Key Market Information Discrepancy on November 14th - A Must-See! | Alpha Morning Report

Editor's Picks

1.Crypto Market Suffers Another Blow as Bitcoin Touches $98,000, US Stock Crypto Concept Stocks Fall Across the Board

2.Musk Announces X Money Will Soon Go Live

3.Aster Launches DEXE Trading Event with Rewards Totaling Over $200,000

4.Boosted by Robinhood Listing, AVNT Surges Over 8%

5.Total Liquidations in the Past 24 Hours Soar to $748 Million, Over 197,000 People Liquidated

Articles & Threads

1. "The New Era of Token Financing, a Milestone in US Regulatory Financing"

The discussion about Monad's ICO on Coinbase with a $25 billion FDV was a hot topic this week. Apart from debating whether the sale at a $25 billion FDV is worth participating in, the "compliance level" as Coinbase's first ICO also sparked widespread discussion and was seen as a landmark event in the industry's compliance. Stablecoin issuer Circle mentioned in its recent quarterly report that it is exploring the possibility of issuing native tokens on the Arc Network. Coinbase also hinted at the launch of the Base token this October, almost two years after the joint founder of Base Chain, Jesse Pollak, said in an interview. All signs indicate that asset issuance in the industry is entering a new era of compliance.

2. "Major Adjustment in U.S. Crypto Regulation, CFTC Could Take Over Spot Market"

The long-standing blurred boundary of crypto regulation in the United States is being redrawn. With Mike Selig nominated as CFTC chairman and Congress advancing new legislation, the division of labor between the SEC and CFTC is emerging for the first time at a policy level, and a rare clear trend in the regulatory structure is appearing: the SEC focuses on securities; the CFTC focuses on the digital commodity spot market.

Market Data

Daily Marketwide Capital Flow Heatmap (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

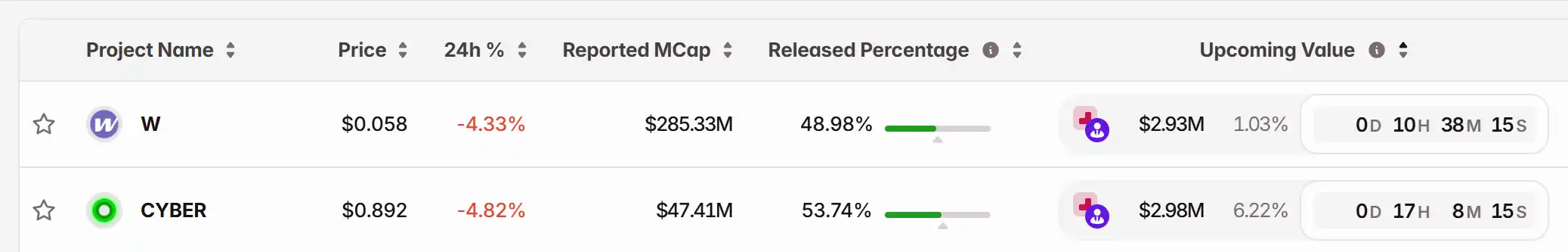

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia eyes crypto and stablecoins to fight inflation and US dollar shortage

COTI and Houdini Swap Integrate Privacy and Regulatory Compliance to Support Institutional Blockchain Integration

- COTI partners with Houdini Swap to enable confidential cross-chain swaps, preserving user privacy while maintaining regulatory compliance for institutional adoption. - The integration uses non-custodial architecture and split-transaction routing to obscure sender-receiver links while allowing KYT checks on regulated exchanges. - COTI's Garbled Circuits infrastructure supports enterprise-grade privacy, enabling full lifecycle compliance from asset swaps to DeFi interactions without data exposure. - With $

XRP News Update: XRP ETF Momentum and Institutional Interest Face Off Against Technical Challenges in $15.5 Trillion Pursuit

- XRP gains traction via spot ETF approvals and institutional adoption, unlocking a $15.5T market potential as Ripple expands into prime brokerage and cross-border payments. - SEC-approved ETFs from Bitwise, 21Shares, and Grayscale attract $645M in AUM, offering investors regulated access to XRP with fees ranging from 0.34% to 1.89%. - Ripple's $1.25B acquisition of Hidden Road (Ripple Prime) enhances XRP's utility as collateral for $3T in annual settlements, boosting institutional liquidity and adoption.

Bitcoin Leverage Liquidations: Potential Impact on Institutional Involvement in 2025

- 2025 crypto market saw $19B in Bitcoin liquidations after October 10 crash, slashing prices from $126k to $82k amid 70% long-position collapses. - 1,001:1 leverage ratios and 78% perpetual futures dominance created self-reinforcing sell-offs, exposing systemic risks in hyper-leveraged derivatives. - Fed rate hikes and the GENIUS Act's stablecoin rules intensified volatility, forcing institutions to adopt AIFM risk models and RWA diversification. - Post-crisis reforms show $73.59B in crypto-collateralized