Date: Fri, Oct 17, 2025 | 05:35 AM GMT

The cryptocurrency market is struggling to stage a meaningful V-shaped recovery after the October 10 crash, which wiped out over $19 billion in liquidations. Ethereum (ETH) remains choppy, adding pressure on major altcoins — including Algorand (ALGO).

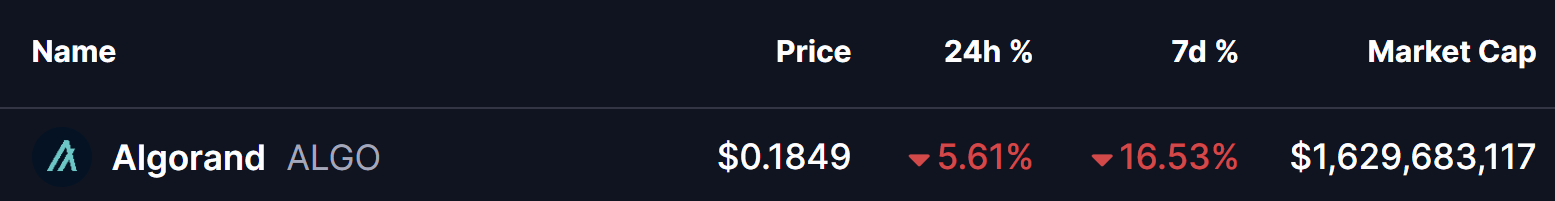

ALGO is currently trading in red, posting a 16% weekly drop, but beyond this short-term weakness, the chart is flashing something far more interesting — a bullish fractal pattern that mirrors Bitcoin’s (BTC) past price behavior right before its major breakout rally.

Source: Coinmarketcap

Source: Coinmarketcap

ALGO Mirrors BTC’s Past Price Behavior

Based on the fractal comparison shown in the chart, ALGO’s current structure closely resembles Bitcoin’s late-2024 correction phase — right before BTC flipped bullish.

Back in September 2024, Bitcoin faced three sharp corrections of around 25%, sharp long liquidation move (2), and 24%, with each dip followed by failed attempts to break its descending resistance trendline. But when BTC finally broke through the trendline and reclaimed its 100-day moving average, it triggered a massive 80% rally, catapulting prices into a strong uptrend.

BTC and ALGO Fractal Chart/Coinsprobe (Source: Tradingview)

BTC and ALGO Fractal Chart/Coinsprobe (Source: Tradingview)

Fast-forward to October 2025, and ALGO seems to be repeating this pattern. After two major corrections of roughly 23%, sharp long liquidation move (2), and a third decline now in progress, ALGO sits right below its descending resistance and 100-hour moving average, forming a setup that looks strikingly similar to BTC’s pre-breakout phase.

What’s Next for ALGO?

If the BTC fractal continues to play out, ALGO might dip once more — potentially toward the $0.17 region — before forming a strong base for a rebound.

A confirmed breakout above the descending trendline and a reclaim of the 100 MA could mark the start of ALGO’s “BTC-style” recovery, with a potential target near $0.35, representing nearly a 90% upside from current levels.

However, it’s worth noting that fractals reflect historical market symmetry, not guaranteed outcomes. While ALGO’s pattern aligns strongly with BTC’s past movements, traders should still look for confirmation through breakout and volume signals before positioning for a larger move.