HBAR Price Continues To Survive, Holds Above Month-Long Support

Hedera’s HBAR remains resilient above critical support levels, but weak inflows and bearish momentum suggest continued consolidation until investor participation strengthens.

Hedera’s native token, HBAR, has shown remarkable resilience despite enduring repeated market crashes and failed recovery attempts.

The altcoin continues to hold above a key support level, maintaining investor confidence even as bearish market sentiment persists. However, questions remain about how long HBAR can sustain this stability.

Hedera Needs Stronger Market Support

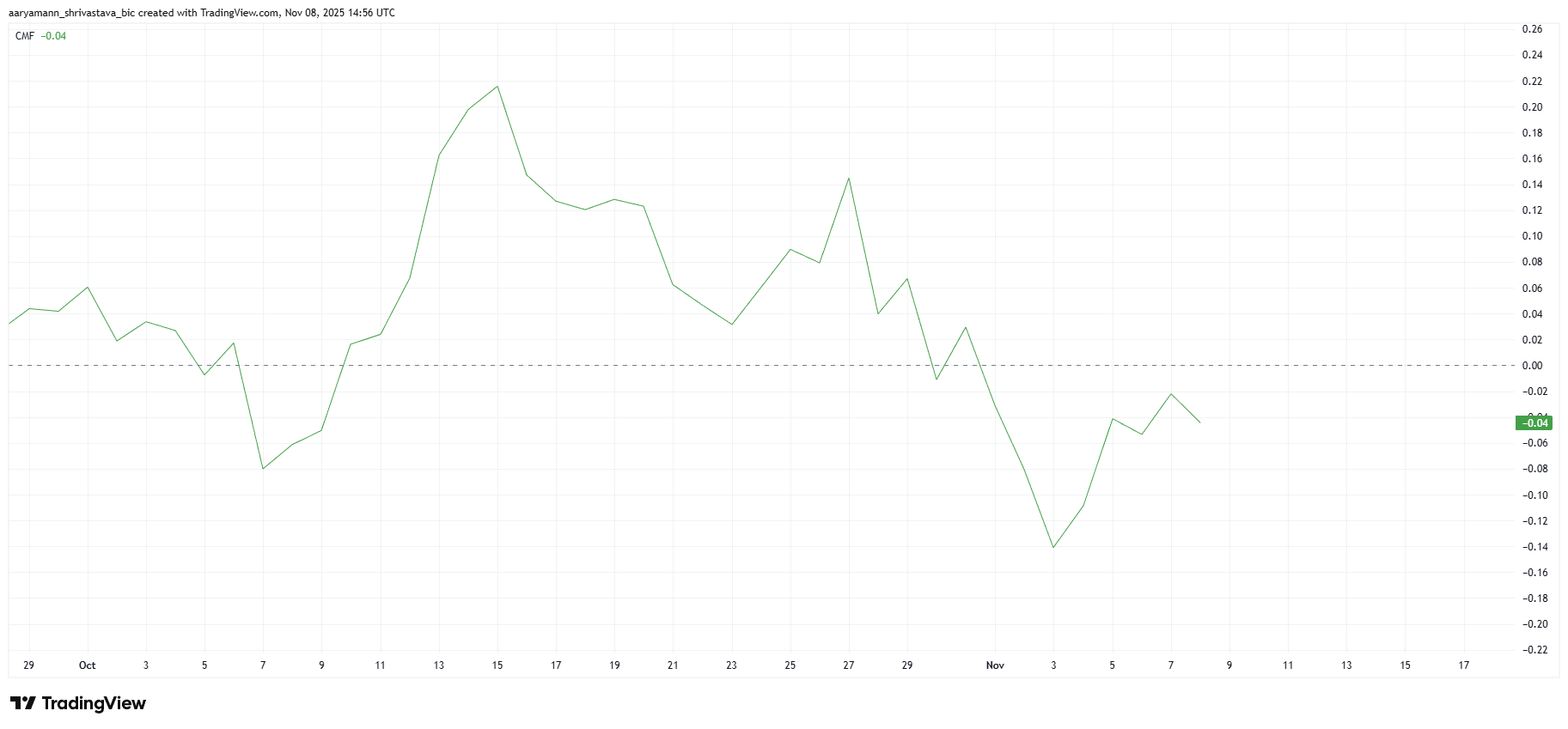

The Chaikin Money Flow (CMF) indicator shows HBAR sitting in the bearish zone below the zero line, reflecting ongoing outflows. Although there has been a modest uptick recently, inflows are still insufficient to reverse the trend. This suggests that sellers maintain control of the market.

Until consistent inflows surpass outflows, the HBAR price will likely remain under pressure. The gradual increase in inflows indicates that investor interest is slowly returning, but it is not yet strong enough to dictate price direction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

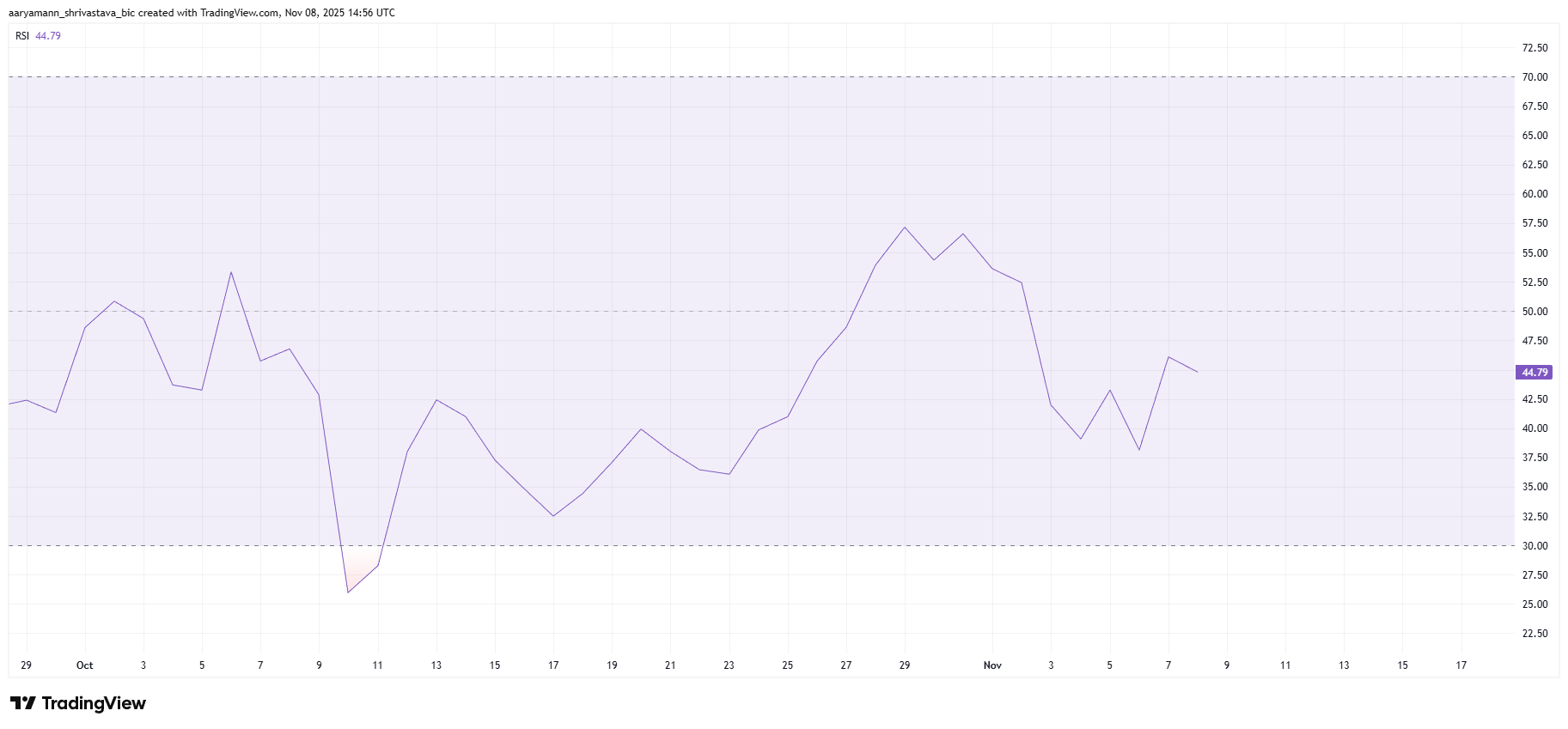

The Relative Strength Index (RSI) reinforces this bearish sentiment. Currently positioned below the neutral 50.0 mark, the RSI signals that market conditions are not favorable for recovery.

The lack of upward momentum reflects broader market weakness and hesitancy among traders to re-enter bullish positions.

This bearish momentum poses a challenge for HBAR’s price performance. Without support from the overall market, any potential bounce could be limited or short-lived. For HBAR to regain strength, the RSI must rise toward neutral levels.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price May Remain Consolidated

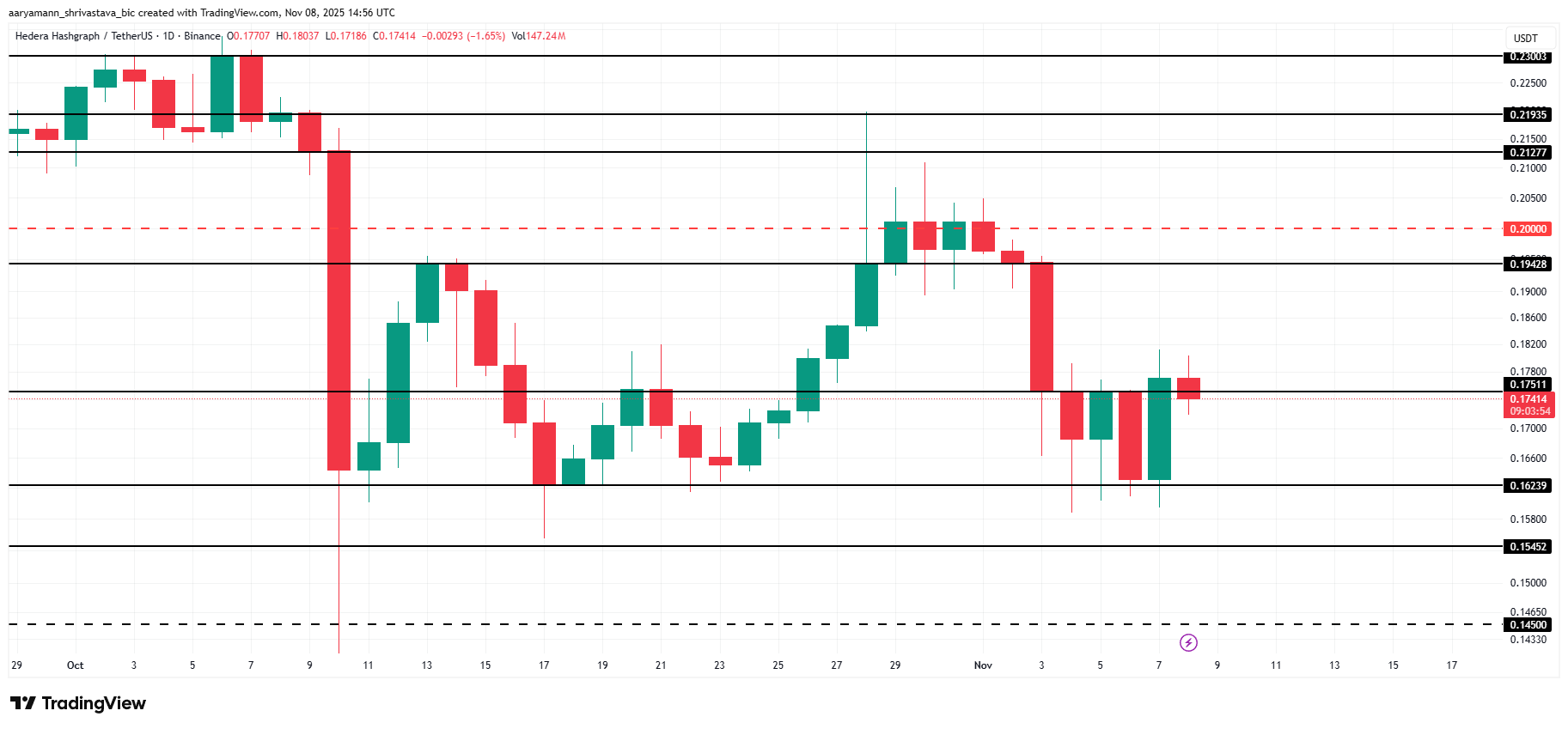

HBAR is trading at $0.174 at the time of writing, hovering just below the $0.175 resistance level. Despite several setbacks, the token has managed to hold above its critical $0.162 support level, showcasing its resilience.

This support has been pivotal for HBAR over the past month, preventing a deeper decline toward $0.154. Even under current bearish conditions, the token will likely continue consolidating above this zone, providing a stable base for potential recovery.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If broader market conditions improve and inflows strengthen, HBAR could flip the $0.175 resistance into support. This could trigger a rally toward $0.194, paving the way for another attempt to breach $0.200 and potentially invalidate the bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin's Unstable Holiday Periods Hide Average Gains of 6%

- Bitcoin's Thanksgiving-to-Christmas performance shows equal odds of rising or falling, with a 6% average seasonal return despite volatility. - Historical extremes include a 50% 2020 rally and 2022's 3.62% drop post-FTX collapse, amid a $2.49-to-$91,600 long-term surge since 2011. - 2025's $91,600 price reflects ongoing recovery from 2024's $95,531 peak, with institutional crypto adoption and macroeconomic factors shaping future trajectories. - Analysts advise dollar-cost averaging for retail investors, w

Australia Strikes a Balance Between Fostering Crypto Innovation and Safeguarding Investors with Updated Regulations

