Injective launches native EVM mainnet to enhance on-chain finance

Key Takeaways

- Injective launched its Native EVM mainnet, enabling developers to build on both WebAssembly and EVM with unified assets.

- The MultiVM environment provides fast transactions, shared liquidity, and compatibility with Ethereum tools without modification.

Injective has launched its native EVM mainnet, adding Ethereum Virtual Machine capabilities to its blockchain infrastructure to advance on-chain finance, the team announced Tuesday.

The upgrade introduces seamless interoperability between WebAssembly (WASM) and the Ethereum Virtual Machine (EVM), enabling developers to build sophisticated on-chain finance applications across both environments while sharing liquidity and unified assets.

According to Injective, the new mainnet delivers 0.64-second block times and ultra-low transaction fees, supporting high-performance financial operations for users, developers, and institutions.

Developers can deploy using familiar Ethereum tools such as Hardhat and Foundry without modification, while leveraging Injective’s plug-and-play financial modules. The platform also plans to integrate Solana VM support in the future, expanding its multi-VM architecture.

At launch, more than 40 decentralized applications (dApps) and infrastructure partners are joining the ecosystem, aiming to streamline dApp creation and interaction while overcoming long-standing blockchain barriers like high fees and slow transaction speeds.

Use cases include lending and borrowing markets, tokenized traditional assets and commodities, pre-IPO market exposure, advanced derivatives and perpetual futures, and institutional-grade infrastructure and custody solutions.

Injective’s governance and network security are overseen by the Injective Council, which includes representatives from Google Cloud and Binance’s YZI Labs. The project is backed by prominent investors such as Jump Crypto, Pantera Capital, and Mark Cuban.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

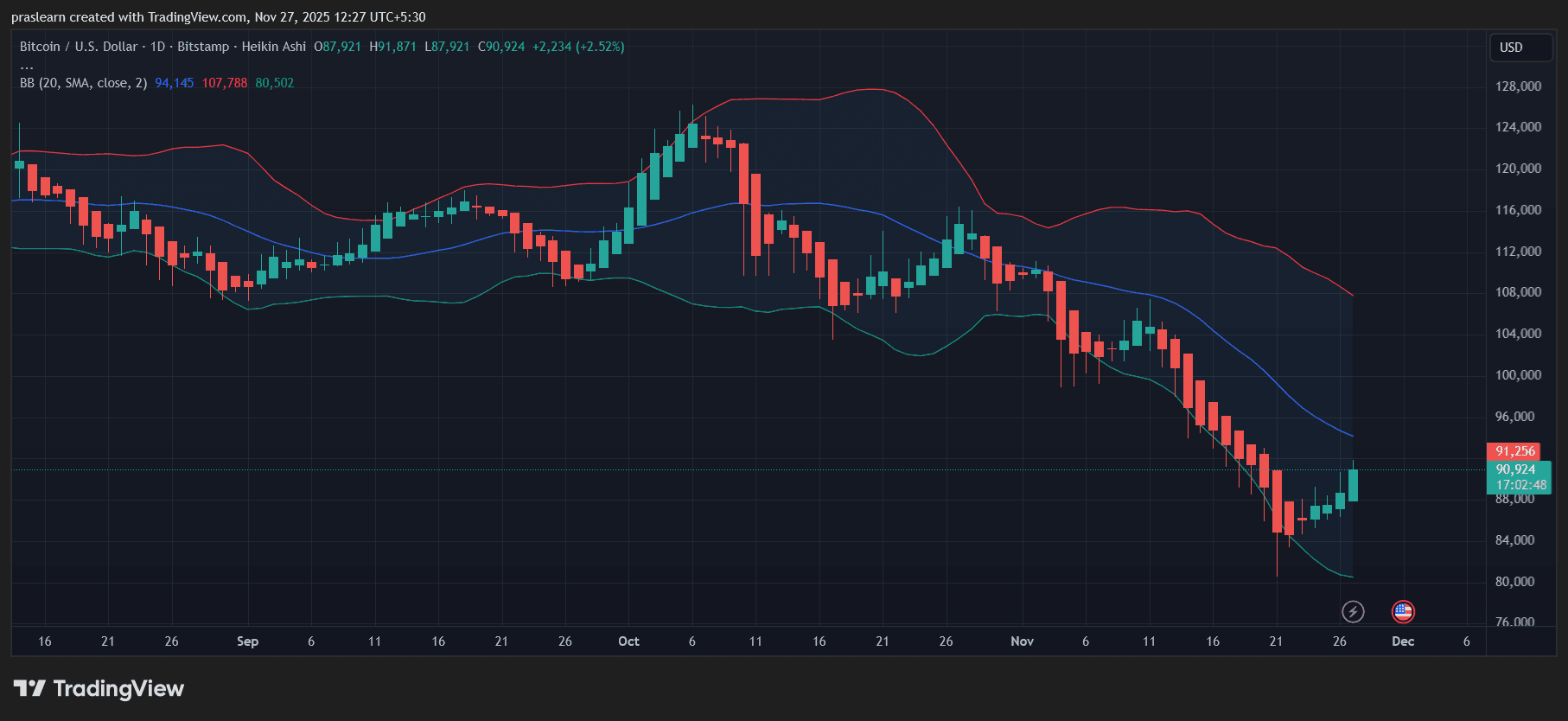

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi