FIRO’cious Price Rally Shows No Signs of Slowing — Can It Extend Beyond $10?

FIRO’s surge continues as the privacy-coin market heats up. The price has broken out of a flag pattern, backed by rising money flow and strong bull-bear pressure. With resistance zones approaching and double-digit projections returning, FIRO now stands at a critical point that could decide whether the rally extends toward $10+ or stalls.

The FIRO price has surged almost 60% in the past 24 hours and is now up more than 300% over the past month. The move has outpaced even Zcash, one of the strongest privacy coins this cycle. FIRO, previously known as Zcoin, is clearly riding the renewed momentum in the privacy coin space.

The key question now is whether this rally still has fuel left — and whether FIRO can realistically revisit the $10+ zone.

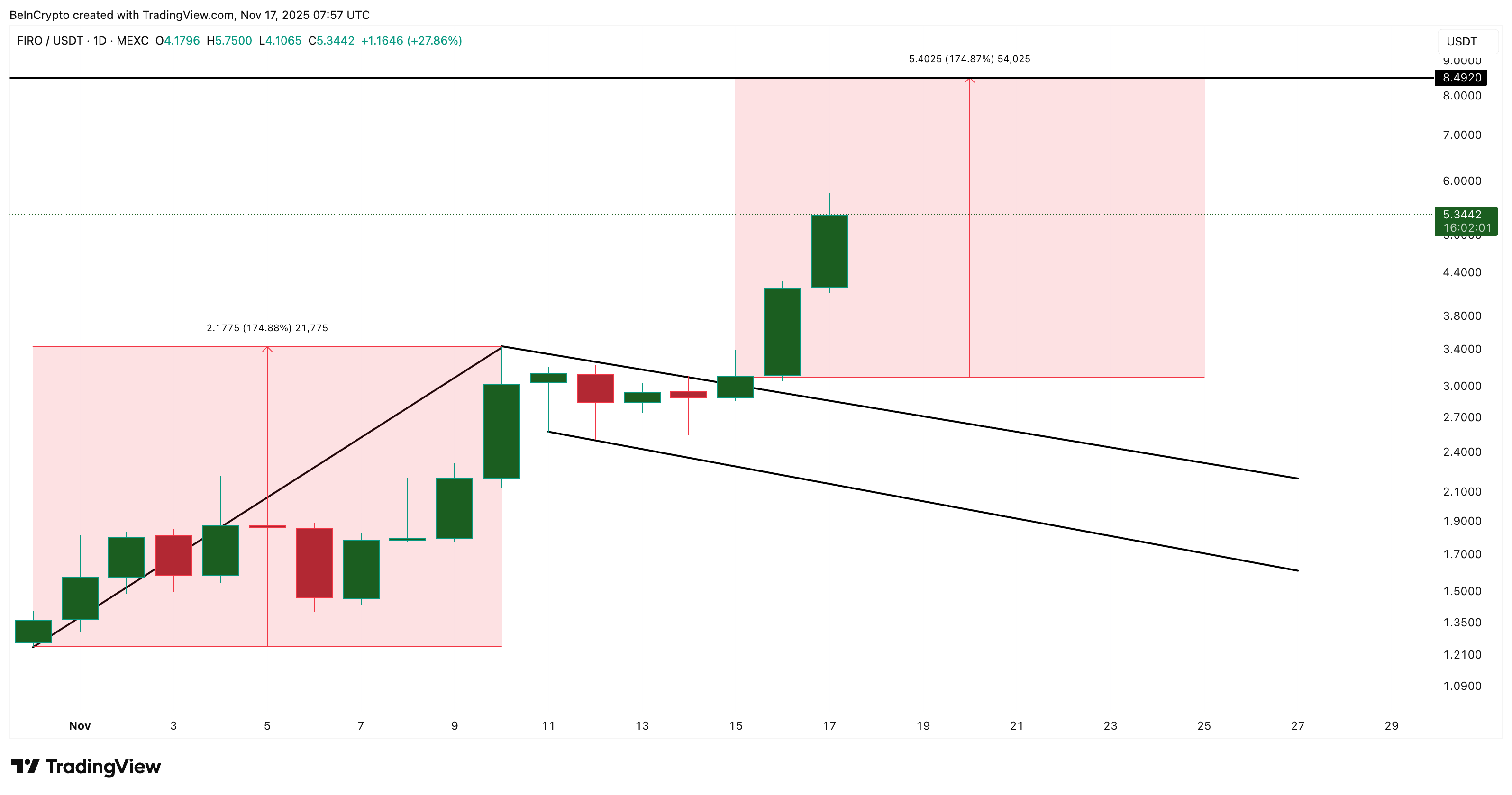

Flag Breakout Sets the Tone for FIRO’s Rally

FIRO recently broke out of a flag pattern, a classic bullish continuation structure that forms when price pauses after a sharp run-up.

