Pi Coin’s Rare Green Streak Could Last If The Altcoin Clears One Key Level

The Pi Coin price is flashing a rare multi-timeframe green streak even while the broader market struggles. A breakout from a symmetrical triangle, a CMF surge, and improving OBV all point to growing strength. But the entire move depends on one level: $0.229. A close above it could unlock more upside.

Pi Coin just printed something unusual. Three major timeframes are green at the same time. The one-month chart is up 9.5%, the seven-day chart is up 2.1%, and the last 24 hours are up 3.5%.

This is rare because the Pi Coin price is still down almost 40% in the three-month window. The token is showing early strength while most of the market is still stuck in a slow bleed. The question now is simple: is this just a brief bounce, or the start of a larger move?

Symmetrical Triangle Breakout Surfaces As Money Flow Turns Positive

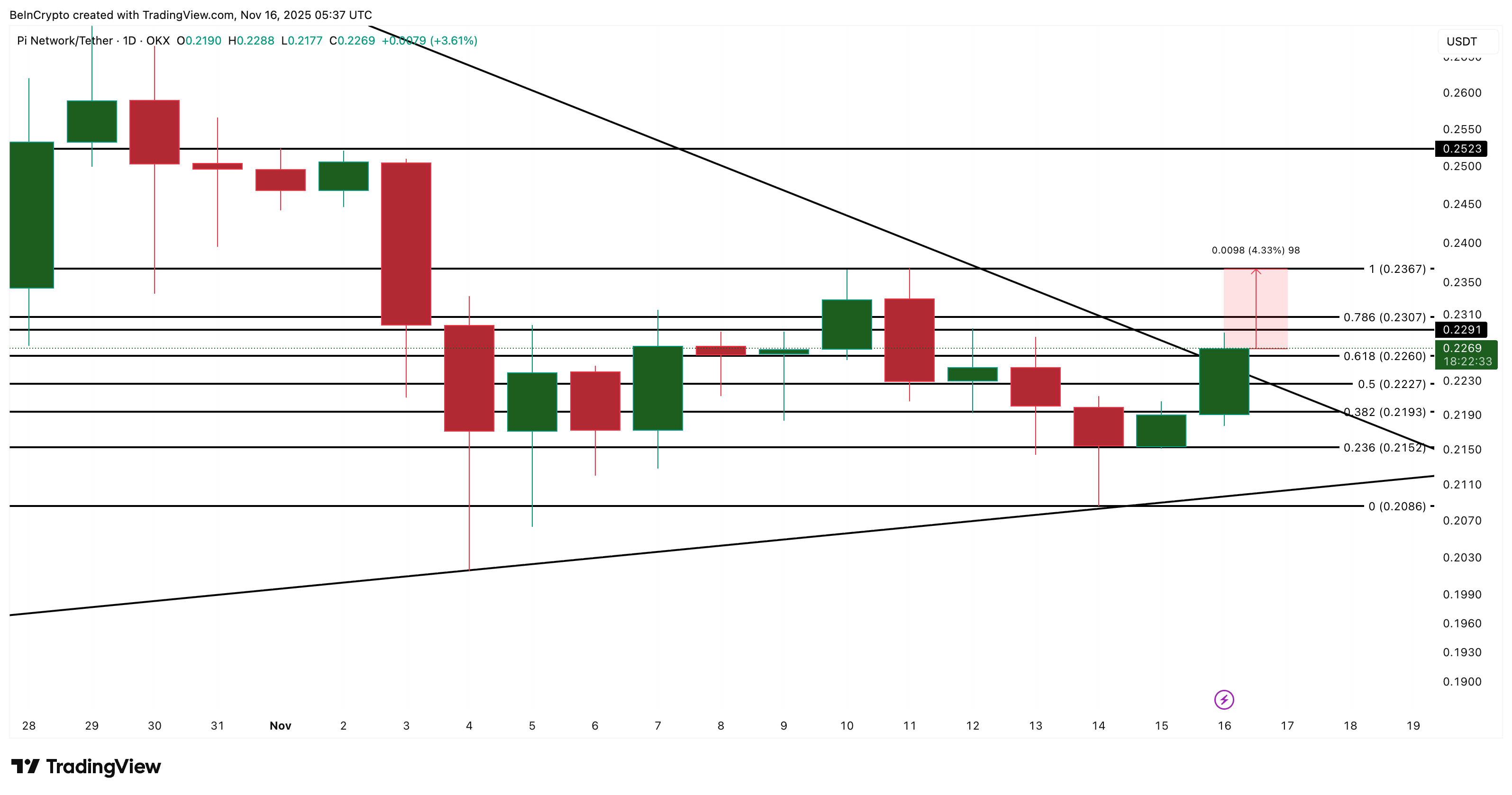

PI has been stuck inside a symmetrical triangle for weeks. This pattern typically indicates indecision, rather than a trend direction.

