Key Notes

- BlackRock’s IBIT led spot Bitcoin ETF inflows, pulling in $2.63 billion last week.

- October has already seen over $5 billion in net Bitcoin ETF inflows.

- After a brief crash, BTC has rebounded to trade above $115,000 with surging trading volume.

Last week, from Oct. 6 to Oct. 10, spot Bitcoin ETFs recorded $2.71 billion in net inflows, reflecting strong institutional confidence in cryptocurrency’s long-term potential. BlackRock’s iShares Bitcoin Trust (IBIT) took the lead, contributing $2.63 billion alone.

According to data from SoSoValue , IBIT’s net assets now stand at $94 billion.

BTC ETFs continue to dominate investor sentiment in October. So far this month, the market has seen inflows every day except for a minor $4.5 million outflow on Oct. 10. This has pushed total October inflows past the $5 billion mark in just two weeks.

From October 6 to October 10 (ET), spot Bitcoin ETFs saw a net weekly inflow of $2.71 billion, with BlackRock’s IBIT leading the pack with $2.63 billion. Spot Ethereum ETFs recorded a net weekly inflow of $488 million, led by BlackRock’s ETHA with $638 million.… pic.twitter.com/gYdBrbPzON

— Wu Blockchain (@WuBlockchain) October 13, 2025

This wave of inflows comes amid optimism for an “Uptober” rally, even as short-term volatility remains. BTC BTC $114 334 24h volatility: 2.0% Market cap: $2.27 T Vol. 24h: $95.33 B briefly fell below the critical $110,000 level on Oct. 11 after a US-China tariff announcement rattled global markets.

However, the top crypto quickly rebounded and is now trading around $115,570, up 3.5% in the past 24 hours. Bitcoin’s 24-hour trading volume has also climbed 15% to roughly $92 billion, according to CoinMarketCap .

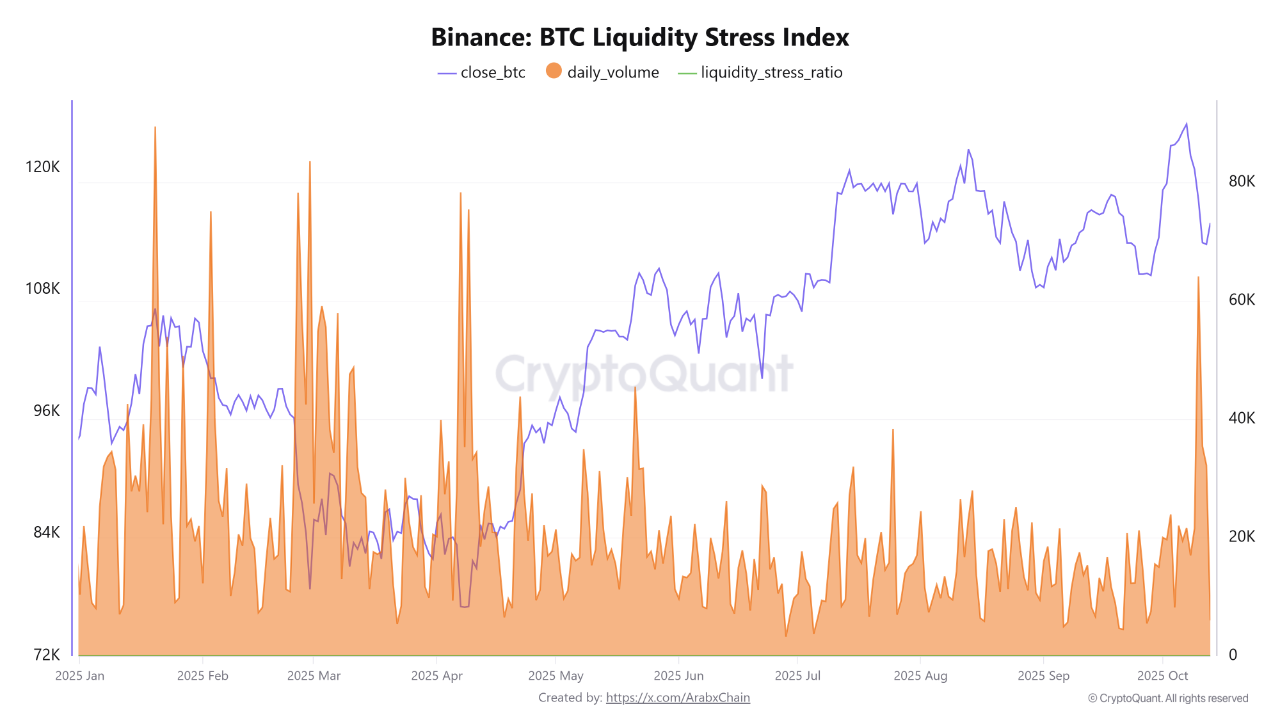

Liquidity Stress Peaks on Exchanges

The market is currently facing its highest liquidity stress levels since early 2025 on Binance, the world’s most liquid crypto exchange. This suggests difficulty in executing large trades without impacting price, pointing to a liquidity shock due to stop-loss triggers and leveraged liquidations.

According to the data from CryptoQuant , the liquidity stress index is currently at 0.2867, one of the year’s highest readings.

Bitcoin liquidity stress index on Binance | Source: CryptoQuant

According to a CryptoQuant contributor, the recent price drop signals a rapid transfer of liquidity from short-term traders to institutional holders. Analysts suggest that large investors may have taken advantage of the drop to accumulate BTC at support levels.

The current stabilization phase hints at market rebalancing, according to the analyst. They expect a return of confidence if volumes taper while prices hold above $112,000.

What’s Next for BTC Price?

Glassnode data shows funding rates across major derivatives exchanges have plunged to bear-market lows. Between Oct. 10 and 12, over $20 billion in positions were wiped from exchanges, before recovering slightly to $74 billion.

Crypto market traders are now confused whether this marks the end of the correction or just the beginning of a deeper retracement. However, many analysts remain optimistic, predicting Bitcoin could surge to $150,000 before the quarter’s end.

next