The pole formed between October 31 and November 10, followed by a tight consolidation from November 10–15. FIRO then broke out on November 15, completing the pattern.

FIRO Breakout:

TradingView

FIRO Breakout:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Based on the pole projection, the technical target sits near $8.49, assuming broader market conditions remain supportive. With privacy coins catching strong flows across the board, FIRO has a realistic shot at reaching this extension.

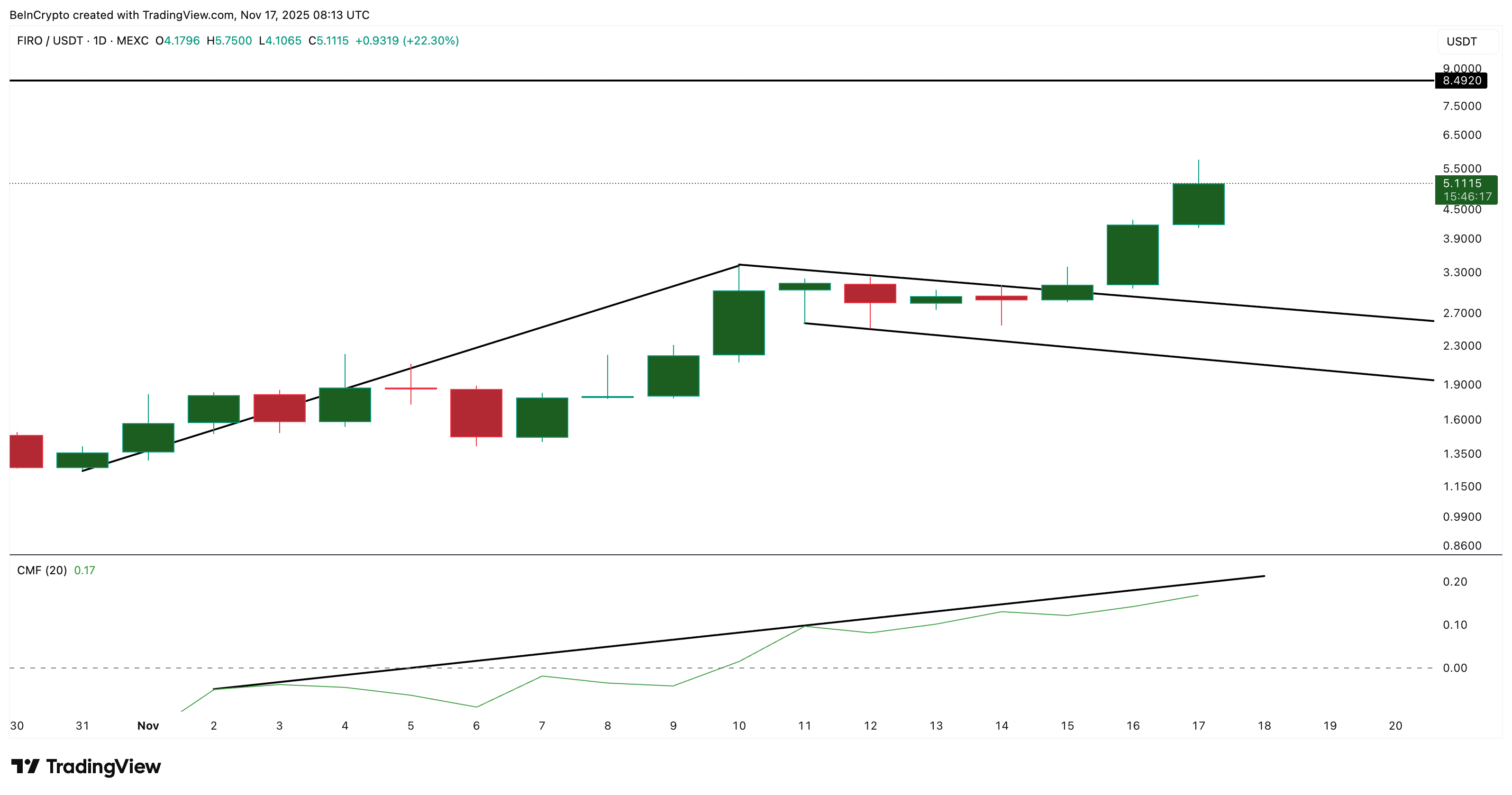

Big Money Flows and Bull-Bear Power Add Strength to the Move

The breakout has strong backing from volume-based indicators. FIRO’s Chaikin Money Flow (CMF) — an indicator that measures buying vs selling pressure weighted by volume — has been rising through the consolidation. CMF held steady even as the FIRO price was consolidating, indicating that big wallets were quietly accumulating during the dip.

Rising Inflows:

TradingView

Rising Inflows:

TradingView

The CMF ascending trendline breakout is still pending. A clean move above the upper CMF trendline would confirm a new wave of inflows and support FIRO’s next leg toward the projected target. However, until the CMF breakout happens, the FIRO price action remains prone to pullbacks.

The Bull-Bear Power indicator also confirms strength. This indicator measures the gap between buying pressure and selling pressure. On FIRO’s chart, Bull-Bear Power has surged to bullish levels higher than those seen during the original pole, validating the force behind this breakout.

Bulls Control The FIRO Price:

TradingView

Bulls Control The FIRO Price:

TradingView

Both indicators support the idea that the FIRO price rally might have more room to run.

