The Great Korean Pivot: From Memecoins to Machine Chips

For years, South Korea was the global heartbeat of crypto speculation. It became the place where digital coins traded at a premium, and where retail investors moved markets overnight. The “Kimchi Premium” became shorthand for a national obsession: Rampant and frenetic trading activity unrivaled by any region across the globe.

But by late 2025, the story has reversed. The same traders who once hunted for the next altcoin gem on Upbit are now glued to Korean stock exchange tickers, swapping meme tokens for memory chips and high-bandwidth semiconductors. The crypto charts have gone quiet — and a new speculative engine has taken their place.

A market gone silent

Upbit, once the undisputed hub of Korean crypto mania, now trades at a fraction of its former pace. Average daily volumes have dropped nearly 80% from a year ago, slipping from roughly $9 billion in late 2024 to just $1.8 billion by November 2025. Bithumb, Korea’s second-largest exchange, has suffered a similar fate, losing more than two-thirds of its liquidity over the same period, according to reporting from Wu Blockchain.

What was once a nightly national pastime, the endless churn of small-cap coins and chatroom rumors, has evaporated. Even volatility itself has collapsed. Where daily volumes once swung wildly between $5 billion and $27 billion, 2025’s trading bands have flattened to a muted $2 to $4 billion range.

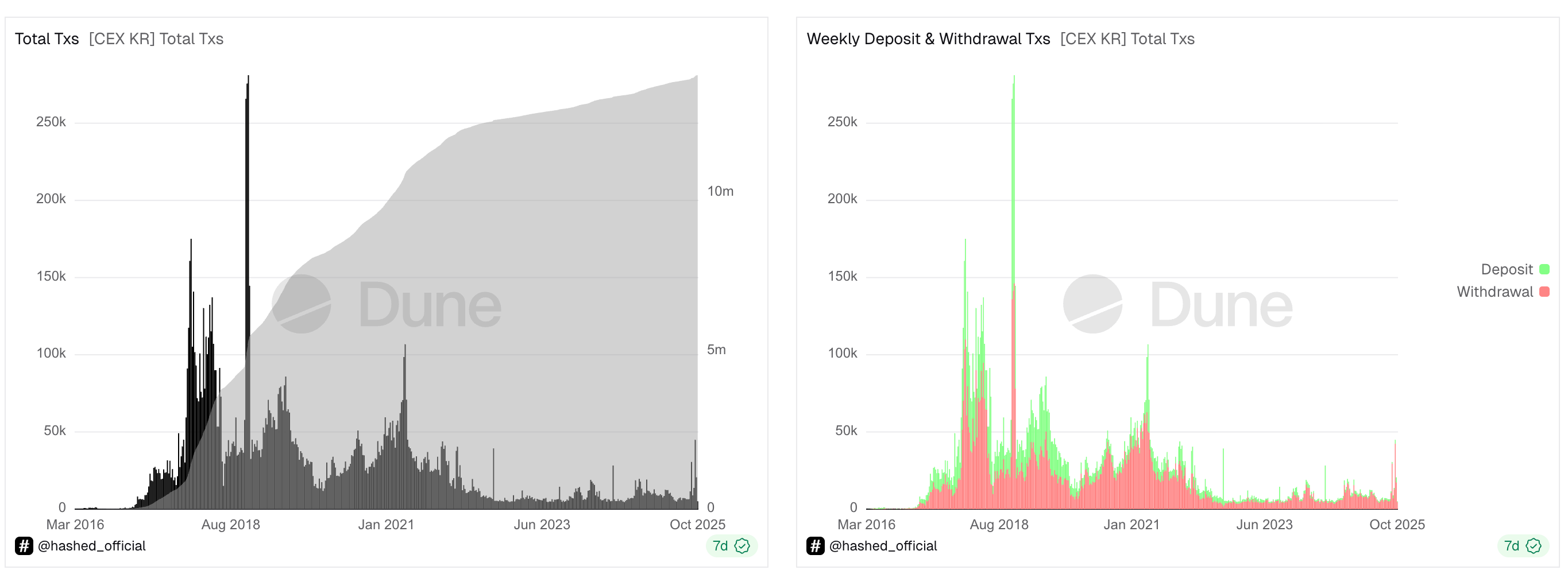

Data from analytics provider Dune shows that the drop in activity is compounded when compared to 2018, when at the mania's peak Korean exchanges facilitated 280,000 deposits per day; the daily figure hasn’t exceeded 50,000 since 2021.

The rise of a new obsession

The vacuum left by crypto didn’t last long. Retail investors simply migrated to a different table — the Korean stock market, which has staged one of the most explosive rallies in its history.

The KOSPI index has surged more than 70% year-to-date, setting a number of record highs. In October alone, it posted its strongest monthly gain since 2001, climbing 21% and logging 17 new intraday records. The frenzy has been led by AI-linked giants like Samsung Electronics and SK hynix, whose combined daily turnover now makes up more than a quarter of the entire exchange.

