Date: Thu, Nov 13, 2025 | 05:45 AM GMT

The cryptocurrency market is showing signs of a rebound in the last few hours as Ethereum (ETH) climbed from its 24-hour low of $3,373 to around $3,500. This short-term recovery has boosted overall market sentiment, pushing several altcoins into the green — including Zcash (ZEC).

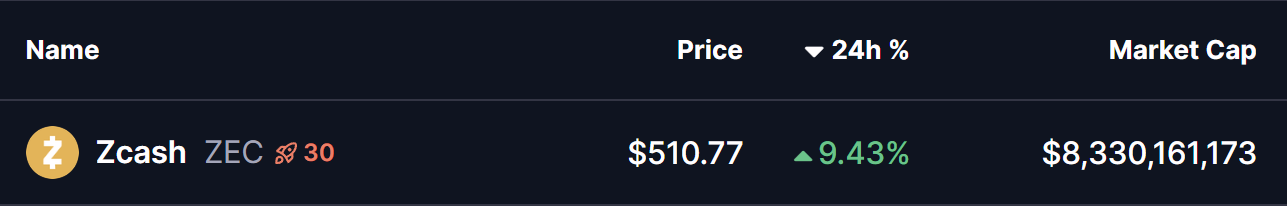

ZEC has jumped by 9% today, and more importantly, its latest chart setup reveals the emergence of a harmonic pattern that may fuel the next leg higher if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the 4-hour timeframe, Zcash has developed a textbook Bullish Bat harmonic pattern, which is often seen as a reversal signal suggesting a potential upward movement.

The pattern structure started from point X near $370.60, followed by a strong impulse up to point A, then a corrective move to point B, another rally to point C, and a final dip to point D around $685.26, completing the pattern.

Following this completion, ZEC has shown a notable bounce and is now trading to $510.29, confirming renewed buying interest. The price has also reclaimed the 100 moving average (100 MA) at $462.00, a level that often acts as an important dynamic support zone during bullish transitions.

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

At the same time, ZEC’s price action is approaching the 50 moving average (50 MA) at $545.69, which serves as a key resistance level. A sustained breakout above this area could validate the start of a broader upward trend.

What’s Next for ZEC?

If Zcash manages to break convincingly above the 50 MA with increasing volume, the Bullish Bat pattern indicates that price could extend higher toward its Potential Reversal Zone (PRZ).

This zone spans between $604.37 — representing the 0.618 Fibonacci extension of the CD leg — and $748.87, aligning with the 1.0 extension level. Historically, this is where the Bat pattern completes before the market either reverses or consolidates.

However, if ZEC fails to maintain strength above the 100 MA, it could face another period of sideways consolidation, delaying the bullish momentum until stronger accumulation appears.