Bull trap? Bear trap? The truth may be more complex: After the Federal Reserve's rate cut, the crypto market is entering a new liquidity cycle.

The recent performance of the crypto market has been perplexing:

Some people firmly believe this is just a "bull trap,"

while others are calling it a "bear trap."

However, after 19 hours of systematic research on macro data, on-chain capital flows, and market structure, one conclusion can be drawn:

The market is not a trap, but rather is nurturing the starting point of a new growth cycle.

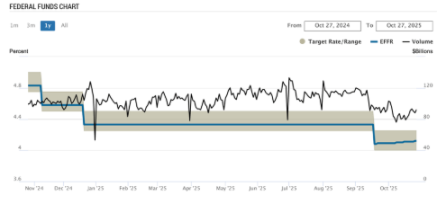

1. Fed Rate Cuts: Liquidity is Restarting

Yesterday, the Federal Reserve announced another rate cut.

Historical experience tells us—cheap money will eventually flow into risk assets.

2021 is the best example:

Every rate-cutting cycle has brought a large influx of liquidity, and crypto assets are often the first sector to react.

Ignoring changes in macro liquidity is equivalent to missing the start of a market trend.

2. Easing China-US Relations, Declining Risk Premium

The latest tariff reduction is about 10%, which is equivalent to releasing billions of dollars in international trade space.

This macro easing not only boosts corporate confidence but also revives risk appetite for capital.

In the pricing logic of risk assets, "certainty" itself is value.

The easing of trade frictions means more capital will return to investment channels, and the crypto market is one of the most obvious beneficiaries.

3. Fear Fades, Market Confidence Recovers

The extreme panic from a few weeks ago did not trigger a deeper sell-off.

This "panic without a crash" structure is actually a positive signal—

Institutional funds are using fear to accumulate positions.

On-chain data shows that after the drop on October 10, large institutions (including BlackRock) began to increase their holdings of ETH and other major assets at low levels.

Smart money never acts loudly, but it is always one step ahead.

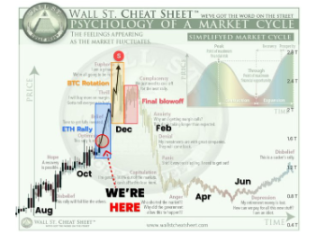

4. Price Structure of the Interest Rate Cycle: From False Breakouts to Real Trends

The market reaction to rate cuts usually occurs in three steps:

Initial rebound (pump)

Correction and shakeout (liquidity grab)

Second strong breakout (new highs)

Currently, we are just in the first stage.

The real trend has not yet unfolded.

5. Liquidity Return Path: BTC → Major Coins → Altcoins

Capital inflow will not happen overnight.

The first step is for Bitcoin (BTC), as "digital gold," to regain favor with capital;

Next comes Ethereum and major L1s;

Only then will it be the turn of high-risk, high-reward small and mid-cap altcoins (Low caps).

The market frenzy has not yet begun, but the window for positioning is rapidly narrowing.

6. Altseason Signal: Neutral Zone Means Potential

The Altseason index is currently in the neutral range, which is not uncommon.

In the early stages of every bull market, BTC always starts ahead of altcoins,

then liquidity gradually spreads, and the altcoin sector can erupt within just a few days.

According to historical data, Altseason often occurs "1-2 weeks after BTC stabilizes."

This means the prelude to the next phase of capital rotation is approaching.

7. Market Opportunity: Entry Value During the Quiet Period

The most dangerous moment has passed.

The smartest investors often buy when the market is quiet and reap rewards amid the noise.

Those waiting for "confirmation signals" always rush into the market only after confirmation.

But by then, the best prices have already been taken by others.

Conclusion:

The market is not a trap, but a structural restart.

The liquidity brought by Fed rate cuts, the easing of macro relations, and the return of institutional capital—

These signals all point to one fact: a new upward cycle has already begun.

The real risk is not a sharp drop, but missing the opportunity to build positions during the restart phase.

When the market becomes noisy again, the best entry window will be gone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.