- Bitcoin rallies often follow days of heavy FUD

- Santiment highlights 4 major negative sentiment days in 7 months

- Negative crowd mood may signal buying opportunities

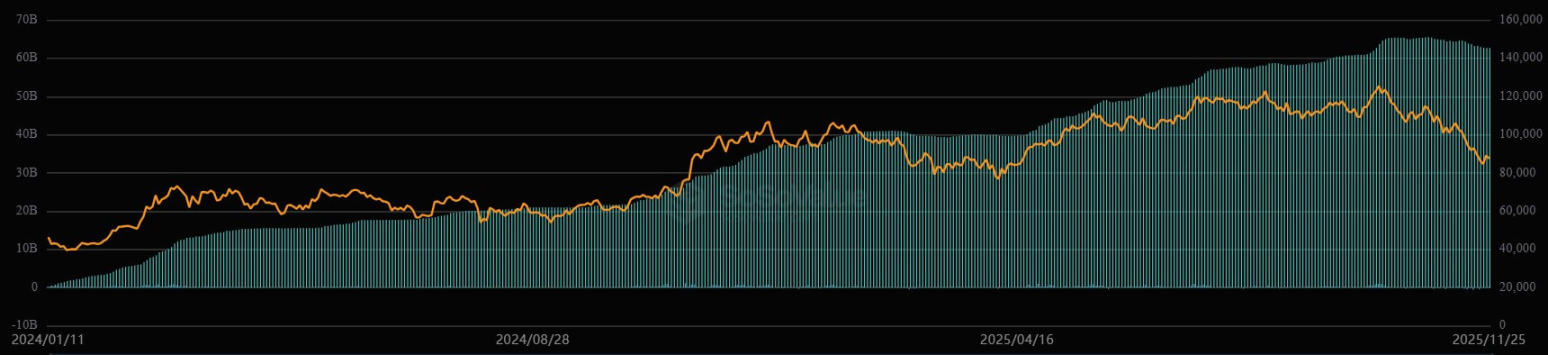

In the world of crypto, crowd sentiment plays a surprising role in price movements. According to data from Santiment, the most negative sentiment days for Bitcoin in the past seven months have been followed by notable price rallies. This pattern suggests that when public fear, uncertainty, and doubt (FUD) peaks, it could actually signal a good time to buy.

This phenomenon is not new. Historically, markets often move against the majority’s expectations. In Bitcoin’s case, when social media platforms and forums are flooded with bearish posts and fear-driven reactions, the price often does the opposite — it climbs.

Santiment Identifies Key Contrarian Signals

Santiment, a leading blockchain analytics firm, reported that the four days with the most negative Bitcoin sentiment between March and October 2025 were each followed by significant price increases. These days were marked by rising panic in the community — caused by anything from regulatory headlines to price dips — yet they served as launching points for Bitcoin rallies.

This data reinforces the idea that extreme negativity can be a reliable contrarian indicator. Traders who pay close attention to sentiment metrics might find value in going against the crowd.

Understanding the Sentiment-Price Connection

Why does this pattern repeat? When the market is overly pessimistic, it often signals that many have already sold or are sitting on the sidelines. This creates an environment where fewer sellers remain, and any positive news or buying pressure can push prices up quickly.

Investors looking to time the market might consider monitoring sentiment indicators as part of their strategy. While not foolproof, negative sentiment—especially when it hits extreme levels—has historically aligned with upcoming bullish momentum.