Date: Sat, Nov 15, 2025 | 11:20 AM GMT

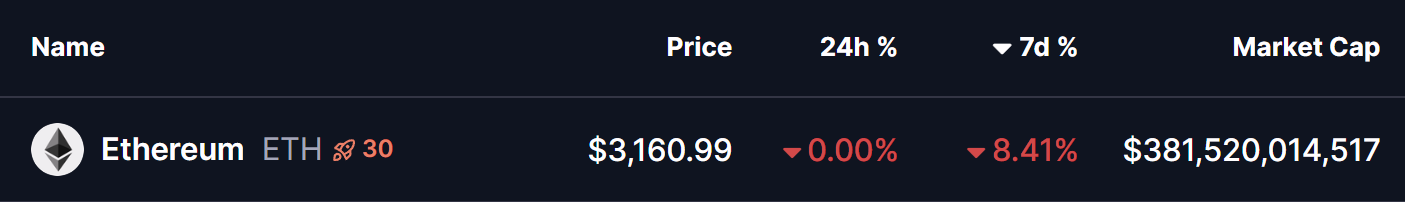

The broader altcoin market continues to face heavy selling this week as Ethereum (ETH) plunged more than 8% over the past seven days, dropping from its weekly high of $3658 to the current level around $3160.

This sharp volatility has weighed on major altcoins , but beneath all the red, the BTC Dominance (BTC.D) chart is flashing a technical signal that could be preparing the market for an potential short term altcoin rebound.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Broadening Wedge Breakdown

On the 4-hour chart, Bitcoin Dominance had been trading inside a broadening wedge structure — a pattern that often reflects increasing volatility and indecision.

After multiple rejections from the wedge’s upper resistance zone, BTC.D finally broke below its critical support trendline near 59.66%, confirming a bearish breakdown in dominance. Previously, such a breakdown is often interpreted as a bullish sign for altcoins, as it indicates a potential shift of market strength away from Bitcoin.

BTC.D 4H Chart/Coinsprobe (Source: Tradingview)

BTC.D 4H Chart/Coinsprobe (Source: Tradingview)

Following the drop, BTC.D slid to around 59.28% before bouncing slightly higher to retest its breakdown level near 59.63%. This retest is an important moment for the market — dominance either reclaims the trendline (bearish for alts) or gets rejected and continues lower (bullish for alts).

So far, the chart suggests a weakening structure that aligns with a fading bearish phase for altcoins. If the retest confirms resistance, altcoins could begin transitioning into a recovery phase.

What’s Next for BTC.D?

If BTC.D continues to respect this breakdown, the next major target sits near 58.05%, which marks a key support zone. A move toward this level usually signals a broader rotation of liquidity into the altcoin market.

Such a shift could ignite short tern fresh upward momentum across leading altcoins, many of which have been heavily oversold throughout the recent correction.

For now, this technical breakdown in BTC dominance stands as one of the most promising signals altcoin traders have seen in weeks, hinting that the long-awaited altcoin rebound may finally be approaching.