Bitcoin Price’s Last Line Of Defense Could Prevent Structural Weakness

Bitcoin hovers near a critical support range between $108,000 and $117,000. Sustaining this zone is essential to avoid structural weakness and potential long-term correction.

Bitcoin is currently facing one of its most critical tests in months as its price hovers near a key support level that has repeatedly prevented deeper declines.

However, investor sentiment and market conditions will now determine whether Bitcoin can sustain this level or risk entering a prolonged correction phase.

Bitcoin Is Vulnerable

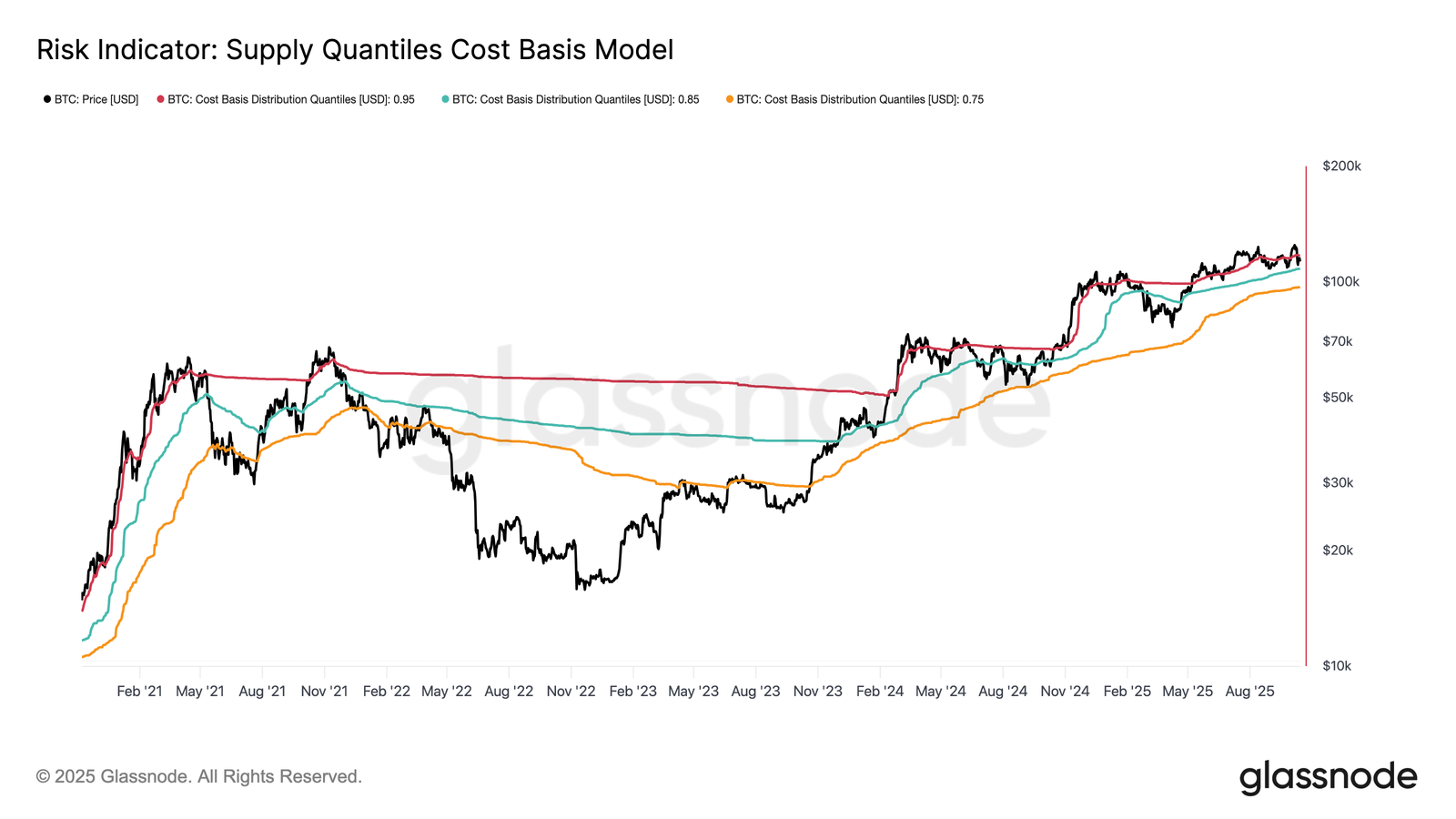

Bitcoin’s supply quantiles show that the asset has entered its third instance since late August, where spot prices dipped below the 0.95-quantile price model ($117,100). This level represents holdings where roughly 5% of supply, primarily owned by top buyers, sits at a loss. BTC currently trades within the 0.85–0.95 quantile range ($108,400–$117,100), reflecting a significant retracement from the euphoric phase of recent months.

Without renewed momentum to lift prices back above $117,100, Bitcoin risks sliding toward the lower boundary of this range. Historically, when BTC failed to sustain this critical support zone, extended mid- to long-term corrections followed. A drop below $108,000 would likely signal structural weakness, potentially leading to greater losses as investor confidence wavers.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Supply Quantiles. Source:

Glassnode

Bitcoin Supply Quantiles. Source:

Glassnode

The broader macro environment remains challenging for Bitcoin. Since July 2025, persistent long-term holder (LTH) distribution has restricted upside potential. Data shows that approximately 0.3 million BTC have been offloaded by mature investors over this period, indicating steady profit-taking. This sustained sell-side pressure has limited demand growth and kept volatility elevated.

If the distribution trend continues without new inflows from institutions or retail buyers, Bitcoin could face further consolidation. Demand exhaustion may lead to localized capitulation events or temporary market pullbacks before long-term equilibrium returns.

Bitcoin LTH Supply. Source:

Glassnode

Bitcoin LTH Supply. Source:

Glassnode

BTC Price Holds Strong

Bitcoin’s price has remained volatile since July 2025 due to macroeconomic pressure and shifting investor sentiment. Even so, BTC has repeatedly found stability around $110,000, signaling potential resilience.

The next major support lies at $108,000, a historically strong level that has been tested several times before. Holding above this zone could enable a rebound toward $112,500 in the short term, especially if macro conditions improve.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if bearish pressure intensifies and selling accelerates, Bitcoin could fall below $110,000. A breakdown under $108,000 would invalidate the bullish-neutral outlook and expose BTC to deeper structural weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens

Polygon Exec Predicts Surge to 100,000 Stablecoins, Banks Scramble to Retain Capital