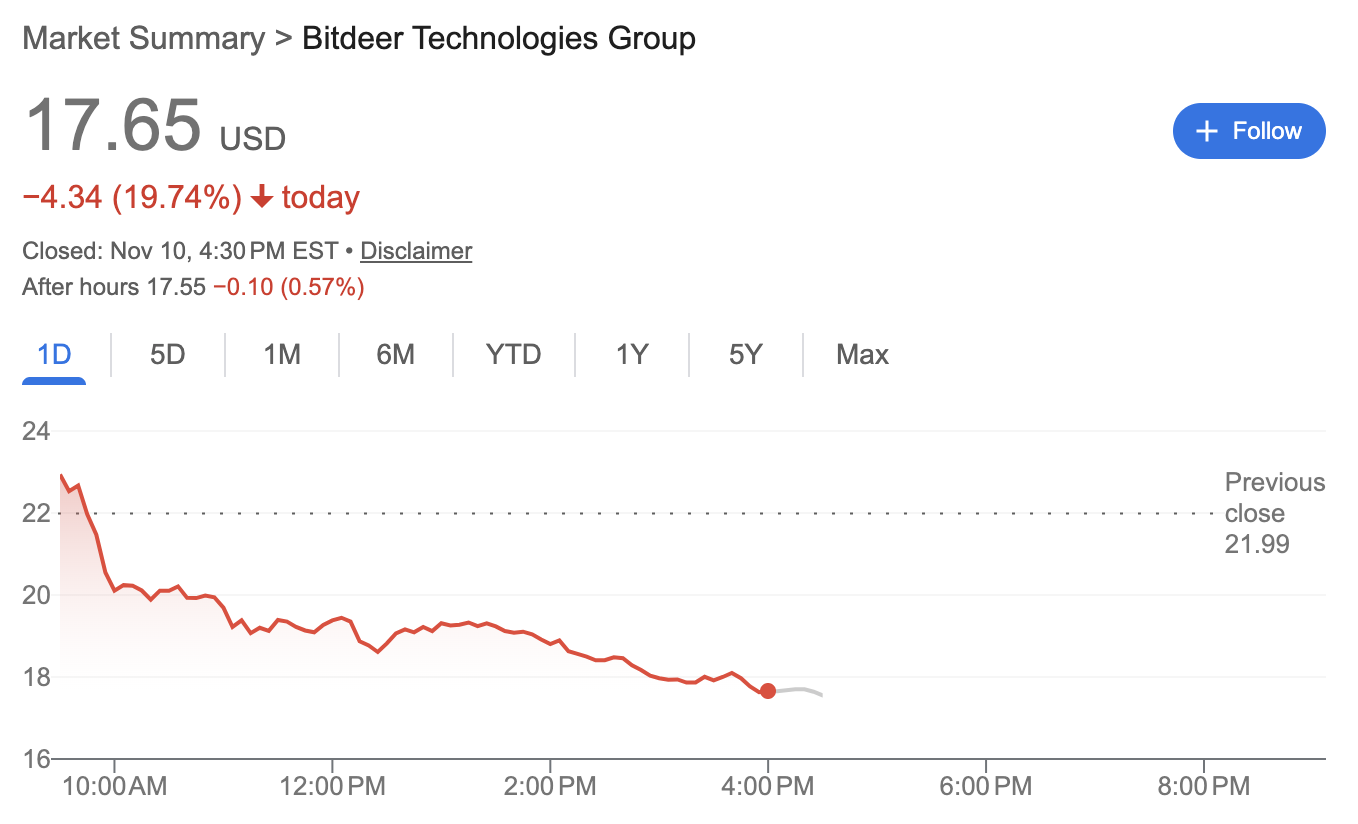

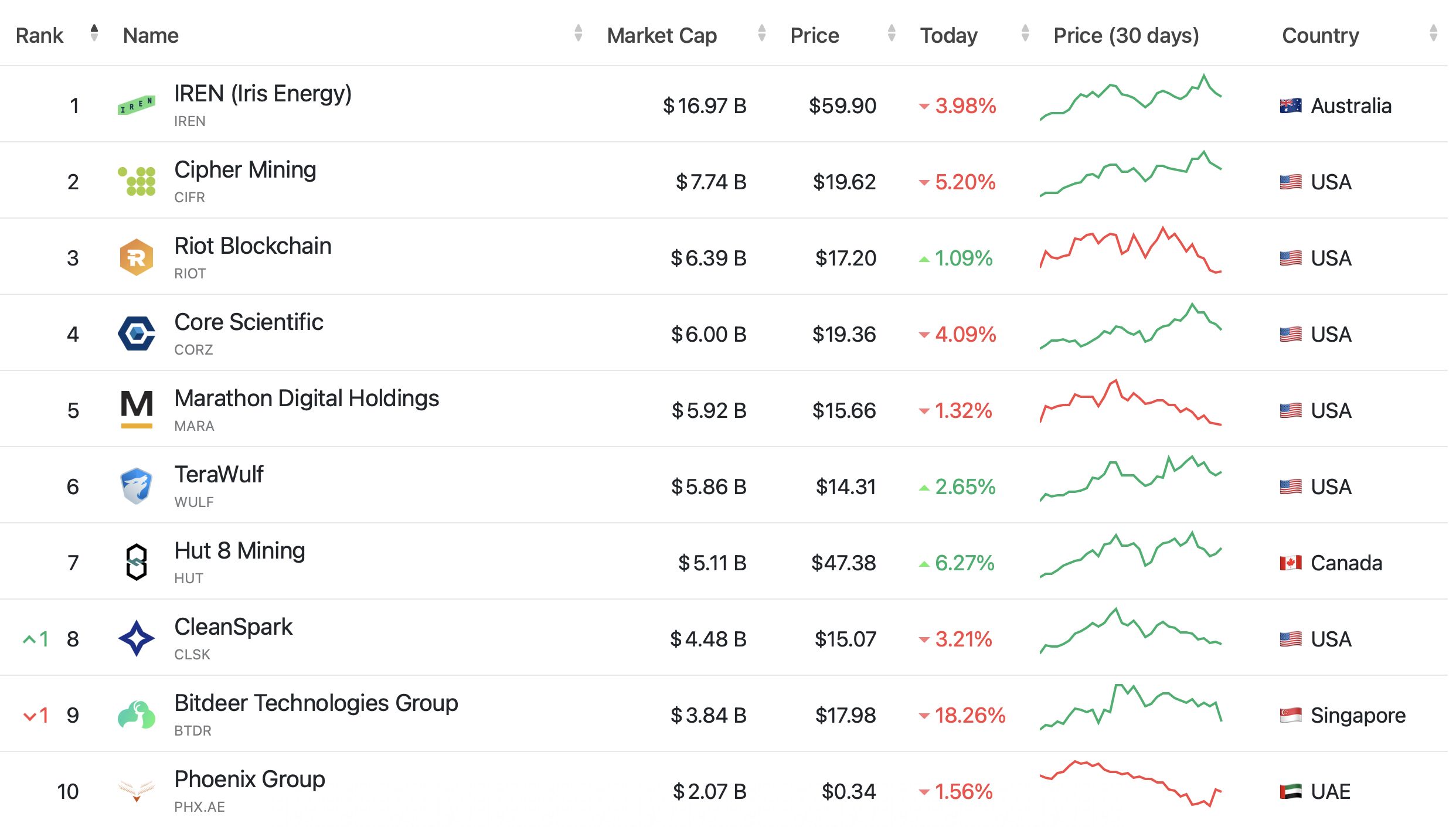

Bitdeer shares drop 20% after posting $266M quarterly loss

Shares of Singapore-based Bitcoin miner Bitdeer Technologies fell nearly 20% on Monday after the company reported a jump in quarterly losses.

Bitdeer recorded a net loss of $266.7 million for the third quarter of 2025, compared with a net loss of $50.1 million for the same period a year ago, largely due to non-cash losses resulting from the revaluation of its convertible debt.

Revenue climbed to $169.7 million, up 174% from the previous year, driven by the expansion of its self-mining operations, according to the company.

Bitdeer also reported gains in its operating performance, with adjusted EBITDA rising to $43 million from a $7.9 million loss in the same period in 2024. The company also doubled its Bitcoin production, mining 1,109 BTC during the quarter.

Bitdeer reported its first revenue from high-performance and AI cloud services, bringing in $1.8 million in Q3 as it began shifting part of its computing power toward artificial intelligence.

Matt Kong, chief business officer at Bitdeer, said the company was “uniquely positioned to capitalize” on AI and the surge in demand for computing power. He added that allocating “200 MW of power capacity to AI cloud services could generate an annualized revenue run-rate exceeding $2 billion by the end of 2026.”

