Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

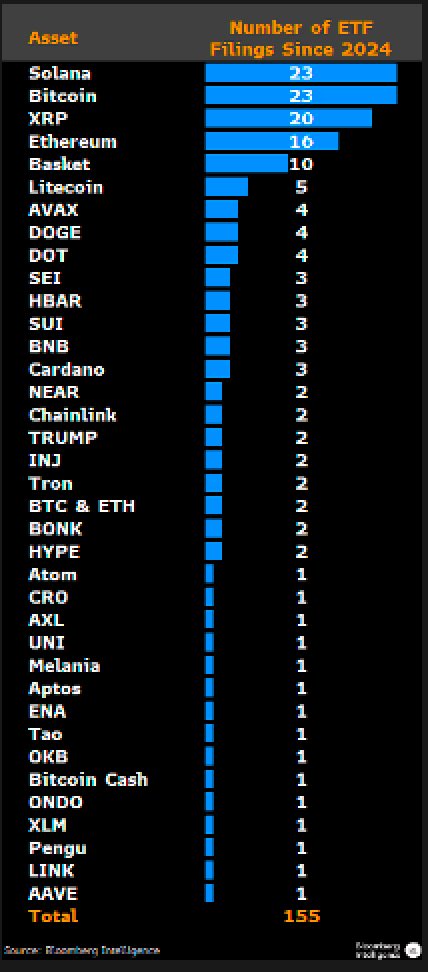

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategic Collaborations Between Public and Private Sectors: Driving Real Estate and Industrial Expansion in Underdeveloped Areas

- Public-private partnerships (PPPs) are transforming underserved regions by bridging infrastructure gaps and driving real estate and industrial growth. - Projects like Madrid Nuevo Norte and Costa Rica's affordable housing initiatives demonstrate PPPs' ability to boost property values and create jobs through mixed-use development and public land utilization. - U.S. data reveals racial disparities in PPP benefits, with communities of color experiencing lower baseline home values despite similar growth rate

ICP's 30% Price Jump: Key Factors and What It Means for Web3 Investors

- ICP surged 30% in late 2025 due to upgraded on-chain governance and tokenomics, enhancing decentralized control and utility-driven demand. - Network Nervous System (NNS) reforms simplified neuron activation, boosted developer participation, and introduced periodic voting reaffirmations. - Caffeine AI integration and partnerships with Microsoft/Google drove TVL to $237B, though dApp usage declined 22.4% amid macroeconomic volatility. - Analysts project $11.15–$31.89 price range for 2026, contingent on sus

New Prospects in EdTech for STEM and Renewable Energy Sectors: Strategic Integration and Sustainable Investment Opportunities

- Global decarbonization and tech innovation drive surging demand for STEM and renewable energy skills, but talent shortages persist. - Universities modernize curricula with quantum computing, AI ethics, and sustainable engineering to align with industry needs and green job targets. - EdTech bridges gaps through AI-driven personalized learning, VR/AR simulations, and cloud-based hybrid models, enhancing accessibility and practical training. - EdTech market projected to grow at 13.3% CAGR to $348B by 2030,

AAVE Rises 1.13% as Weekly Increase Balances Out Monthly Decline During Market Fluctuations

- Aave (AAVE) rose 1.13% in 24 hours, rebounding from a 39.1% annual decline amid crypto market volatility. - The 12.3% weekly gain reflects speculative buying in DeFi, though broader trends show 17.68% monthly losses. - Analysts highlight DeFi's fragility due to regulatory uncertainty and shifting capital flows, despite short-term optimism. - Aave's future depends on innovation, macroeconomic stability, and competition from emerging lending platforms.