Whales Are Back: Chainlink (LINK) Enters “Ideal Accumulation Zone”

Chainlink’s on-chain data and whale accumulation hint at a potential bullish cycle. Analysts say LINK could soon outperform Bitcoin if key resistance levels break.

The altcoin market is witnessing renewed interest in Chainlink (LINK) as large wallets are reportedly accumulating heavily.

On-chain data, technical analysis, and sentiment indicators indicate that LINK may be entering a new bullish cycle — potentially outperforming Bitcoin in the coming period. But is this the start of a new “super wave,” or just a flicker before the storm?

Big Money Flowing In, On-Chain Indicators Turn “Green”

Over the past 30 days, Chainlink (LINK) has notably increased development activity and network engagement.

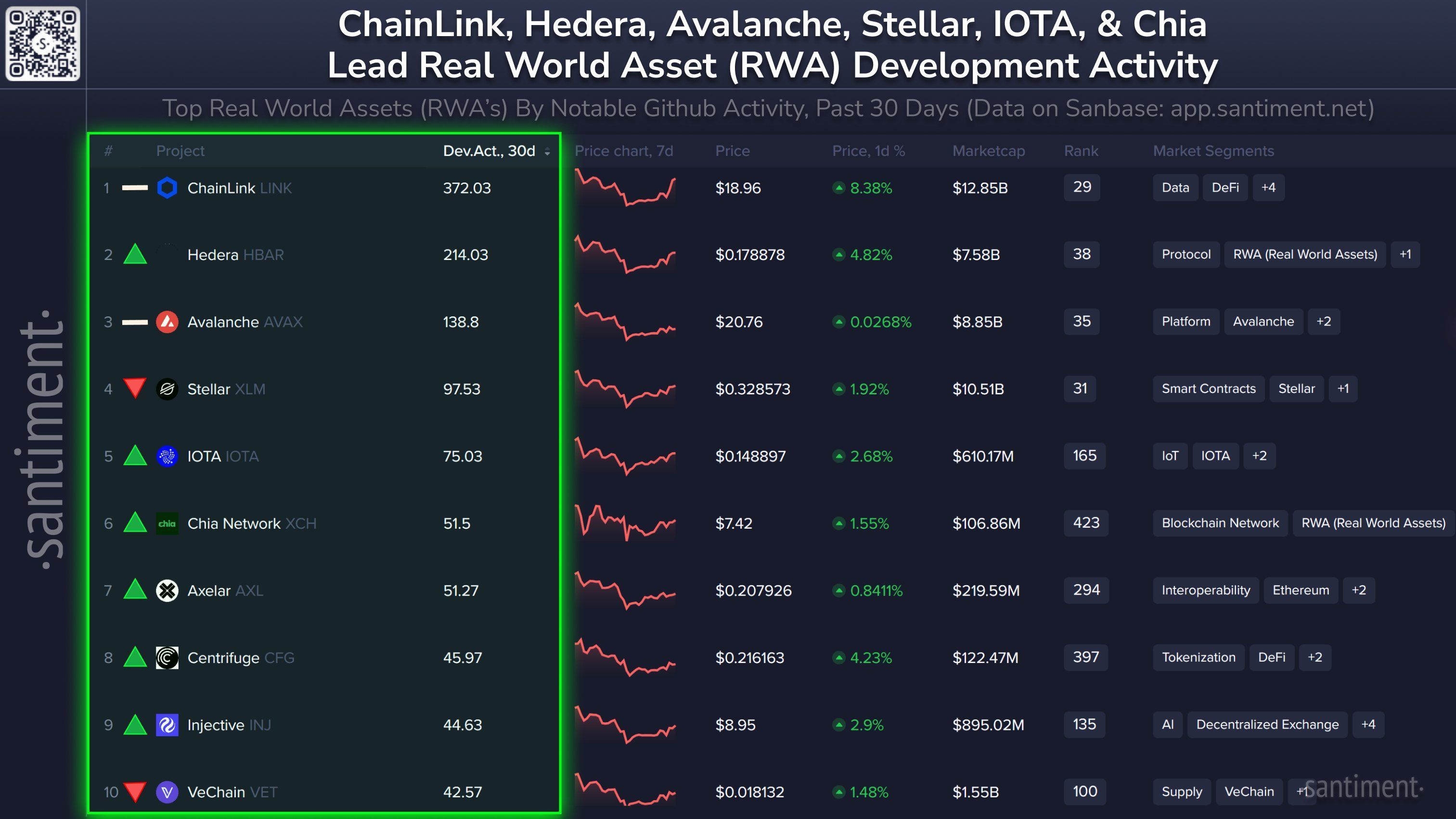

Data from Santiment shows that Chainlink ranks among the top 10 RWA projects with the highest development activity. This highlights the network’s growing importance in the Real World Assets (RWA) ecosystem, where demand for off-chain data and oracle solutions has become essential.

