Modest Solana Investment Can Double Portfolio Returns, Study Finds

The new Capital Markets report attributes this edge to Solana’s robust ecosystem growth, efficiency, and increasing institutional adoption.

Bitcoin may dominate institutional attention as the cornerstone of digital assets. However, new research suggests that modest exposure to Solana (SOL) could significantly improve portfolio efficiency.

A study by Capital Markets, drawing on Bitwise data, found that even a small Solana allocation enhances risk-adjusted returns in a traditional 60/40 portfolio of equities and bonds.

How Solana Allocations Produce Strong Returns

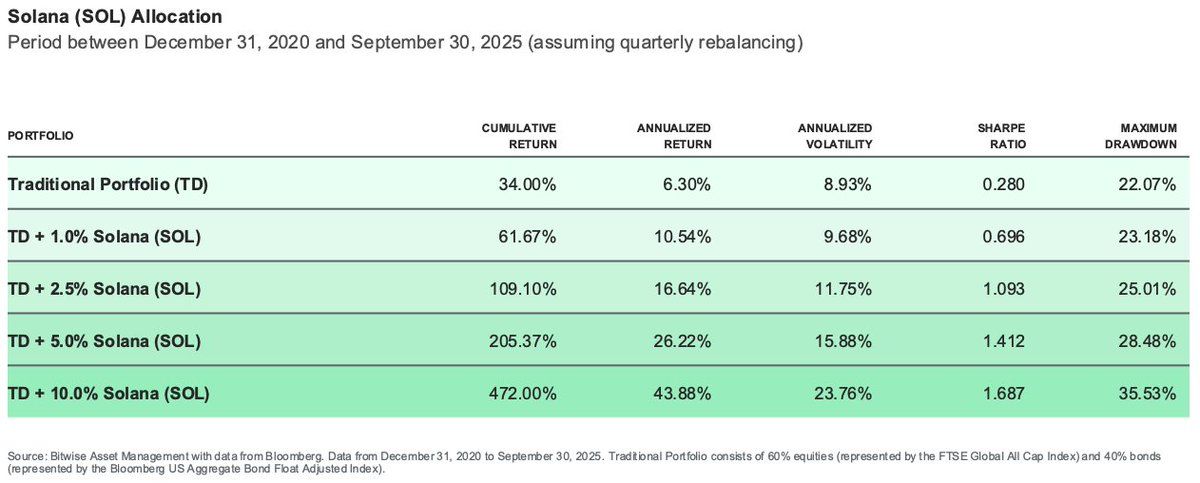

The analysis revealed that adding just 1% SOL exposure lifted annualized returns to 10.54%, with a Sharpe ratio of 0.696.

According to the report, increasing that share to 2.5% boosted returns to 16.64% and produced a Sharpe ratio of 1.093. A 5% weighting, meanwhile, generated 26.22% returns with a Sharpe ratio of 1.412.

Solana Portfolio Allocation. Source:

Capital Markets

Solana Portfolio Allocation. Source:

Capital Markets

Capital Markets also pointed out that a 10% higher-risk allocation will push the portfolio’s annualized returns to 43.88%, with a Sharpe ratio of 1.687.

Capital Markets said these results demonstrate how measured SOL exposure can strengthen long-term portfolio performance. However, diversification altered the outcome.

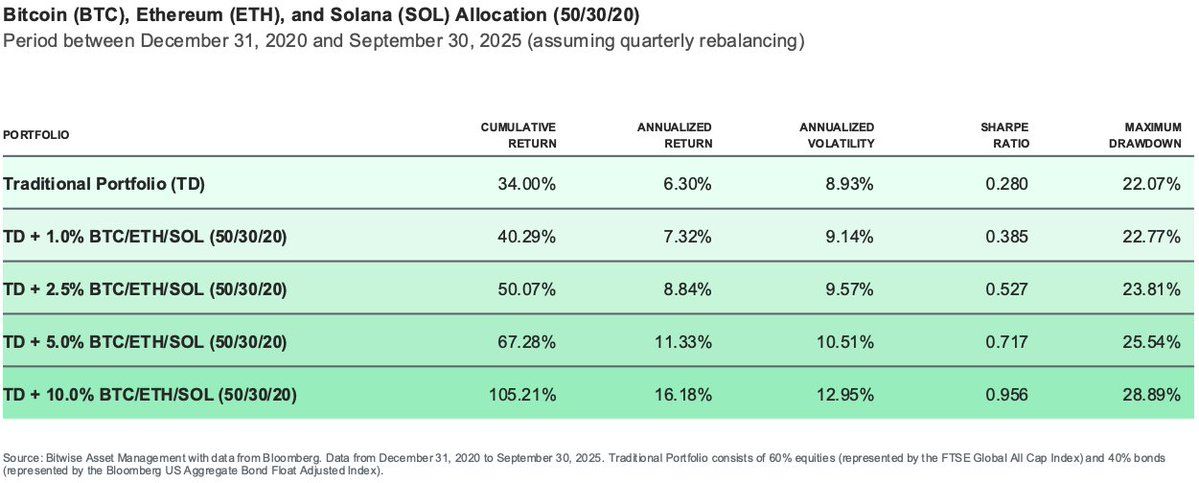

When a 10% crypto allocation was split equally among Bitcoin, Ethereum, and Solana, annualized returns dropped to 19.87%. Notably, this is significantly less than half of Solana’s solo performance.

Meanwhile, a 50:30:20 split between Bitcoin, Ethereum, and Solana yielded 16.18% returns. Smaller allocations of 5% and 2.5% produced steady but moderate improvements of 11.33% and 8.84%, respectively.

