November 4th Market Key Intelligence, How Much Did You Miss?

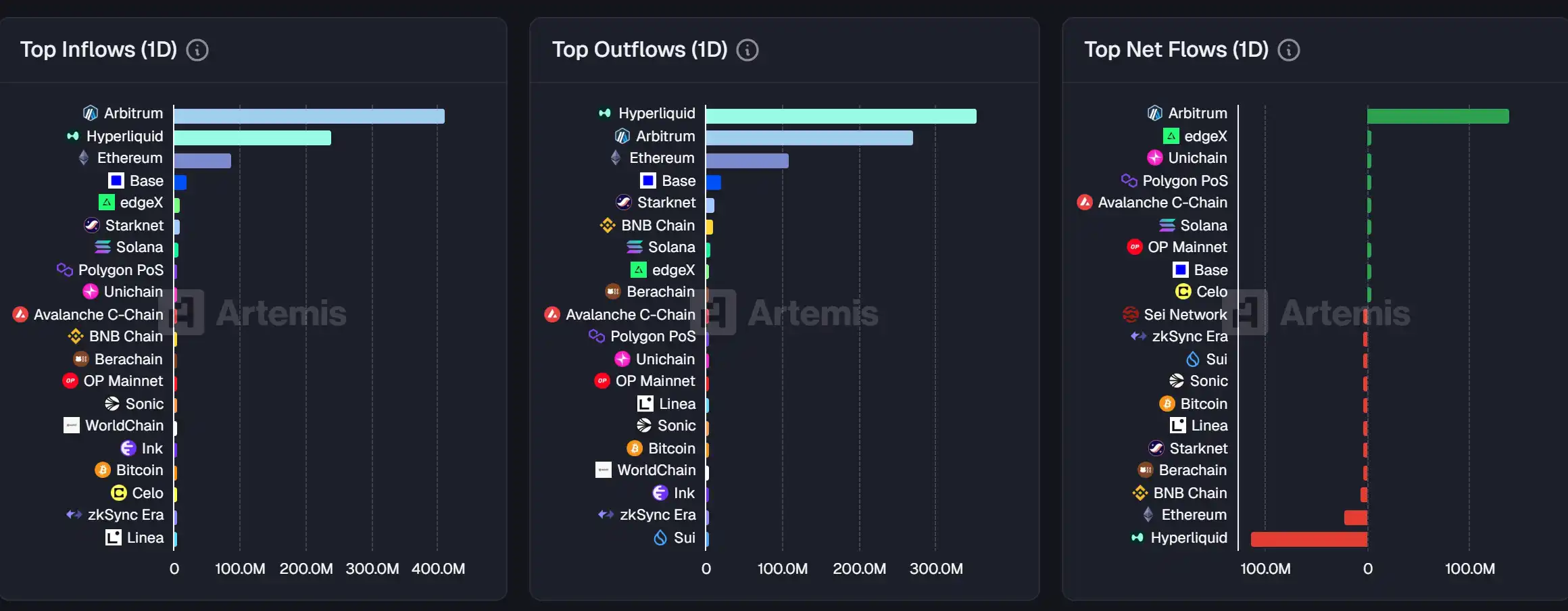

1. On-chain Funds: $139.8M USD inflow to Arbitrum today; $113.8M USD outflow from Hyperliquid 2. Largest Price Swings: $DCR, $XUSD 3. Top News: WILD experiences cascading liquidations leading to flash crash, Arthur Hayes posts encouraging bottom-fishing orders

Featured News

1. WILD Experiences Flash Crash Due to Cascade Liquidations, Arthur Hayes Posts Long Calls for Bottom Fishing

2. JELLY Surges 130% in 24 Hours, Market Cap Peaks Above $2.2 Billion

3. ASTER Skyrockets Over 7.7% in a Short Time, Market Cap Reaches $16.75 Billion

4. Pre-market Crypto Concept Stocks in the U.S. Experience a General Decline, MSTR Drops by 3.30%

5. Multiple New Meme Coins on the BSC Chain See Price Drops Exceeding 40%, GIGGLE's Market Cap Falls Below $50 Million

Trending Topics

Source: Kaito

Below is the Chinese translation of the original content:

[BAL]

Today's core discussion around BAL revolves around a major exploit suffered by Balancer V2 pools, resulting in a multi-chain loss of over $110 million. The hacker targeted Balancer V2's treasury and liquidity pools, exploiting a vulnerability in smart contract interactions to carry out the attack. The Balancer team is actively collaborating with security experts to investigate the incident and recover the stolen funds. This event has led to the temporary suspension of the Berachain network and prompted several platforms to take preventive measures. Despite this setback, the DeFi community continues to show support for Balancer, with most expressing confidence in the protocol's recovery.

[FLIPSTER]

FLIPSTER has garnered significant attention today due to its ongoing trading competition and reward activities. Participants are eagerly looking forward to earning generous USDT rewards by climbing the ranks. The competition is conducted in multiple stages with weekly rewards. Additionally, the platform has launched social activities to provide additional incentives. Community users actively engage in platform interactions, sharing experiences and strategies for climbing the leaderboard.

[BERA]

Today's BERA discussion focused on Berachain network's emergency response to a major vulnerability in Balancer V2 — a coordinated validator-led network pause. This action aims to prevent further losses and address the vulnerability through a hard fork (especially impacting the BEX platform). The community widely supported this decision, emphasizing security over strict decentralization principles. This event has highlighted the security maintenance challenges in the DeFi ecosystem and triggered discussions about the role of validators in crisis management.

[BINANCE]

Today's Binance discussion mainly revolved around various initiatives and controversies the exchange has been involved in. Binance supported the Giggle Fund through donation of trading fees and listed new tokens like Momentum (MMT) and Intuition (TRUST). Additionally, there are rumors that Wintermute may sue Binance over a recent liquidation crisis, sparking debates on the impact of this event on the cryptocurrency market. Binance founder Changpeng Zhao's (CZ) involvement in multiple projects and partnerships (including the controversial event of being pardoned by Donald Trump) has also been a focus of attention.

[METAWIN]

Today's METAWIN core discussion centered around its potential as a preferred cryptocurrency investment target, with users highlighting its gaming features such as Plinko and blackjack. The market sentiment is generally positive, with many users regretting not investing in METAWIN earlier. The discussion also touched on the platform's gaming and prediction features, which are gaining increasing user acceptance.

Featured Articles

1.《Robotics Trending: Overview of Robot Concept Projects on Virtuals》

Virtuals Protocol gained more attention recently due to the surge in the x402 protocol. Last Saturday, Virtuals' token price experienced a 35% single-day increase, although it retraced much of the gains in the following days due to overall market conditions. This "AI Agent Hub" based on the Base is still worth watching. Another hot topic lately is the robotics track, and Virtuals has maintained high interest in this area, announcing "Virtuals Robotics" on October 21st. So, what actions has Virtuals taken, and what are the robotics-related projects within its ecosystem?

2. "The Butterfly Effect of Balancer Hack: Why Did XUSD Break Its Peg?"

After the multi-chain platform fell victim to a hack, causing widespread uncertainty in the DeFi sector for several hours, swiftly carried out a hard fork, and froze the attacker's wallet. Subsequently, the price of Stream Finance's xUSD stablecoin deviated significantly from its target range, exhibiting a clear peg break.

On-chain Data

November 4th On-chain Fund Flow

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like