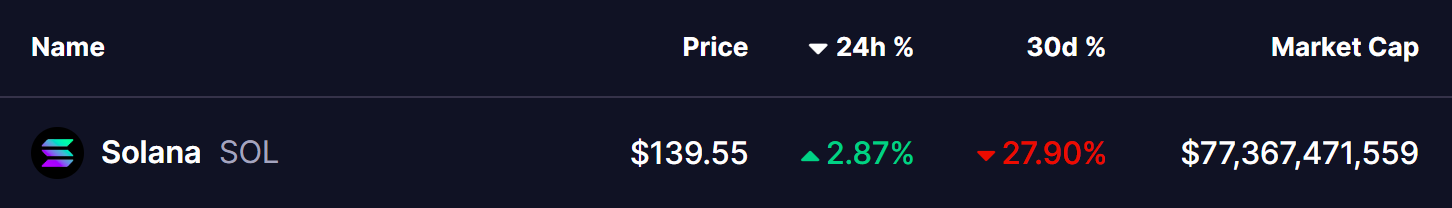

The broader crypto market remains under heavy selling pressure as Ethereum (ETH) extends its 30-day decline to over 26%. This weakness has spilled across major altcoins, and Solana (SOL) has not been spared — dropping nearly 27% in recent weeks.

However, beneath this sharp pullback, the chart is revealing an important technical setup that could be positioning SOL for a potential recovery.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle in Play

On the weekly timeframe, SOL has been consolidating within a symmetrical triangle, a pattern that typically marks a period of tightening price action before a decisive breakout. This structure has been forming for months, with price compressing between converging trendlines.

The latest correction dragged SOL toward the triangle’s lower boundary, touching the support area near $128.81, which also aligns closely with a horizontal zone where buyers have previously stepped in. This confluence has triggered a fresh reaction from the bulls, keeping the trendline intact for now.

Solana (SOL) Weekly Chart/Coinsprobe (Source: Tradingview)

Solana (SOL) Weekly Chart/Coinsprobe (Source: Tradingview)

SOL is currently trading around $139.55, positioned just above this key support but still sitting below the 50-week moving average (MA) at $177.48 — a level that has consistently acted as resistance and remains the first major hurdle for any sustainable rebound.

If SOL manages to reclaim the 50-week MA, it would be one of the earliest signals of renewed bullish momentum.

What’s Next for SOL?

If the ascending support trendline continues to hold, SOL may attempt a move back toward the triangle’s descending resistance line, gradually tightening price action as it approaches an eventual breakout point.

There is also a developing possibility of the right shoulder of a head-and-shoulders formation forming at this support region. If that structure plays out, it could fuel an upside push toward the 50-week MA around $177, which aligns with the logical neckline area of the pattern.

However, the risk remains clear. A strong breakdown below the symmetrical triangle support could invalidate the bullish scenario, paving the way for deeper downside levels and prolonging the corrective phase.

For now, SOL’s reaction at this support zone is crucial. As long as buyers defend the lower boundary, the potential for a recovery bounce remains alive.