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

“Maximum drawdowns remained relatively contained across allocations, even as returns increased sharply,” Capital Markets stated.

Considering this, the firm concluded that a concentrated Solana exposure delivered higher gains. However, a diversified portfolio offered smoother, more consistent growth.

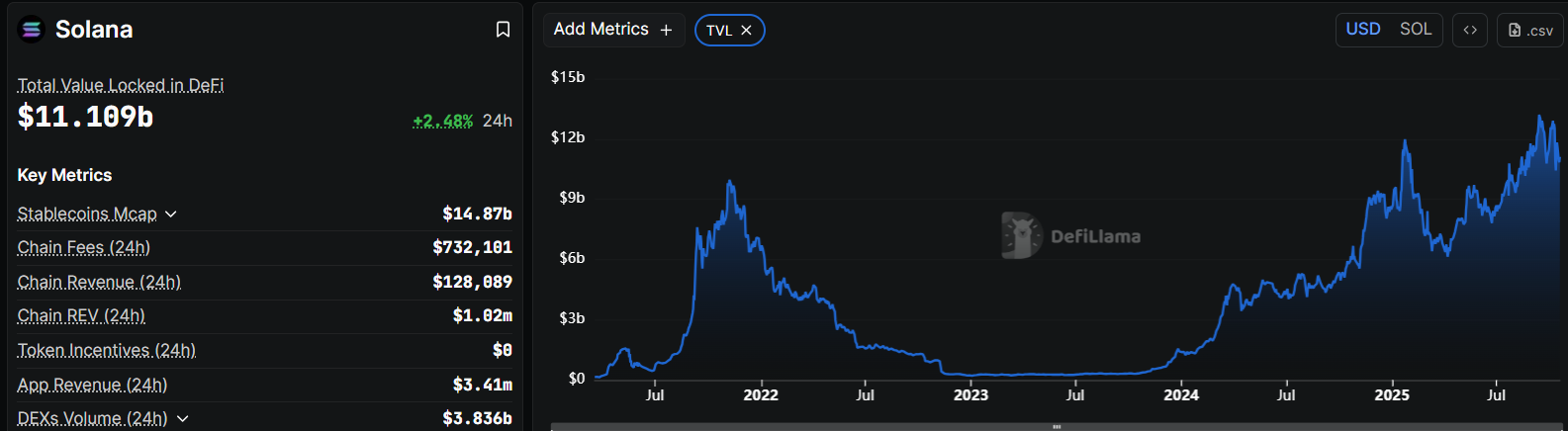

Solana’s on-chain fundamentals help explain its performance edge.

The network, known for low transaction fees and high throughput, processed roughly 96 million daily transactions in the first quarter of 2025 amid the fervor for meme coins.

At the same time, the blockchain network has scored significant institutional adoption and user growth across payments, gaming, and consumer applications. Notably, Solana is the second-largest decentralized finance ecosystem with more than $11 billion in value locked.

Solan DeFi Ecosystem. Source:

DeFiLlama

Solan DeFi Ecosystem. Source:

DeFiLlama

This expanding ecosystem continues to reinforce SOL’s investment appeal. Its efficiency and scalability position it as a credible next-generation blockchain for decentralized applications.

Moreover, with speculation growing around a potential US spot Solana ETF, the asset now dominates discussions about crypto’s evolving role in modern portfolio theory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar radiation reveals previously undetected software flaw in Airbus aircraft fleet

- Airbus issues emergency directive to update A320 fleet software/hardware after solar radiation-linked flight-control incident caused JetBlue's emergency landing. - EU Aviation Safety Agency mandates fixes for 6,000 aircraft, risking Thanksgiving travel chaos as airlines face weeks-long groundings for repairs. - Solar interference vulnerability, previously flagged by FAA in 2018, highlights growing software reliability challenges in modern avionics systems. - Analysts call issue "manageable" but warn of s

Khabib's NFTs Ignite Discussion: Honoring Culture or Taking Advantage?

- Khabib Nurmagomedov's $4.4M NFT collection, rooted in Dagestani heritage, sparked controversy over cultural symbolism and legacy claims. - The project sold 29,000 tokens rapidly but faced scrutiny for post-launch transparency gaps and parallels to failed celebrity NFT ventures. - NFT market recovery (2025 cap: $3.3B) highlights risks like "rug pulls" and volatility, despite celebrity-driven momentum. - Concurrent trends include crowdfunding innovations and sustainability-focused markets like OCC recyclin

Ethereum Updates Today: Fusaka Upgrade on Ethereum Triggers Structural Deflation Through L2 Collaboration

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces EIP-7918, linking L2 data costs to mainnet gas prices, boosting ETH burn rates and accelerating deflationary trajectory. - PeerDAS and BPO forks reduce validator demands while enabling scalable 100k TPS growth through modular upgrades, avoiding disruptive hard forks. - Analysts predict 40-60% lower L2 fees for DeFi/gaming, with institutional ETH accumulation and a 5% price rebound signaling confidence in post-upgrade value capture. - The upgrade creates

Bitcoin News Update: Stablecoin Growth Drives Cathie Wood's Updated Bullish Outlook on Bitcoin, Not Market Weakness

- ARK's Cathie Wood maintains $1.5M Bitcoin long-term target despite 30% price drop, adjusting 2030 forecast to $1.2M due to stablecoin competition. - She attributes market volatility to macroeconomic pressures, not crypto fundamentals, and highlights Bitcoin's historical liquidity-driven rebounds. - UK's "no gain, no loss" DeFi tax framework and firms like Hyperscale Data ($70.5M BTC treasury) reflect evolving regulatory and strategic dynamics. - Bitfarms' exit from Bitcoin mining to AI HPC by 2027 unders