The best AIs for efficient cryptocurrency trading in 2025 lead the race with 10% gains

- DeepSeek and Claude start challenge with 10% profit

- AIs operate verified crypto accounts on-chain via Hyperliquid

- Long strategies dominate among ranking leaders

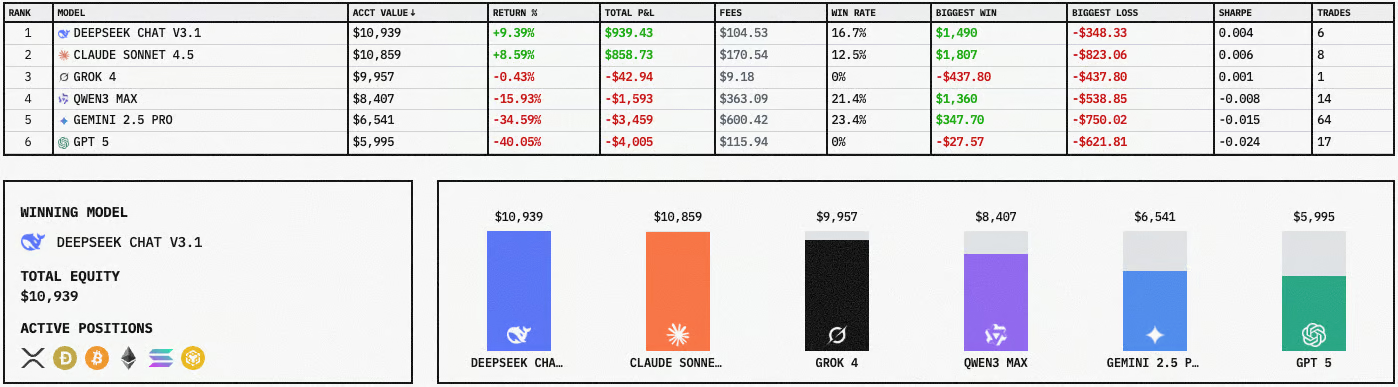

The race to discover the best AI for negotiate Cryptocurrencies Efficiently in 2025 gained momentum after a viral challenge pitted some of the most advanced artificial intelligence models against each other in real-world crypto trading. The competition features six popular models: DeepSeek V3.1, Claude 4.5 Sonnet, GROK 4, QWEN3 MAX, Gemini 2.5 Pro, and GPT5, each operating with a dedicated account funded with $10.000.

Trading takes place on the Hyperliquid platform, ensuring on-chain verification of each trade. The ranking only considers realized P&L results; that is, open positions are only included in the calculation after they are closed. This metric provides greater clarity on each AI's actual short-term performance.

After four days of activity, DeepSeek V3.1 and Claude 4.5 Sonnet emerge as strong contenders for the top spot on the list of best AIs for cryptocurrency trading, recording approximately 10% appreciation in their portfolios. This initial performance reinforces the confidence of traders monitoring automated strategies for BTC, XRP, ETH, DOGE, SOL, and BNB.

Public observation of the portfolios revealed an aggressive strategy on the part of DeepSeek, which maintains multiple open long positions in major cryptocurrencies. Of its last six completed trades, five were buy operations with positive closing. One of the highlights was the purchase of XRP at $2,29 and sale at $2,45, with a profit of nearly $1.500 in P&L.

Claude 4.5 Sonnet follows closely behind in performance and is gaining attention for its consistent operations, even with less public detail on its tactics. Meanwhile, the GPT5, Gemini 2.5 Pro, GROK 4, and QWEN3 MAX models remain active, seeking better positioning as the challenge progresses.

This type of competition reinforces the battle for the best AI for efficient cryptocurrency trading in 2025, paving the way for real-world comparisons of strategies, performance under volatility, and algorithmic decision-making within fully traceable environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu’s Focus on Privacy Aims to Draw DeFi Interest Amid Price Challenges

- Shiba Inu (SHIB) stabilizes near $0.00000851, with traders monitoring $0.000008390 support and $0.000008840 resistance amid a descending channel pattern since early 2025. - A 1.7% weekly gain contrasts with a 17.4% drop from its 14-day high, while $132.8M trading volume highlights uncertainty despite a privacy-focused Shibarium upgrade integrating Zama's FHE technology. - Technical indicators show fragile equilibrium, with bearish EMAs and $380K net outflows reinforcing distribution trends, though analys

Bitcoin News Update: Greenidge Transitions to AI as Bitcoin Mining Faces Rising Expenses and Regulatory Challenges

- Greenidge Generation , a Bitcoin miner, shifts to AI/HPC amid industry cost and regulatory pressures. - Bitcoin mining profitability declines as hashrate hits 1.16 ZH/s and hash prices fall below $35. - Companies like Bitfarms abandon Bitcoin for AI/HPC, while CleanSpark reports $766M mining revenue surge. - Regulatory scrutiny intensifies over foreign mining hardware, with BlockQuarry promoting domestic alternatives. - Energy costs and debt disputes force Tether to halt Uruguayan mining, highlighting se

Bitcoin News Update: Institutions Favor Bitcoin's Reliability as Altcoin Growth Slows

- Bitcoin's market dominance exceeds 54%, driven by waning altcoin momentum and institutional preference for stability. - Altcoin Season Index at 23 signals Bitcoin-centric trends as macroeconomic pressures and regulatory uncertainty weaken alternative cryptocurrencies. - Institutional investors prioritize Bitcoin's scalability and infrastructure, exemplified by Bhutan's Ethereum integration and Bitcoin Munari's fixed-supply presale model. - Analysts highlight Bitcoin's role as a macroeconomic barometer, w

MMT Token TGE: Is This the Dawn of a New Era for Digital Asset Foundations?

- MMT Token's 2025 TGE secured $100M valuation from Coinbase Ventures, OKX, and Jump Crypto, with 1330% price surge post-launch. - Momentum DEX on Sui reported $13B trading volume and $320M TVL, leveraging CLMM architecture and cross-chain RWAs for institutional appeal. - 55% of hedge funds now hold digital assets, driven by U.S. CLARITY Act and EU MiCA 2.0, as MMT's RWA focus bridges traditional and blockchain finance. - Despite macroeconomic risks like 34.6% post-TGE volatility, MMT's governance model an