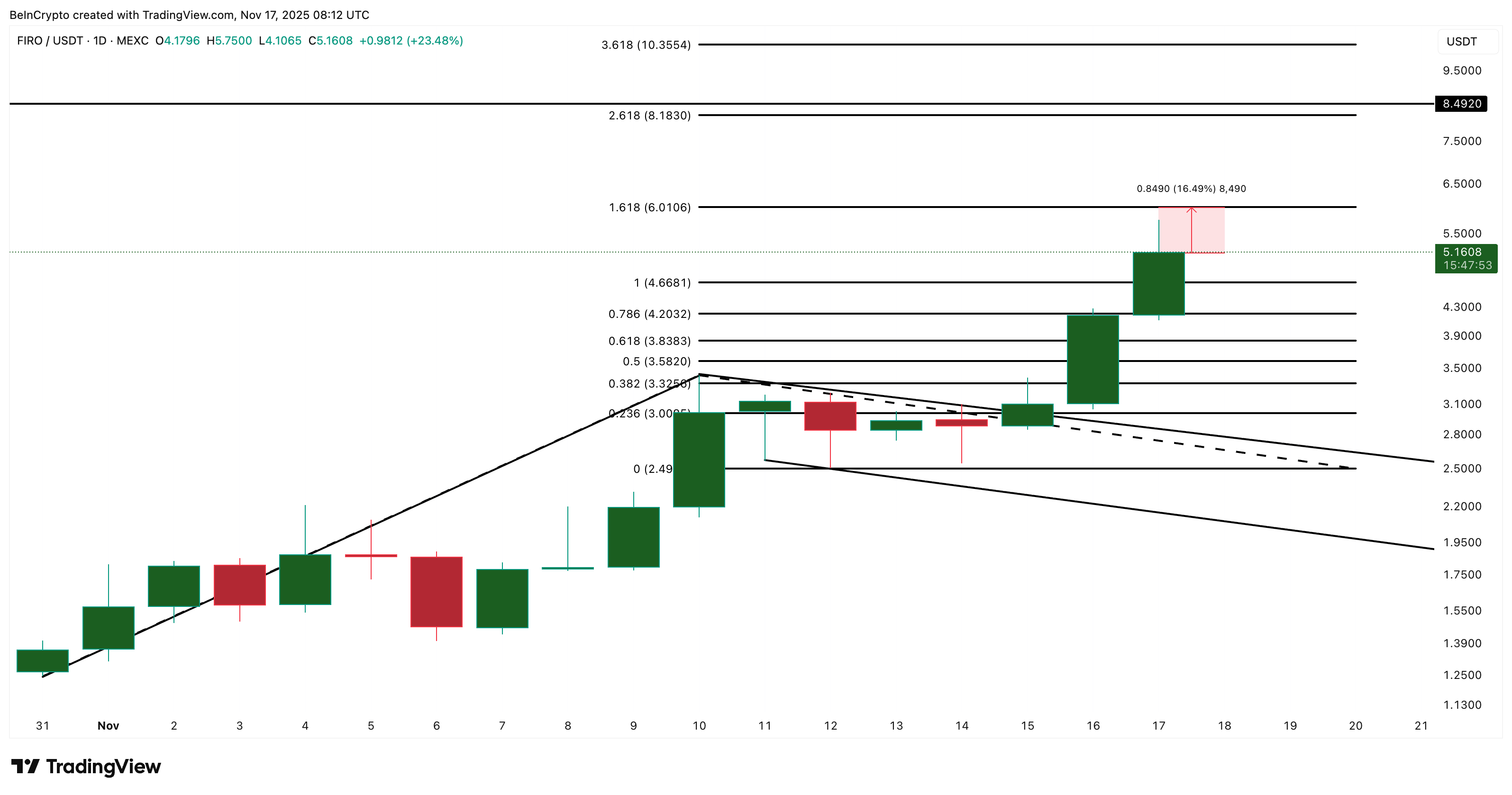

FIRO Price Levels That Matter Next

The FIRO price now faces two major hurdles.

- The first resistance sits at $6.01. A daily close above this level strengthens the momentum case.

- The next major resistance sits at $8.18, just below the pole-derived target.

Crossing both levels keeps the $8.49 projection in play.

FIRO Price Analysis:

TradingView

FIRO Price Analysis:

TradingView

If FIRO clears $8.49 (the pole projection), the next psychological and technical target becomes $10.35, marking the return of the double-digit zone.

On the downside, a move below $3.00 weakens the structure, and falling under $2.49 breaks it completely. These are the invalidation levels for the current rally. That could happen only if a FIRO price pullback runs deeper, led by big money exiting and not breaking the trendline that we mentioned earlier.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Crypto ETPs Signal Market Growth as Leverage Shares Debuts on SIX

- Leverage Shares launched the world's first 3x leveraged and -3x inverse Bitcoin/Ethereum ETPs on SIX Swiss Exchange, expanding its crypto product range to 452 offerings. - The EUR/USD-traded ETPs target sophisticated investors seeking directional exposure, aligning with SIX's 19% YoY crypto ETP turnover growth to CHF 3.83 billion. - Market timing raises concerns as Bitcoin/Ethereum fell 21%/26% in November 2025, with experts warning leveraged products could amplify losses during volatility. - SIX's regul

Ethereum Updates Today: Buterin Moves ETH to Safeguard Privacy Against Major Financial Players and Quantum Threats

