VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

VISA Transactions Could Soon Flow Through Ripple’s Interledger Protocol

A recent report, highlighted by renowned crypto observer SMQKE, reveals a potential breakthrough in payments infrastructure that VISA transactions may soon be integrated with Ripple’s Interledger Protocol (ILP).

Therefore, this development could mark a significant milestone in bridging traditional financial systems with blockchain-based payment networks.

Ripple’s ILP, a protocol designed for seamless, cross-ledger payments, enables instant transfers across different payment networks without relying on intermediaries.

By connecting traditional financial rails like VISA to ILP, financial institutions could achieve faster, more efficient, and cost-effective transaction processing. The integration promises to reduce the friction and delays that often plague cross-border payments, which currently rely on legacy systems such as SWIFT.

The report indicates that VISA could leverage Ripple’s Interledger Protocol to enable near-instant, transparent payments across banks, digital wallets, and financial networks, offering faster fund access, lower fees, and a seamless payment experience for businesses and consumers.

Notably, Ripple’s Interledger Protocol is built for seamless interoperability, enabling real-time connections across diverse ledgers. This positions VISA to modernize its payment infrastructure while maintaining regulatory compliance and operational reliability, bridging traditional finance and digital assets.

Beyond speed and efficiency, integrating Ripple’s ILP with VISA could bridge traditional finance and blockchain, creating a seamless hybrid ecosystem. This move could drive mainstream adoption of digital currencies, positioning ILP as a key infrastructure for global payments.

Therefore, the report highlights the rising convergence of traditional finance and decentralized networks. Integrating VISA transactions with Ripple’s ILP could usher in a new era of cross-border payments, delivering unmatched speed, transparency, and scalability.

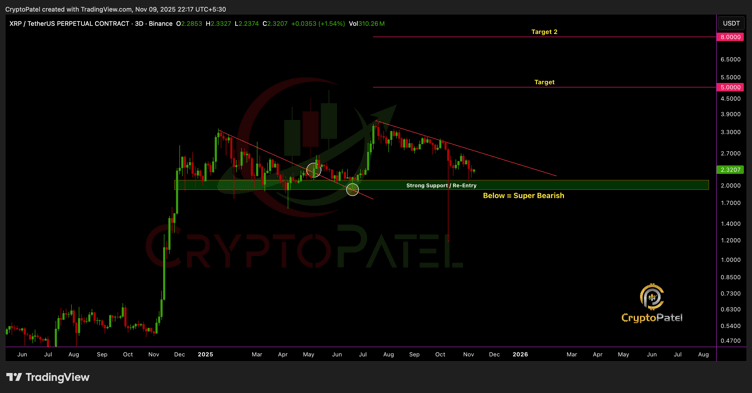

XRP Eyes $5–$8 as Strong Support Zone Bolsters Institutional Confidence

According to prominent market analyst Crypto Patel, XRP has established a decisive support zone between $1.85 and $2, signaling a robust foundation for both retail and institutional investors. This range, Patel notes, represents a strong liquidity and accumulation base, creating a favorable environment for potential price expansion in the months ahead.

XRP’s $1.85–$2 support zone is proving pivotal with the current price being $2.27. Historically, areas of high liquidity and concentrated institutional accumulation absorb selling pressure and anchor markets during volatility.

As Crypto Patel notes, XRP’s consolidation here reflects strong investor confidence and positions the coin for potential structural growth.

XRP continues its bullish momentum across multiple timeframes, with strong trading volumes and clear institutional accumulation signaling strategic positioning. Analyst Patel suggests that if the $1.85–$2 support holds, XRP could see a structural surge toward $5–$8, representing substantial upside potential.

Therefore, XRP’s $1.85–$2 support zone is more than a floor, it signals strong institutional backing, deep liquidity, and bullish momentum. If trends hold, a structural move toward $5–$8 is well-supported by market dynamics and investor activity, reinforcing XRP’s upward trajectory.

Conclusion

Integrating VISA transactions with Ripple’s Interledger Protocol could transform payments, combining traditional network reliability with blockchain’s speed, transparency, and interoperability. This leap promises a faster, more efficient ecosystem and marks a major step toward a truly connected global financial landscape.

On the other hand, XRP’s $1.85–$2 support zone highlights strong institutional interest and deep liquidity. With bullish momentum intact, this level not only defends current valuations but also positions XRP for a potential surge toward $5–$8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Federal Reserve's Softer Stance and ETF Investments Drive Bitcoin's Recovery to $91,000

- Bitcoin surged above $91,000 in December 2025 as Fed rate-cut odds hit 70%, driven by dovish signals and ETF inflows reversing outflows. - Technical indicators showed oversold RSI levels and seller exhaustion, while altcoins like XRP/ZEC jumped 7.7%-17% amid $2.95T market cap growth. - Institutional flows favored Solana ETFs and altcoin products, but MSCI's crypto exclusion policy sparked backlash from advocates like Michael Saylor. - Retail fear metrics and $605M liquidations highlighted fragility, yet

Ethereum Updates Today: Institutional Investments Rise While Prices Remain Flat: The Challenge of Ethereum's Potential Breakout

- Ethereum's MVRV Z-Score (0.29) signals potential buying opportunities amid prolonged accumulation and institutional ETF inflows. - Retail investors reduced exposure while whales (10K+ ETH) accumulated, contrasting with $92M ETH ETF inflows on Nov 24. - BlackRock's staked ETH ETF filing threatens DATs' opaque fee models as ETH price struggles to reclaim $2,800 despite technical buildup. - Divergent ETF flows ($88M ETHA inflow vs. $53M outflow) highlight market volatility, with analysts eyeing $9K breakout

Stablecoins Solidify Their Position as the Foundation of Global Finance, Surpassing Conventional Powerhouses

- A 214M USDT transfer highlights stablecoins' growing role as global finance's backbone, surpassing traditional payment giants. - VCI Global's $50M OOB token accumulation underscores institutional confidence in Tether-aligned ecosystems for merchant adoption. - Tether's $180B USDT circulation and $12T+ 2023 volume reflect structural adoption in cross-border payments and settlements. - Stablecoin growth challenges traditional intermediaries while Oobit's platform incentivizes real-world commerce adoption t

Character.AI's Interactive Storytelling AI Seeks to Disrupt the Cycle of Teen Addiction

- Character.AI replaces open-ended chatbots with "Stories," a choose-your-own-adventure AI feature for teens to mitigate mental health risks and regulatory pressures. - The new feature restricts unrestricted AI conversations for under-18s, offering structured narratives with user-driven choices and visual storytelling. - Legal challenges and California's AI companion regulations intensify scrutiny, as critics warn of unresolved risks like parasocial addiction and emotional manipulation. - Mixed user reacti