Market Flash Crash, Funds Seeking Exit on-chain: A Comprehensive Look at the Contract DEX Yield Farming Battle

The market flash crash has exposed the centralization risks in the crypto industry, providing DEX with a development opportunity.

The largest-scale liquidation event in recent history, a $19 billion leveraged bet, occurred last Friday evening with most of the trading volume coming from just three centralized exchanges. This exposed a continuing vulnerability: the industry is still too centralized, with power and risk highly concentrated in the hands of a few giants. This was not just a digital liquidation but also a severe questioning of the core principles of the crypto industry. This is also the golden moment for DEXs. In the midst of this chaotic battlefield, Hyperliquid has loudly proclaimed itself as "The House of All Finance," a positioning that truly reflects their development direction. Grvt has also openly stated its long-term vision of becoming the highest-yielding exchange, occupying a strategically unique position in the perpetual contract DEX field that no other platform is currently focusing on.

DEX Overview

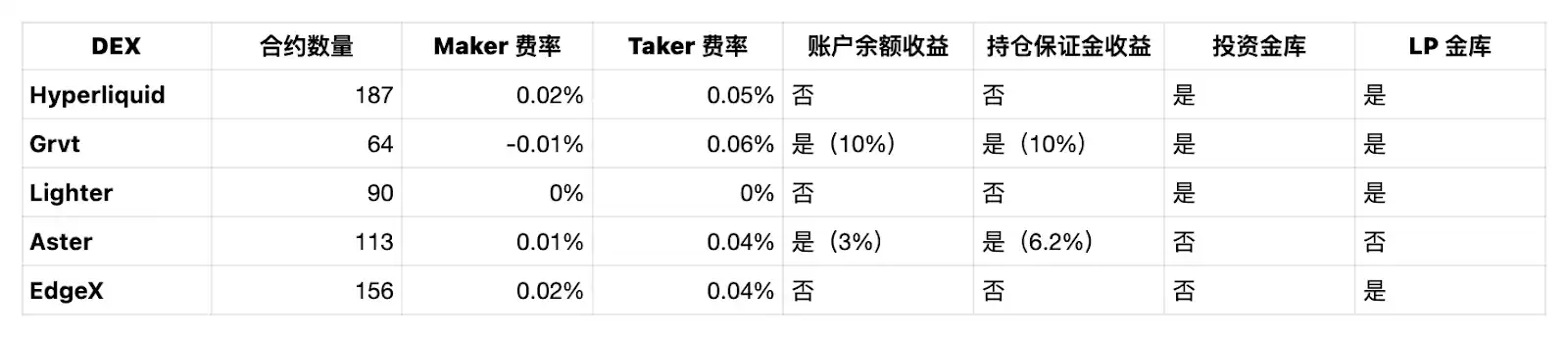

As of October 15, 2025, here is a comparison of the basic fee rates and related yield features of several major perpetual contract DEXs:

Currently, Hyperliquid has the most perpetual contract trading pairs, while Grvt has the fewest number of contracts.

However, in terms of Maker fees (i.e., limit order placement fees), Grvt has surpassed its competitors. It even charges a negative fee for Maker trades—meaning traders not only receive airdrop rewards when placing limit orders but also earn actual USDT profits.

In contrast, although Grvt has the highest Taker fee (market order), this part is more valuable during point farming as it directly affects future Grvt airdrop rewards.

In terms of Account Balance Yield, Grvt and Aster stand out:

· Grvt offers a 10% APY on users' USDT trading account balance, with the rewards paid in USDT;

· Aster provides a 3% APY on users' USDF balance, with rewards paid in USDF.

For Margin Yield, Grvt and Aster are also leading:

· Grvt offers 10% APY on USDT regardless of whether the user's USDT is idle in their account or used as collateral for positions;

· Aster, on the other hand, provides an additional 3.2% APY when the user uses USDF as collateral, accumulating to a total of 6.2% APY.

On the Investment Vault, apart from Aster and EdgeX, all other platforms allow users to invest in the exchange's internal vault, earning potential returns outside of trading. Except for Aster, most other platforms are equipped with LP (Liquidity Provider) vaults.

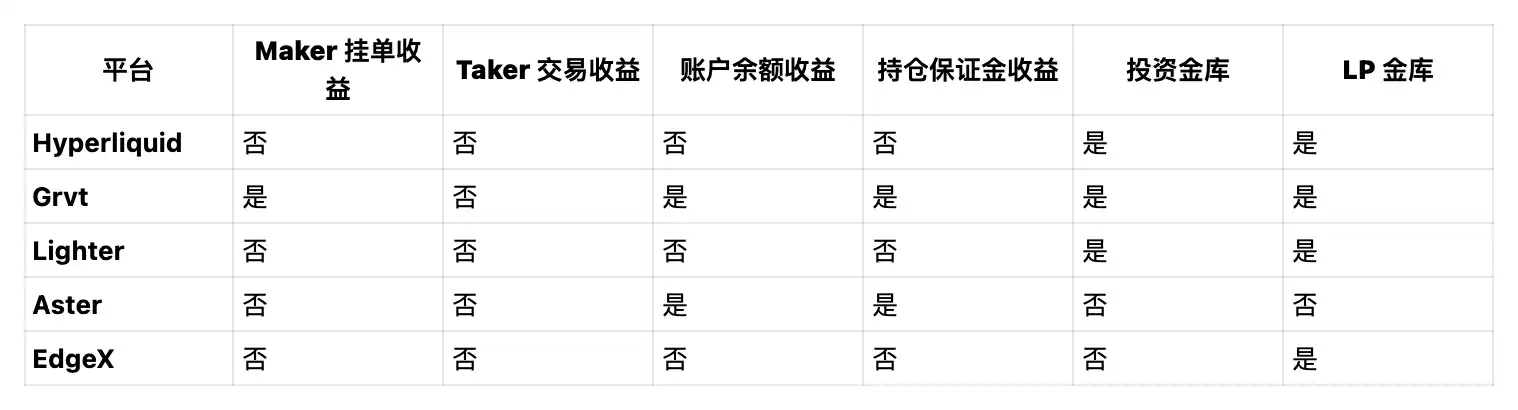

How to Earn Yield on These DEXes (Apart from Trading and Airdrops)?

From the table above, Grvt is currently the only platform within perpetual contract DEXes that offers multiple yield avenues, not limited to just trading or points farming.

While Aster stands out with its unique account balance and collateral yield mechanism, it still falls short compared to competitors in the most common investment vault and LP vault aspects.

Conclusion

By enabling earning negative fee rate rewards through limit order execution and providing the highest APY for both accounts and positions, Grvt is gradually realizing its vision of being the "highest-yielding trading platform." With the intense competition among perpetual contract DEXes, we may witness more innovative product forms and yield structures in the future. The future of decentralized perpetual contracts is becoming increasingly anticipated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c

The Transformation of Webster, NY: Targeted Property and Infrastructure Initiatives After the Xerox Era

- Webster , NY, secured a $9.8M FAST NY grant to transform the former Xerox campus into a shovel-ready industrial hub, part of Governor Hochul’s upstate revitalization strategy. - Infrastructure upgrades, including road and sewer improvements, aim to attract advanced manufacturing and logistics firms by reducing development risks and costs. - The Xerox campus redevelopment includes mixed-use projects, projected to create 250 jobs and boost property values through residential and commercial integration. - W