SWC CEO Andrew Webley Highlights 1.7% BTC Yield, Eyes Fair Valuation

The Smarter Web Company CEO, Andrew Webley, shared new insights with investors. This reflects on trading volume, valuation and the company’s recent Bitcoin yield. His post came at the end of the firm’s financial year. It offers a transparent view of its operations and outlook.

Strong Trading Volume and Investor Confidence

Webley noted that trading volume across three markets, Aquis, OTCQB, and Frankfurt. It reached levels that are unlikely to drop further. He credited investor Jon Levy for tracking SWC’s trading data through a unified chart. It helps the community stay informed. Despite strong activity, Andrew Webley admitted that the market price remains disappointing. However, he expressed optimism that the company’s value would be recognized in due time.

“A more sensible valuation will be applied in due course,” he said. He emphasized that SWC’s fundamentals remain solid, citing the firm’s ability to deliver a 1.7% Bitcoin yield in October. When annualized, that translates to a 22.4% BTC return per share, even with a 9% discount to NAV (mNAV 0.91). According to Andrew Webley, this data suggests “exceptional value” for shareholders.

UTXO Management and Insider Holdings

In regulatory updates, Webley confirmed that UTXO Management. An early investor since SWC’s IPO filed a TR-1 form verifying that they have not sold any shares. When combined with Webley’s own holdings , more than 22% of the company’s shares are held by notifiable investors (those owning over 3%). This strong shareholder retention reinforces confidence in the firm’s long-term strategy. Even as the stock continues to trade below what management believes is its fair value.

Behind the Scenes: Redesign and New Opportunities

Andrew Webley shared candid insights into the challenges of leading a publicly traded Bitcoin Treasury company. He acknowledged that many of SWC’s ongoing projects cannot be publicly disclosed until finalized. Still, he confirmed that the company’s website redesign project has accelerated. Alongside several “potentially positive” meetings held during the week.

He also referenced MicroStrategy ’s latest earnings call, praising the company’s time horizon for capital deployment. Also, its international expansion plans. Webley agreed that volatility remains a crucial part of the Bitcoin ecosystem. As it creates opportunities for investors seeking higher short-term gains.

Looking Ahead: Year-End Outlook and Community Strength

With the financial year ending at midnight on Friday. SWC will soon report unrealized profits based on Bitcoin’s closing valuation. Andrew Webley said the analytics page already shows a small gain. Though the final figure will depend on the exact data point used. He outlined a busy week ahead, including travel, a media interview and attendance at the Global Digital Assets Forum in London.

Andrew Webley also expressed gratitude toward the SWC community. He named several users who contribute to tracking data and promoting transparency. He highlighted a new community-built dashboard that tracks ATM progress and SWC trading across all exchanges.

To close, Webley reminded investors to remain patient with Bitcoin’s price movements. “Historically, most of Bitcoin’s annual gains come from fewer than 15 days,” he said. Despite recent market dips, he remains confident. “Bitcoin is getting stronger every day, every week, every month,” he added. A sentiment echoing his optimism for SWC’s growth and Bitcoin’s long-term value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether’s Bitcoin Investment Compared to Stability: S&P Raises Concerns Over Unstable Peg

- S&P Global Ratings downgraded Tether's USDT to "weak" due to 5.6% Bitcoin exposure exceeding its 3.9% overcollateralization threshold and limited reserve transparency. - Tether CEO defended the model, citing no redemption refusals and $10B 2025 net profit, while S&P warned Bitcoin/gold price drops could trigger undercollateralization risks. - Market turbulence saw $3.5B Bitcoin ETF outflows and $9.9B Bitcoin holdings, with Tether expanding into gold producers and crypto lending despite regulatory scrutin

Ethereum Updates Today: Blockchain’s Cleanliness Transformation: Privacy Moves from a Choice to a Necessity

- Ethereum co-founder Vitalik Buterin donated to privacy-focused projects Aztec Network and Kohaku, signaling blockchain's shift toward data protection as a core priority. - The Ignition Chain and Kohaku framework aim to address data breaches like SitusAMC by enabling private transactions via zero-knowledge proofs and protocol upgrades. - Ethereum's Fusaka upgrade (2025) and growing $1.2 trillion blockchain messaging market highlight privacy's rising economic and technical importance in decentralized syste