In a country that once traded crypto as a kind of collective hobby, the psychology feels familiar. The same spirit of retail speculation has resurfaced, only this time it’s wearing a suit of semiconductor stocks.Data reported by the Korea Times showed the amount of active trading accounts in the nation jumped from 86.57 million at the turn of the year to 95.33 million as of Oct. 31.

Retail euphoria spills over into equities

Unlike the meme-driven altcoin rallies of old, Korea’s equity boom has a more tangible backbone. AI is the global growth narrative of the decade, and Korea happens to control one of its most critical supply chains.

As Nvidia and AMD fuel much of the world’s demand for AI hardware, Korean firms like SK hynix and Samsung have become indispensable. Their dominance in high-bandwidth memory (HBM), a key component for AI training, has turned them into national champions.

Add to that a government keen on revitalizing domestic markets, and you get what some analysts call a “policy-backed bull run.” President Yoon Suk Yeol’s administration has pushed reforms to reduce the long-standing “Korea Discount,” encouraging higher dividends, tighter governance and incentives for retail and institutional investment at home.

Same spirit, different casino

Speculation in the Korean crypto community was never about restraint; it was about rhythm and speed. That hasn’t changed. Margin lending is booming again, leveraged ETFs are flying off the shelves and retail participation has doubled in just a year. According to Bloomberg data, leveraged retail positions now make up nearly 30% of total holdings, with younger traders leading the charge.

In other words, the migration from crypto to equities isn’t a retreat, it’s a reallocation of risk appetite. Koreans haven’t abandoned speculation; they’ve just found a venue where the leverage feels legitimate and the upside patriotic.

But this shift has consequences. Without Korean retail as a liquidity anchor, global crypto markets have lost one of their most consistent buyers. Memecoin rallies that once lit up Korean chatrooms now fizzle faster. And the wider market in general is in need of a spark; bitcoin currently trades around $100,000 despite recording an all-time high one month ago, while several altcoins lost upwards of 20% over the past month.

Waiting for the next spark

Crypto’s “Kimchi traders” may have stepped away, but history suggests they won’t be gone forever. When the AI trade cools, which analysts are suggesting may be on the near horizon, or when the next major crypto narrative arrives, the same traders could come roaring back, armed with new capital and sharper reflexes.

For now, Korea’s retail traders have swapped blockchains for circuit boards, chasing the same rush in a different arena.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dovish Hints Meet Fed Prudence: Prediction Markets Reflect 87% Probability of Rate Reduction

- Polymarket's prediction markets show 87% odds of a December Fed rate cut, driven by rising crypto and stock market optimism. - Fed officials like Waller and Williams signal potential easing, while Goldman Sachs and Bill Gross endorse the cut likelihood. - Rate-cut expectations surged as maintaining current rates dropped to 18%, with CME FedWatch and Kalshi aligning at ~84% probability. - Lower rates could boost economic activity and crypto adoption, though inflation risks and delayed jobs data remain key

ADGM's Endorsement of Animoca Establishes It as a Center for Web3 Innovation

- Animoca Brands secures in-principle approval from ADGM to operate as a virtual asset service provider, marking a key regulatory milestone. - The approval aligns with ADGM's strategy to position itself as a global fintech and blockchain innovation hub with flexible regulatory frameworks. - This endorsement enhances Animoca's credibility for institutional partnerships while reflecting growing mainstream acceptance of Web3 assets. - ADGM's balanced regulatory approach supports innovation in virtual economie

Hyperliquid (HYPE) Price Rally: How Infrastructure and Institutional Support Drive DeFi Expansion

- Hyperliquid (HYPE) gains DeFi traction with 70-80% market share via HyperEVM/Unit innovations and 78% user growth by Q4 2025. - SEC S-1 compliance and USDH stablecoin (backed by BlackRock/Stripe) strengthen institutional trust and $1B treasury partnerships. - $50 price target depends on absorbing $314M token unlock risks, maintaining technical resilience, and resolving governance controversies. - Macroeconomic factors including Bitcoin performance and Fibonacci level retests will determine HYPE's Decembe

The Transformation of the Xerox Campus and Its Impact on Property and Industrial Investments in Webster, NY

- Webster , NY, redevelops 300-acre Xerox brownfield with $9.8M FAST NY grant to create industrial hub by 2025. - EPA-compliant remediation and infrastructure upgrades align with tech-enabled manufacturing and renewable energy goals. - Project includes fairlife® dairy plant (250 jobs) and leverages low 2% vacancy rates to attract high-value industrial tenants. - State partnerships and zoning reforms position site as scalable platform for semiconductors , logistics, and mixed-use growth. - Initiative exempl