However, yesterday, the Pi Coin price broke through the upper boundary and is now testing the confirmation level near $0.229, a key level. A clean candle close above that line is the first sign that buyers are finally taking control.

Pi Coin Breaks Out:

TradingView

Pi Coin Breaks Out:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

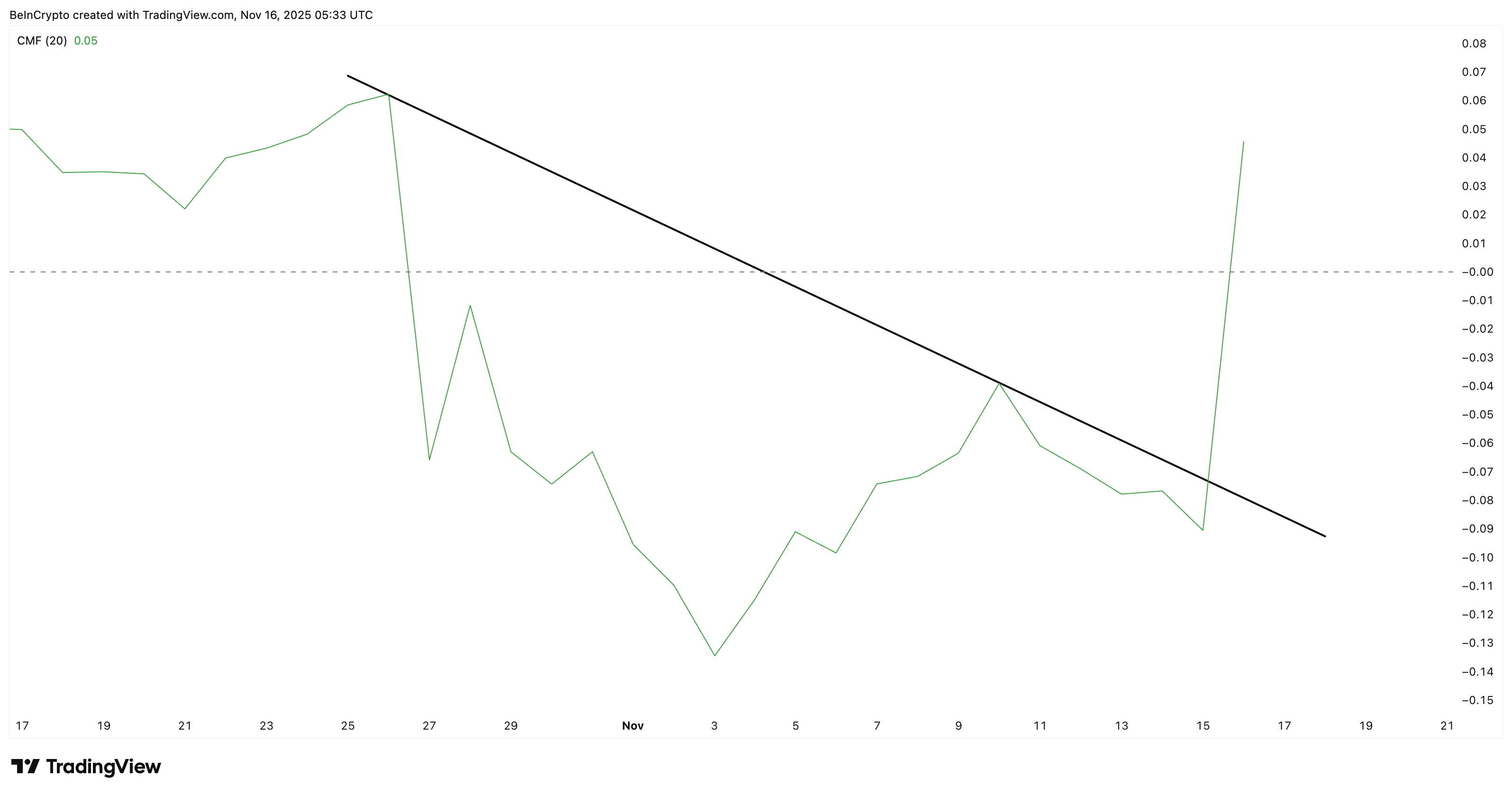

The next clue comes from the Chaikin Money Flow (CMF). CMF measures whether money is moving into or out of an asset. Two days ago, CMF broke out of its descending trend line, rising sharply from –0.09 to +0.05.

This jump shows that the breakout is not random. Bigger Pi Coin wallets may be stepping in as the pattern flips bullish.

Big Money Flows In:

TradingView

Big Money Flows In:

TradingView

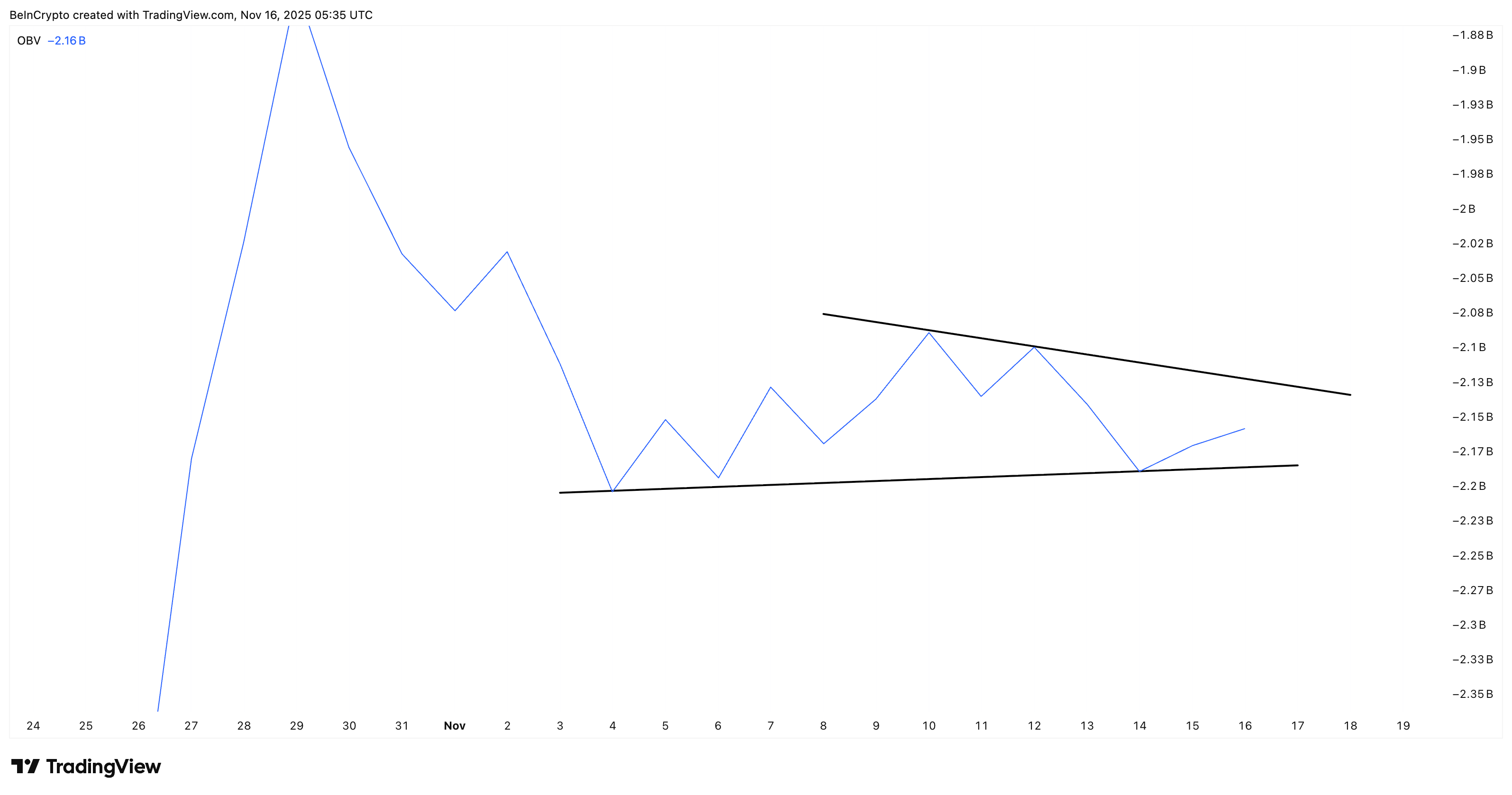

The On-Balance Volume (OBV) tells the other half of the story. OBV tracks buying and selling volume to show whether traders support the move. OBV touched lower, back to its rising trend line on November 12–13, hinting that retail volume wasn’t ready.

However, since November 14, OBV has begun to curl upward again. If OBV breaks its upper trend line, it confirms that retail Pi Coin buyers are now joining the move sparked by the CMF breakout.

Retail Volume Coming Back:

TradingView

Retail Volume Coming Back:

TradingView

The combination of a technical breakout, rising money flow, and recovering OBV gives Pi Coin its strongest setup in weeks.

Pi Coin Price Levels To Watch As Momentum Builds

If the Pi Coin price closes above $0.229, the move could extend to $0.236, representing a gain of approximately 4.2% from current levels. If momentum holds, the next target is near $0.252, which has previously acted as strong resistance.

However, the bullish setup can fail if the OBV rolls over again or the CMF slips back into negative territory. A drop below $0.215 weakens the structure and exposes a slide toward $0.208.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Currently, the Pi Coin price is exhibiting rare strength across multiple timeframes. Whether that strength lasts comes down to one line: $0.229. If the bulls defend it, PI’s green streak may have more room to run.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CryptoAppsy: Experience Instant Access—No Registration Needed, Perfect for Fast-Moving Markets

- CryptoAppsy offers real-time crypto price tracking and alerts via iOS/Android, requiring no account creation, targeting global users in Turkish, English, and Spanish. - Market volatility drives demand for instant data, contrasting with subscription-based models, as seen in GoPlus's 717M monthly API calls and WEEX's 100% APR promotions. - Competitors like BI DeFi emphasize security upgrades post-$15B breach, highlighting crypto's growing focus on risk mitigation alongside innovation. - CryptoAppsy's succe