- Ethereum co-founder Vitalik Buterin donated 128 ETH ($760,000) to privacy-focused apps Session and SimpleX Chat, emphasizing decentralized metadata protection and user-friendly access. - Recent 1,009 ETH transfer to Railgun protocol sparked speculation about asset reallocation, though control remains with Buterin amid mixed Ethereum price trends. - Buterin warns of existential risks: 10.4% institutional Ether ownership and quantum computing threats by 2028, advocating layered security for Ethereum's desi

The Psychological Factors Influencing Retail Investors’ Actions in Cryptocurrency Markets

- Crypto markets are shaped by behavioral finance, where retail investors drive volatility through FOMO, herd behavior, and overconfidence. - The PENGU token exemplifies this dynamic, surging 480% in July 2025 but plummeting 28.5% by October due to emotional trading cycles. - Social media amplifies emotional contagion, with traders checking prices 14.5 times daily, while financial literacy mitigates bias susceptibility. - Personality traits like neuroticism increase cognitive biases, and speculative narrat

Bitcoin News Today: Bitcoin's Unstable Holiday Periods Hide Average Gains of 6%

- Bitcoin's Thanksgiving-to-Christmas performance shows equal odds of rising or falling, with a 6% average seasonal return despite volatility. - Historical extremes include a 50% 2020 rally and 2022's 3.62% drop post-FTX collapse, amid a $2.49-to-$91,600 long-term surge since 2011. - 2025's $91,600 price reflects ongoing recovery from 2024's $95,531 peak, with institutional crypto adoption and macroeconomic factors shaping future trajectories. - Analysts advise dollar-cost averaging for retail investors, w