Australia’s Cryptocurrency Regulations Set to Unlock $24 Billion in Value While Enhancing Investor Protections

- Australia introduces 2025 Digital Assets Framework Bill to unlock $24B productivity gains while imposing strict client asset safeguards. - Legislation creates two new crypto financial product categories under Corporations Act, requiring AFSL licensing for platforms and tokenized custody services. - Exemptions for small operators (<$10M volume) balance innovation with regulation, aligning with global trends like U.S. GENIUS Act and SEC's Project Crypto. - Industry debates regulatory proportionality as Aus

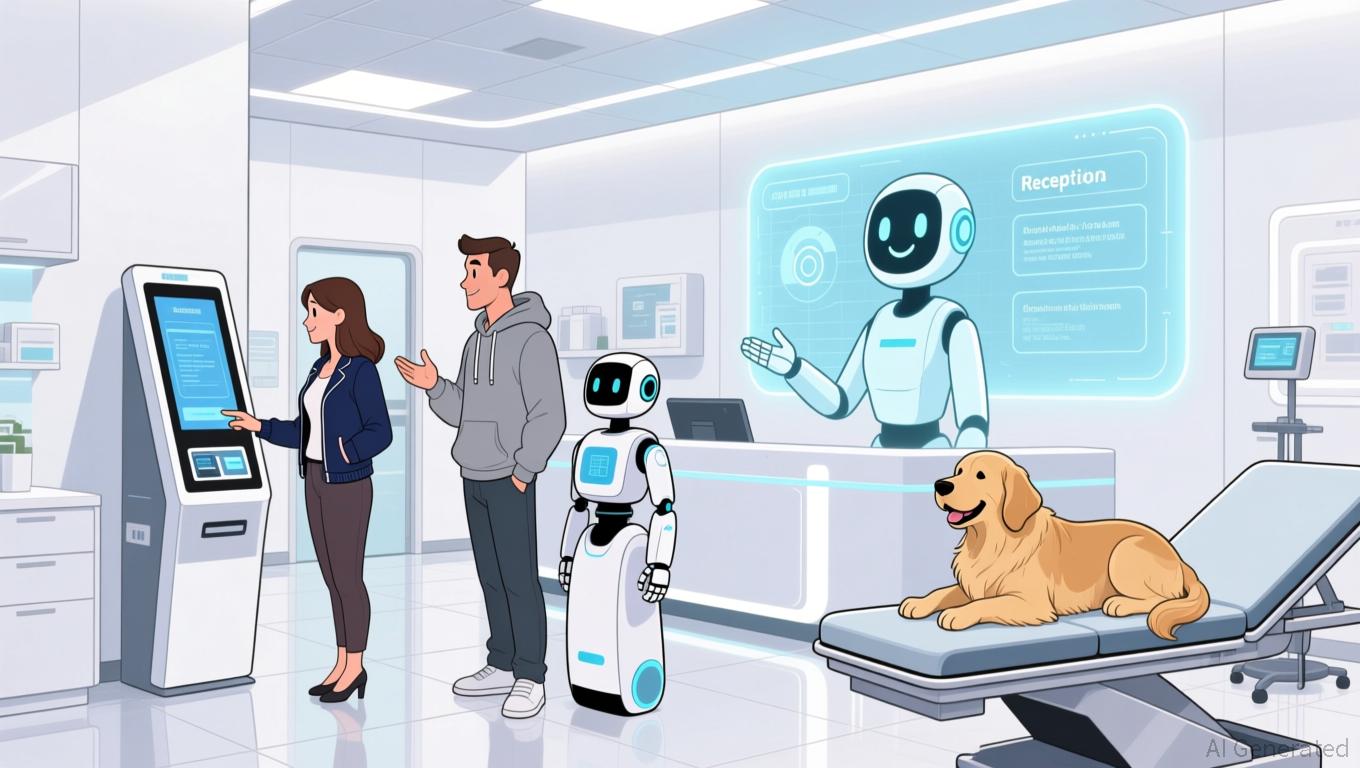

Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.