- Monero provides strong privacy features, protecting user identities in an increasingly traceable blockchain world.

- Render connects unused computing power with creators, supporting graphics rendering and generative AI workloads.

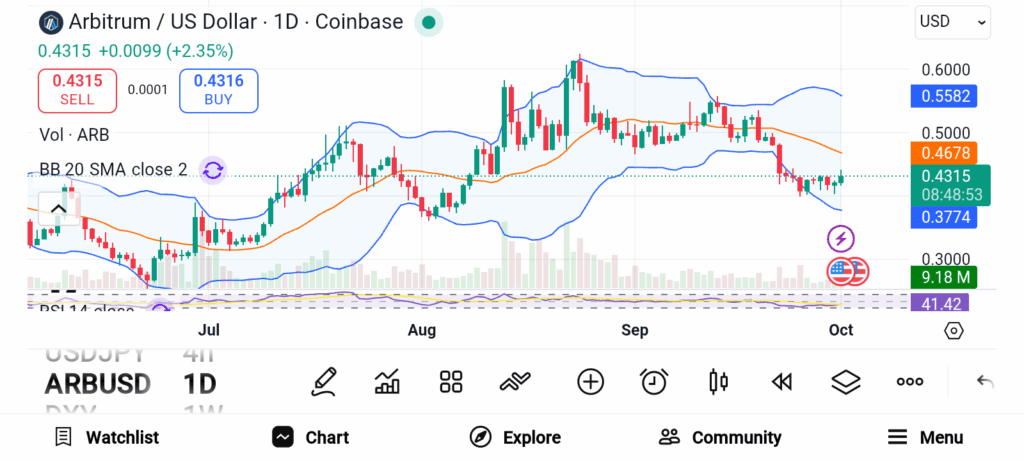

- Arbitrum boosts Ethereum scalability, offering faster transactions and lower fees for developers and users.

Many investors look to the big-name projects such as Bitcoin and Ethereum, but there are many hidden gems. There are many smaller promising crypto projects quietly building solid foundations, without a lot of hype around them. These smaller projects often address a particular problem or offer a different use case that the larger networks are unaware of.

Monero: The Privacy Pioneer

Source: Trading View

Source: Trading View

The Monero Network offers something few other cryptocurrencies do—real privacy. Many assume privacy coins only attract hackers or shady actors. While that concern exists, data shows criminals often prefer Bitcoin because privacy coins lack liquidity. Monero’s purpose goes beyond crime. Blockchain transactions are transparent, but wallet addresses are often traceable.

Over time, those addresses can be linked to actual people. Monero solves this challenge by hiding transaction details. That privacy can protect law-abiding users, like businesses keeping sensitive financial information confidential. With increasing concerns over data exposure, demand for privacy solutions may rise. Monero positions itself as a safeguard in a world where anonymity grows scarce.

Render: Powering Digital Creativity

Source: Trading View

Source: Trading View

Render showcases how blockchain can fuel creativity. The project connects people with unused computer power to those who need it. Participants share extra processing capacity and earn Render tokens in return. This resource is then sold to creators handling heavy workloads. The network splits large jobs across thousands of computers, speeding up tasks like graphics rendering.

Originally designed for artists, Render now also supports generative AI applications. That expansion gives it relevance far beyond digital art. Imagine a filmmaker or designer cutting costs while gaining faster results. Render makes that possible. As AI and digital content grow, so will demand for efficient computing resources.

Arbitrum: Scaling Ethereum’s Future

Source: Trading View

Source: Trading View

While Ethereum is no longer the most important blockchain, it still is one of the most important blockchains. The blockchain suffers from limitations: transactions slow and fees rise while in heavy use cases. Arbitrum is a layer-2 solution built on Ethereum that works to improve transaction speed and reduce transaction costs while keeping Ethereum’s security features intact. Developers can implement Arbitrum like they do on Ethereum, the big difference is that it is cheaper and faster.

Data from DefiLlama shows Arbitrum ranks third in active applications. It also sits within the top 10 blockchains by total value locked. These metrics highlight a growing ecosystem. With more users and projects, the chain could become a leading L2 platform. As Ethereum adoption expands, Arbitrum benefits directly by solving scalability challenges.

Monero, Render, and Arbitrum each tackle different challenges with unique approaches. Monero focuses on privacy, Render connects computing power to creative industries, and Arbitrum strengthens Ethereum. None dominate headlines, yet each offers long-term potential. For investors willing to look beyond popular names, these under-the-radar projects could provide strong opportunities in the years ahead.