Algorand price could run towards $1 if this happens

Algorand price may be approaching a trend reversal, with potential to rally toward $1 if it breaks above the 20-week MA on the weekly chart.

- Algorand price remains in a downtrend, recently dipping below key support at $0.22 before bouncing back.

- A potential double-bottom could form at $0.20, with a breakout above $0.23 possibly driving a move toward $0.26–$0.27.

- Analyst Michaël van de Poppe says that a weekly chart breakout above the 20-week MA could trigger a broader rally toward $0.90–$1.00.

Algorand ( ALGO ) price continues to extend its downtrend, consistently forming lower highs. The price has recently broken horizontal support around $0.22, dipping to $0.20 where buyers stepped in to scoop the dip, driving the altcoin ‘s price back up to retest the $0.22 zone.

However, RSI readings hover around 46, underscoring a neutral-to-bearish bias that leaves room for further downside. Another potential retest of the $0.20 level appears likely, as that area now serves as the new local support.

If this support zone is tested again, it could set up a potential double-bottom pattern, with the neckline forming around $0.23. A confirmed breakout above this neckline could trigger a measured move toward $0.26–$0.27, potentially signaling the start of a trend reversal to the upside.

Source: TradingView

Source: TradingView

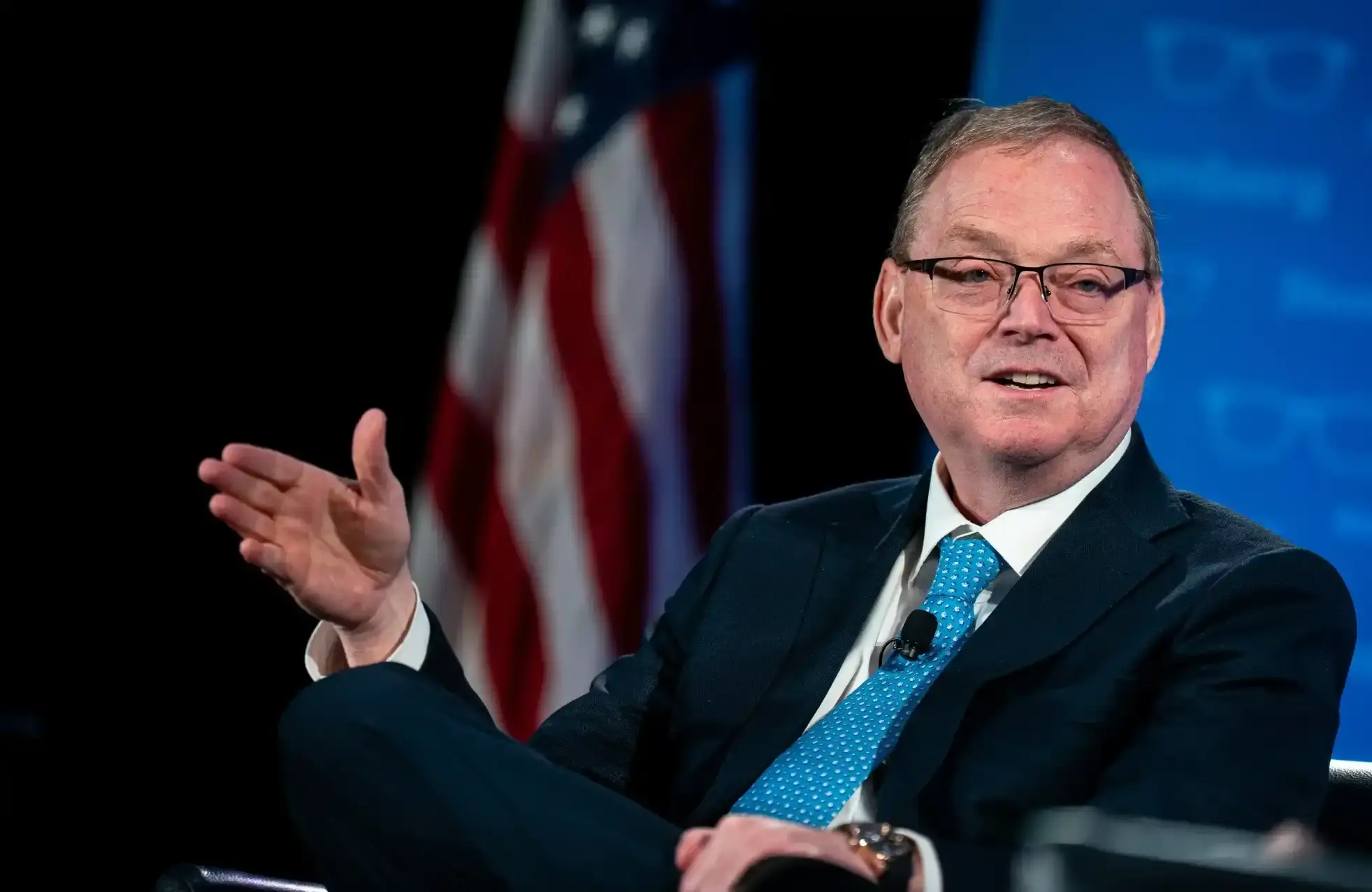

Michaël van de Poppe: Algorand price could rally to $1

Zooming out to the weekly chart, Algorand price appears to be sliding toward its historical accumulation base, according to analyst Michaël van de Poppe . “It’s not unusual for a project to revisit its base — this tends to happen every cycle,” he wrote in a recent post on X .

van de Poppe suggests that a breakout above the 20-week moving average could signal a broader trend reversal for ALGO and potentially trigger a rally toward the $1 mark, in line with the 1.618 Fibonacci extension level near $0.90–$1.00.

Source: @CryptoMichNL

Source: @CryptoMichNL

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?

EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Exclusive: Revealing the Exchange’s New User Acquisition Strategy—$50 for Each New User

Crypto advertising has evolved from being barely noticeable to becoming pervasive everywhere.