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto platforms under ASIC, creating "digital asset platform" and "tokenized custody platform" licenses. - The framework mandates custody standards, transparency requirements, and lighter regulations for small operators (<$5k per customer) to balance innovation with investor protection. - Global alignment with UAE and EU crypto regulations is emphasized, while addressing risks from past failures like FTX through stricter enforcement and

PENGU Token's Latest Price Fluctuations and Blockchain Indicators: An Analytical Perspective on Technical Factors and Institutional Activity

- PENGU token's recent volatility and on-chain activity spark debate over institutional involvement in the crypto market. - Technical indicators show conflicting signals: overbought RSI vs. positive MACD/OBV momentum since November 2025. - Whale accumulation and Solana integration suggest strategic buying, while team wallet outflows highlight market uncertainty. - Social media sentiment drives short-term price swings, but structural risks like tokenomics and regulatory ambiguity persist. - Institutional ad

GameStop's Profit Strategy: Short Sellers, Brick-and-Mortar Stores, and Interest Rate Expectations Intersect

- GameStop (GME) shares rose near 52-week lows amid high short interest and retail-driven speculation, with a potential short squeeze looming as open options activity surged. - Institutional investors cut $5.4B in MicroStrategy (MSTR) holdings, linking crypto-focused MSTR to GME's 2021 meme stock dynamics amid MSCI index exclusion risks. - A December Fed rate cut (85% probability) could boost retail spending and speculative appetite, countering bearish positioning despite GME's 21.8% Q3 revenue growth. - A