Polychain leads $110 million investment into Berachain's treasury

- Polychain and major funds invest in BERA tokens

- Greenlane raises $110 million in treasury operation

- Project seeks to consolidate BERA as a reserve asset

Venture capital firm Polychain Capital is leading a $110 million investment round aimed at creating a cryptocurrency treasury based on the BERA token, native to the Berachain ecosystem. The investment marks a new institutional move toward Layer 1 blockchain projects, with a focus on liquidity and DeFi infrastructure.

The transaction, announced this Monday, also includes the participation of Blockchain.com, dao5, Kraken, North Rock Digital, and CitizenX. The investment is being structured by Greenlane Holdings, a Nasdaq-listed company under the ticker GNLN, which will offer a PIPE (private investment in public equity) to finance the project.

Greenlane intends to raise $50 million in cash and $60 million in BERA tokens, including locked and unlocked assets, through the sale of Class A shares and pre-funded warrants at approximately $3,84 each. According to the statement, BERA will serve as "the company's primary treasury reserve asset," and will be acquired both on the open market and via over-the-counter (OTC) transactions.

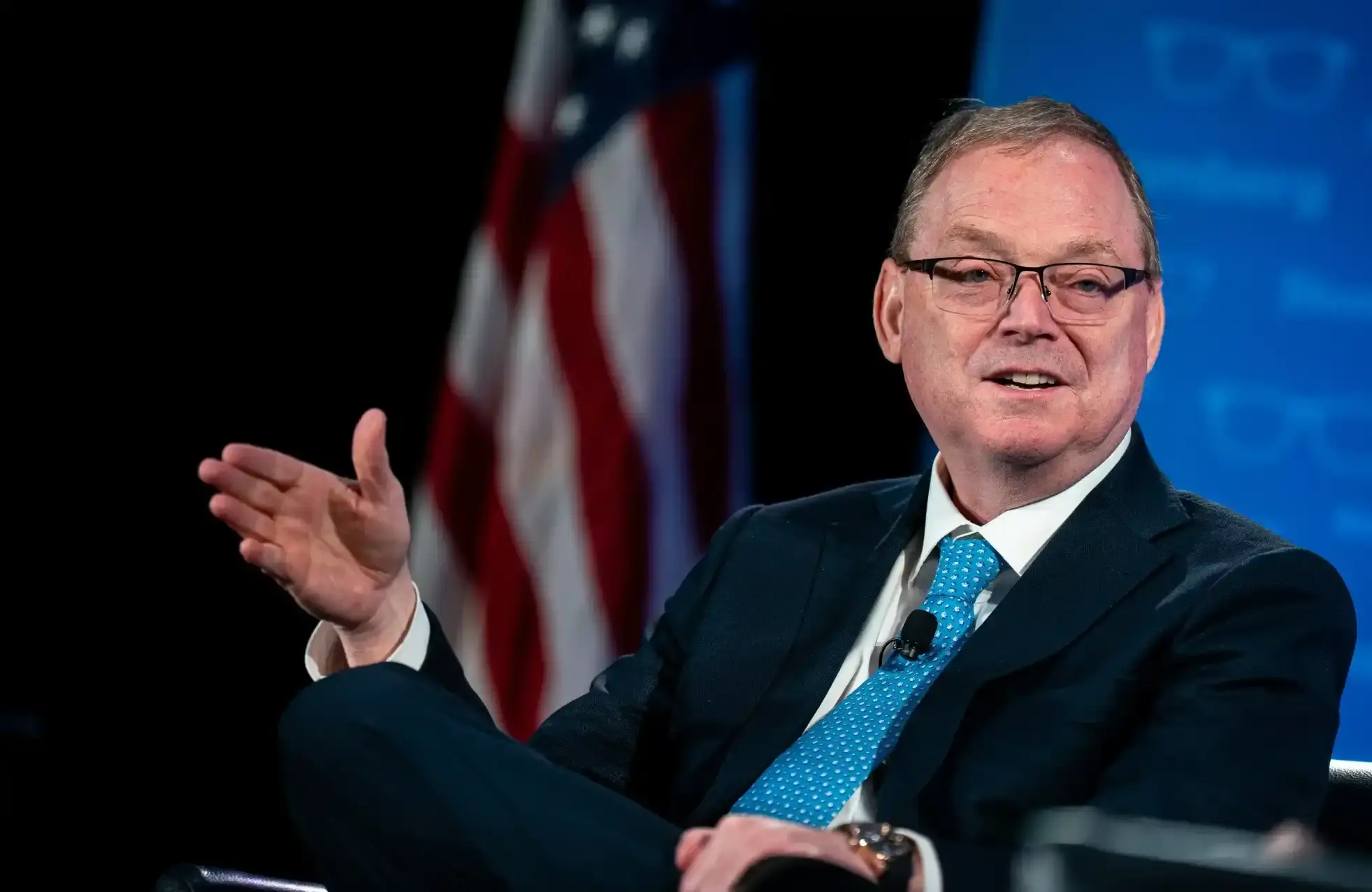

The market reacted positively to the news. GNLN shares rose more than 65% after the announcement, peaking at $6,35, before stabilizing. daily increase of over 14% The new initiative — called BeraStrategy — will be led by Chief Investment Officer Ben Isenberg, with support from names such as Billy Levy, co-founder of Virgin Gaming, and Bruce Linton, former CEO of Canopy Growth Corporation, who will assume the role of chairman of the project.

Launched in February 2025, Berachain is an EVM-compatible Layer 1 blockchain built on Cosmos that introduces the concept of Proof-of-Liquidity — a consensus mechanism that rewards users for providing liquidity in DeFi protocols.

With the investment announcement, the BERA token appreciated more than 10% on the day, trading at around $2,05. Despite this, the asset still trades near all-time lows, well below its high of $14,83, reached shortly after the Berachain mainnet launch earlier this year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?

EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Exclusive: Revealing the Exchange’s New User Acquisition Strategy—$50 for Each New User

Crypto advertising has evolved from being barely noticeable to becoming pervasive everywhere.