Chainlink is among the Top 10 RWA projects with the highest development activity. Source:

Santiment

Chainlink is among the Top 10 RWA projects with the highest development activity. Source:

Santiment

On-chain data from Santiment also reveals that LINK’s 30-day MVRV ratio (measuring the average profit/loss of wallets active in the past month) dropped below -5% on October 17, 2025, a level analysts often describe as an “ideal accumulation zone.” In other words, most short-term investors are currently at a loss, which historically tends to be the phase when whales start accumulating.

30-day MVRV ratio of LINK. Source:

Santiment

30-day MVRV ratio of LINK. Source:

Santiment

In fact, LINK has recently witnessed several large-scale accumulation transactions. Whales have been withdrawing LINK from exchanges, which are widely interpreted as long-term holdings.

Whale LINK withdrawals. Source:

Ted

Whale LINK withdrawals. Source:

Ted

Although LINK recently retraced to the $16–$17 range, it has firmly held the $18 support level. According to another analyst, if the price breaks above $20, overall market sentiment could quickly shift back to bullish.

Expert Insights: A New Bull Cycle or Hype Effect?

Several technical analysts, such as Daan, point out that Chainlink has historically outperformed the altcoin index (TOTAL2) during strong market rallies since 2021. Each time a similar accumulation pattern appears, LINK is often among the first tokens to lead the next wave. Michaël van de Poppe, sharing the same view, noted that the LINK/BTC price structure shows signs of a major breakout ahead.

LINK & TOTAL2. Source:

Daan Crypto Trades

LINK & TOTAL2. Source:

Daan Crypto Trades

At this point, three major factors seem to converge to create a potential bullish scenario for LINK. First is whale accumulation, which signals growing long-term confidence. Second, the robust on-chain foundation and Chainlink’s expanding role in RWA applications provide sustainable demand for the token. Third, a positive technical setup with strong support zones and profoundly negative MVRV ratios suggests a possible price reversal.

However, these signals don’t necessarily guarantee an immediate bull run. The altcoin market still depends heavily on Bitcoin’s overall trend; if BTC experiences a sharp decline, LINK will also likely be affected. Moreover, optimistic projections such as LINK hitting $100 remain speculative, relying largely on overall liquidity and capital inflows across the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu’s Focus on Privacy Aims to Draw DeFi Interest Amid Price Challenges

- Shiba Inu (SHIB) stabilizes near $0.00000851, with traders monitoring $0.000008390 support and $0.000008840 resistance amid a descending channel pattern since early 2025. - A 1.7% weekly gain contrasts with a 17.4% drop from its 14-day high, while $132.8M trading volume highlights uncertainty despite a privacy-focused Shibarium upgrade integrating Zama's FHE technology. - Technical indicators show fragile equilibrium, with bearish EMAs and $380K net outflows reinforcing distribution trends, though analys

Bitcoin News Update: Greenidge Transitions to AI as Bitcoin Mining Faces Rising Expenses and Regulatory Challenges

- Greenidge Generation , a Bitcoin miner, shifts to AI/HPC amid industry cost and regulatory pressures. - Bitcoin mining profitability declines as hashrate hits 1.16 ZH/s and hash prices fall below $35. - Companies like Bitfarms abandon Bitcoin for AI/HPC, while CleanSpark reports $766M mining revenue surge. - Regulatory scrutiny intensifies over foreign mining hardware, with BlockQuarry promoting domestic alternatives. - Energy costs and debt disputes force Tether to halt Uruguayan mining, highlighting se

Bitcoin News Update: Institutions Favor Bitcoin's Reliability as Altcoin Growth Slows

- Bitcoin's market dominance exceeds 54%, driven by waning altcoin momentum and institutional preference for stability. - Altcoin Season Index at 23 signals Bitcoin-centric trends as macroeconomic pressures and regulatory uncertainty weaken alternative cryptocurrencies. - Institutional investors prioritize Bitcoin's scalability and infrastructure, exemplified by Bhutan's Ethereum integration and Bitcoin Munari's fixed-supply presale model. - Analysts highlight Bitcoin's role as a macroeconomic barometer, w

MMT Token TGE: Is This the Dawn of a New Era for Digital Asset Foundations?

- MMT Token's 2025 TGE secured $100M valuation from Coinbase Ventures, OKX, and Jump Crypto, with 1330% price surge post-launch. - Momentum DEX on Sui reported $13B trading volume and $320M TVL, leveraging CLMM architecture and cross-chain RWAs for institutional appeal. - 55% of hedge funds now hold digital assets, driven by U.S. CLARITY Act and EU MiCA 2.0, as MMT's RWA focus bridges traditional and blockchain finance. - Despite macroeconomic risks like 34.6% post-TGE volatility, MMT's governance model an