Bitdeer ended the quarter holding 2,029 BTC, up from 258 BTC a year earlier, and managed 241,000 mining rigs, compared with 165,000 at the same time last year.

Related: EToro stock jumps on Q3 results, $150M buyback plan

Bitcoin miners turn to AI

An increasing number of Bitcoin mining companies are pivoting to AI and high-performance computing (HPC), repurposing a portion of their power capacity to meet the fast-growing demand for computing power.

In August, MARA Holdings announced a $168 million deal to acquire a 64% stake in Exaion, a subsidiary of France’s EDF, to expand into low-carbon AI infrastructure, while TeraWulf signed 10-year colocation agreements with AI company Fluidstack worth $3.7 billion in contract revenue.

On Nov. 3, Bitcoin miner IREN announced a five-year, $9.7 billion GPU cloud services deal with Microsoft, giving the tech giant access to Nvidia GB300 chips hosted in IREN’s data centers.

While the pivot by Bitcoin miners into AI and HPC has been picking up momentum this year, it isn’t entirely new.

In July 2023, HIVE Blockchain Technologies rebranded as HIVE Digital Technologies, reflecting its shift to an HPC strategy, alongside its traditional cryptocurrency mining operations.

In March 2024, Core Scientific signed a multi-year, $100 million deal with GPU cloud firm CoreWeave to host HPC workloads at its Texas data center.

Magazine: How Chinese traders and miners get around China’s crypto ban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat