Sellers Take Control—Will Pi Coin Fall Back Into Another Sideways Phase?

Pi Coin’s momentum is fading as capital outflows rise and technical signals turn bearish, with the price now at risk of reentering a consolidation zone under $0.20.

Pi Coin has struggled to maintain its late-October recovery momentum, with the altcoin facing renewed selling pressure this week.

The ongoing decline has erased a significant portion of recent gains as market uncertainty combines with investor hesitation. Both external market conditions and internal investor sentiment appear to be driving this downward trajectory.

Pi Coin Outflows Rise

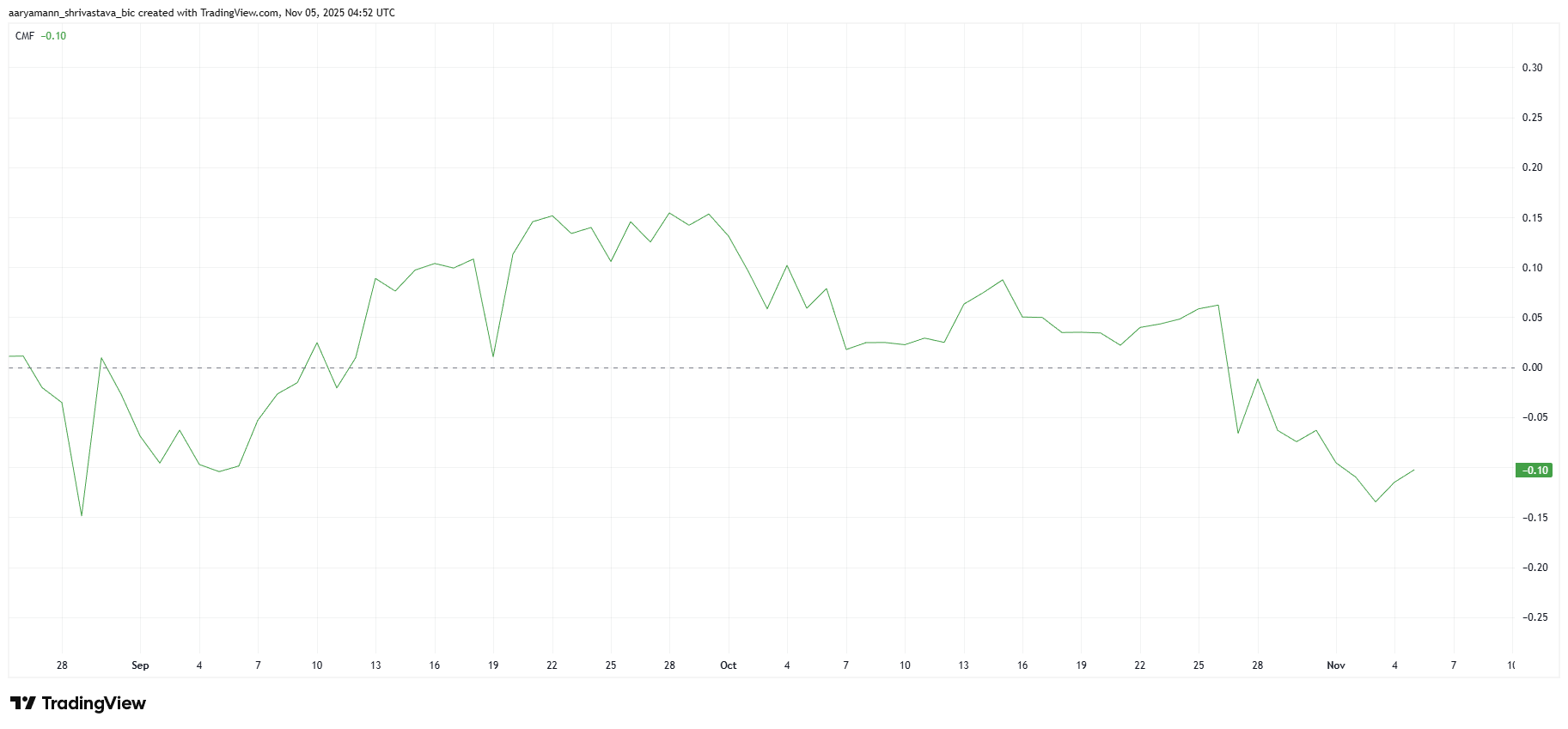

The Chaikin Money Flow (CMF) indicator shows that Pi Coin investors are actively pulling capital out of the market. Currently sitting at a near two-month low and below the neutral zero line, the indicator suggests that outflows are dominating. This signals that investors may be booking profits and reducing exposure amid a slowing recovery.

This shift in sentiment has weakened Pi Coin’s short-term outlook, reflecting waning confidence among holders. The persistent selling pressure indicates that participants are opting for caution over speculation. Unless inflows return, the probability of a sustainable rebound appears limited as liquidity continues to drain from the market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

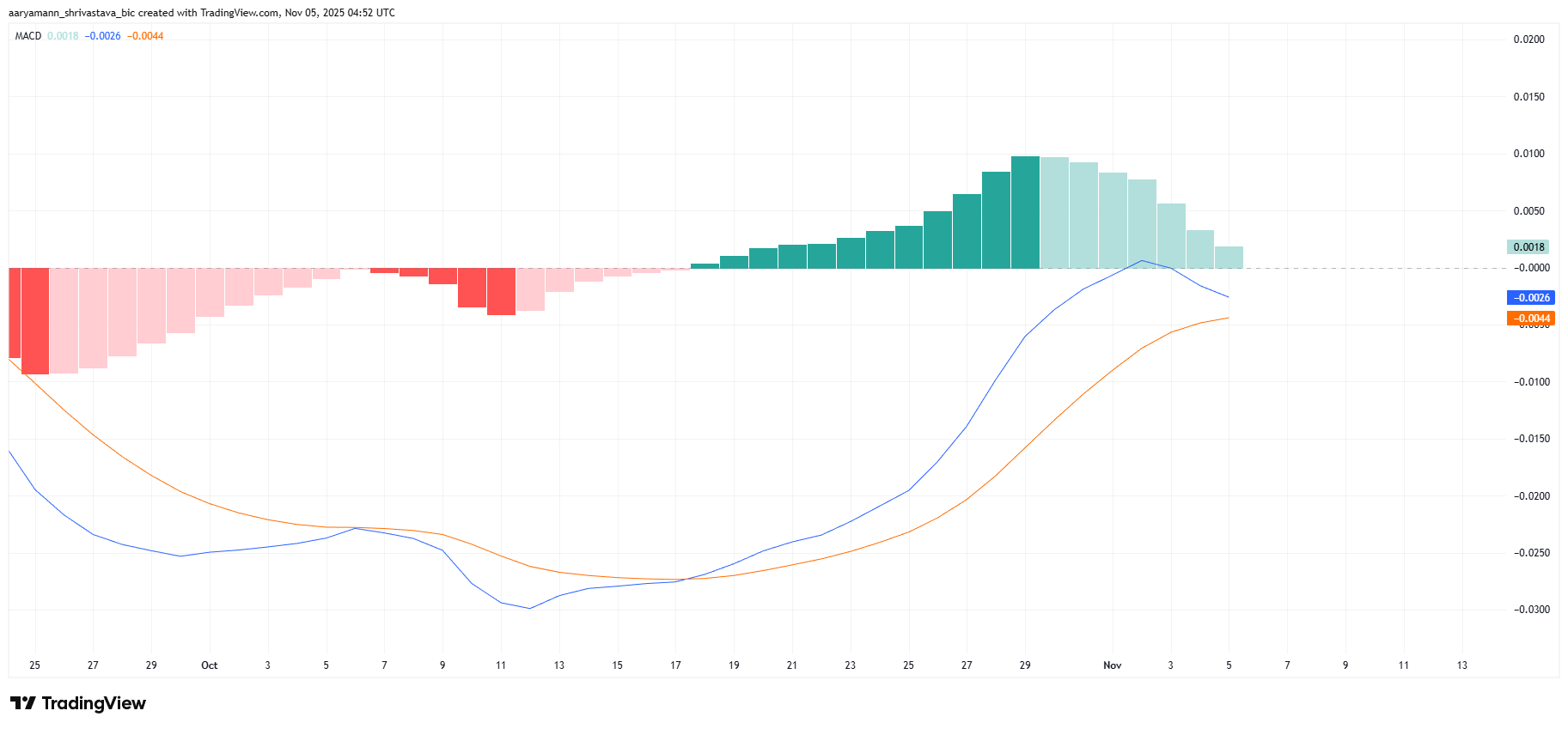

From a broader perspective, Pi Coin’s momentum appears to be leaning bearish. The Moving Average Convergence Divergence (MACD) indicator is on the verge of confirming a bearish crossover. The signal line is nearing the MACD line (blue), suggesting a potential shift from neutral to negative momentum in the coming sessions.

Historically, such crossovers have triggered notable corrections for Pi Coin. The impending signal highlights increasing downside risks, as market conditions continue to favor sellers over buyers.