Ethereum Latest Updates: Buterin's Railgun Transaction Ignites Privacy and Pre-Sale Discussion as ETH Reaches $3,000

- Vitalik Buterin transferred $2.9M ETH to privacy protocol Railgun as Ethereum surged past $3,000, triggering speculation about liquidity events. - On-chain analysts highlight Railgun deposits' historical link to pre-sale activity, though Buterin's 0.4% stake transfer doesn't inherently signal selling. - Buterin's $738.6M ETH holdings and recent privacy advocacy, including his "privacy is hygiene" stance, frame the transaction's strategic context. - Market reactions remain divided between regulatory hedgi

Thailand Closes Worldcoin Due to Unlawful Exchange of Biometric Data for Cryptocurrency

- Thailand ordered Worldcoin to halt operations and delete biometric data from 1.2 million users, citing PDPA violations involving iris scans for crypto tokens. - Authorities raided a Bangkok scanning center in October 2025, arresting employees for operating an unlicensed exchange and highlighting data leakage risks. - Worldcoin paused services in Thailand, denying wrongdoing, while the WLD token dropped to $0.6172 amid global regulatory crackdowns in Colombia, Spain, Brazil, and Kenya. - Regulators worldw

ALT5 Sigma’s Strategic Shift in Crypto: Regulatory Changes, Firm Belief, and Declining Investor Trust

- ALT5 Sigma's shift to a digital asset treasury model triggered an 80% stock plunge amid regulatory scrutiny and leadership turmoil. - U.S. regulators probed abnormal trading patterns while the CEO's suspension and Rwanda's money laundering conviction remained undisclosed. - Shareholders accuse the Trump-backed WLFI partnership of a "money grab," as the token dropped 34% post-listing. - The controversial DAT strategy faces skepticism for enabling large token holders to manipulate markets without direct pr