Crypto Trader Says NFT Altcoin Primed To Surge More Than 15%, Outlines Path Forward for XRP and Sei

A popular crypto analyst thinks chart patterns suggest one non-fungible token (NFT)-related altcoin is primed to surge in price.

The digital asset trader Ali Martinez tells his 161,200 X followers that PENGU , the native token of the Pudgy Penguins NFT collection, just broke out of a falling wedge pattern.

A falling wedge breakout is a technical analysis pattern that is used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When the price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

Martinez says PENGU could surge to $0.026. With the asset trading at $0.0224 at time of writing, that would represent an increase of more than 16%.

The analyst also notes that “key support is holding” for the decentralized finance (DeFi) layer-1 blockchain Sei ( SEI ).

“If buyers step in, the next targets are $0.31 and $0.44.”

SEI is trading at $0.206 at time of writing.

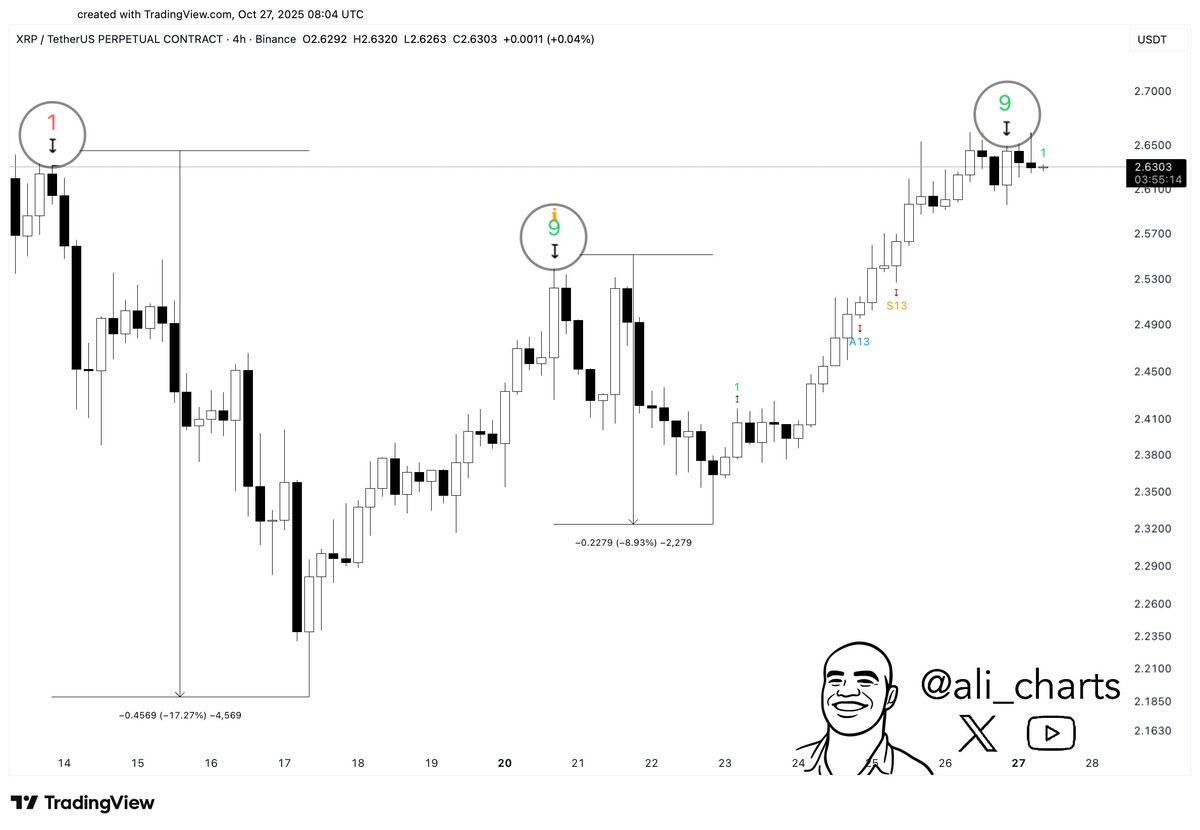

Conversely, Martinez notes that the TD Sequential Indicator, a tool that identifies potential trend exhaustion and price reversal points by counting a sequence of price bars, flashed a sell signal for the payments altcoin XRP .

XRP is trading at $2.68 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.