Pi Coin MACD. Source:

TradingView

Pi Coin MACD. Source:

TradingView

PI Price May Slide Further

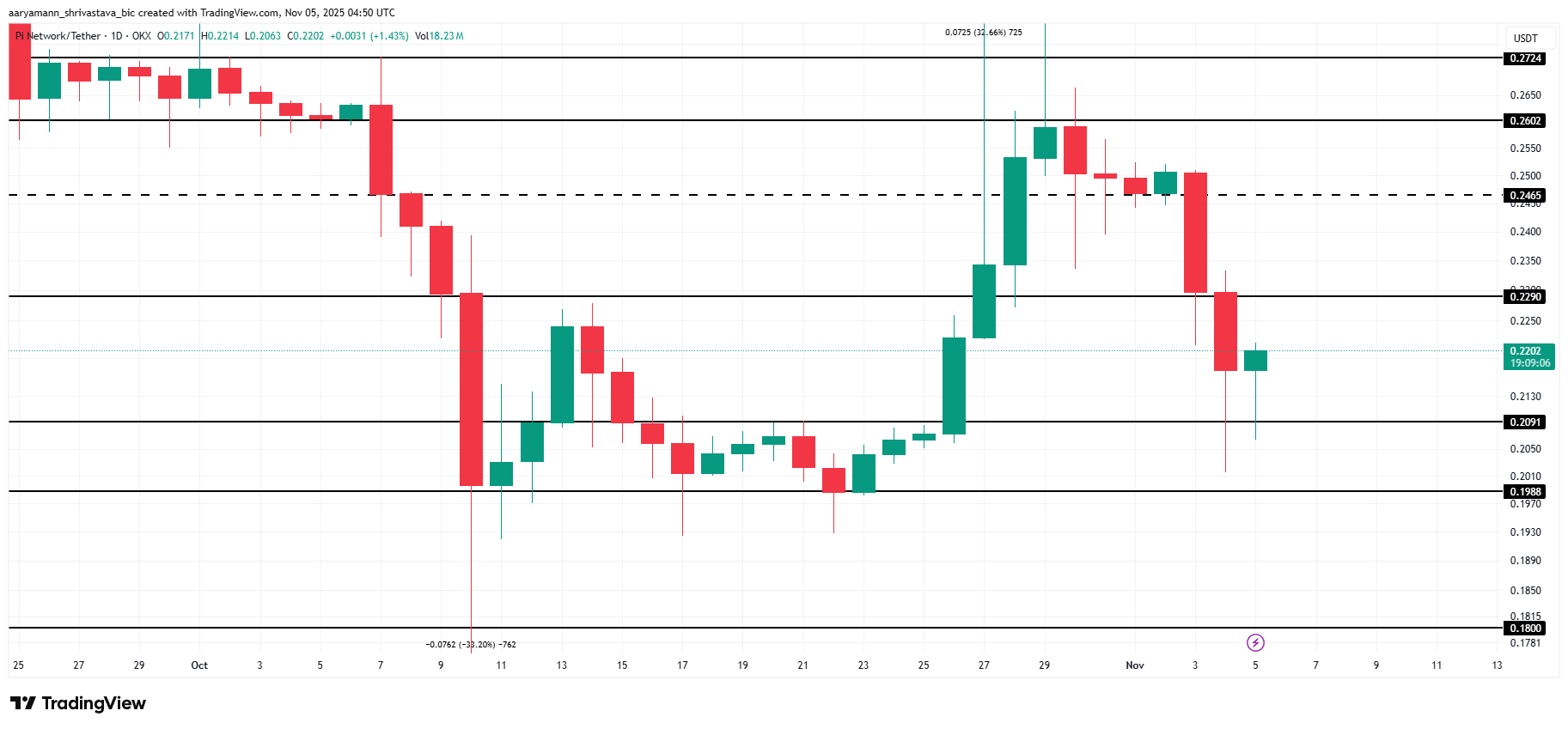

Pi Coin’s price has declined by nearly 15% over the past week after failing to breach the $0.260 resistance. At the time of writing, the altcoin is trading at $0.220, reflecting its weakening technical position amid fading market support and declining investor optimism.

If the downward trend persists, Pi Coin’s price could fall below $0.209 and reenter a consolidation zone between $0.209 and $0.198. This pattern, seen previously, could stall recovery attempts and extend the bearish phase for a few more weeks.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, a bounce from current levels could shift momentum. If Pi Coin reclaims $0.229 as support, it could attempt a rally toward the $0.246 resistance. Sustaining inflows and investor interest will be critical to invalidating the bearish outlook.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Forbes 2026 Crypto Trend Forecast: Where Will the Market Go After Volatility Decreases?

The stablecoin boom, the financialization of bitcoin, and cross-border capital flows are rapidly accelerating the restructuring of the industry.

Stablecoin yields collapse, marking the end of the high-yield DeFi era

The cryptocurrency sector must adapt to life "after the party."

Texas establishes Bitcoin reserves—why choose BlackRock BTC ETF as the first choice?

Texas has officially taken the first step and is poised to become the first state in the United States to list bitcoin as a strategic reserve asset.

Lowest Rating! Why Doesn’t S&P Recognize USDT?

S&P warns that Tether's bitcoin exposure has breached safety limits. Tether CEO responds defiantly: "We take pride in your disdain."