Chainlink price is under pressure after a 700,000 LINK whale deposit and sustained spot selling; on-chain metrics—active addresses, transaction count and exchange netflow—point to continued downside toward $20.3 unless selling eases and network activity rebounds.

-

700,000 LINK whale sale worth $15.52M signaled bearish intent

-

Active addresses and transactions plunged, showing collapsing on-chain demand

-

Exchange netflow and Buy-Sell Delta indicate sustained spot selling (Sell Volume 1.77M vs Buy 1.25M)

Chainlink price drops after a 700,000 LINK whale sale; on-chain demand collapses—read analysis, risks and actionable signals for traders.

What is driving the current Chainlink price decline?

Chainlink price has fallen amid heavy spot selling after a whale deposited 700,000 LINK to an exchange and sold at a loss, while on-chain demand metrics — active addresses and transaction counts — contracted sharply. These combined signals increase the probability of further downside to $20.3 if selling persists.

How did whale activity and spot flows impact LINK?

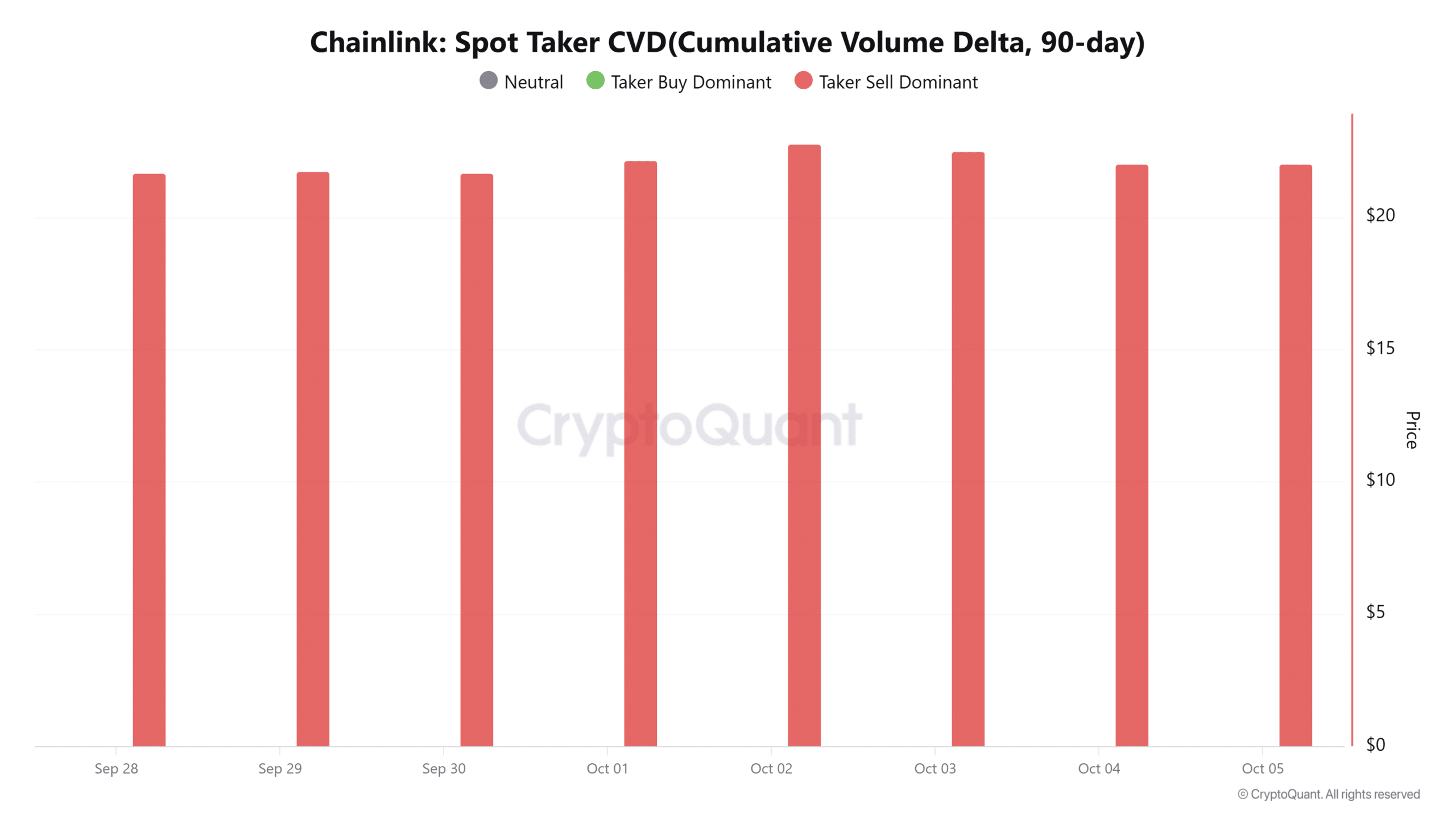

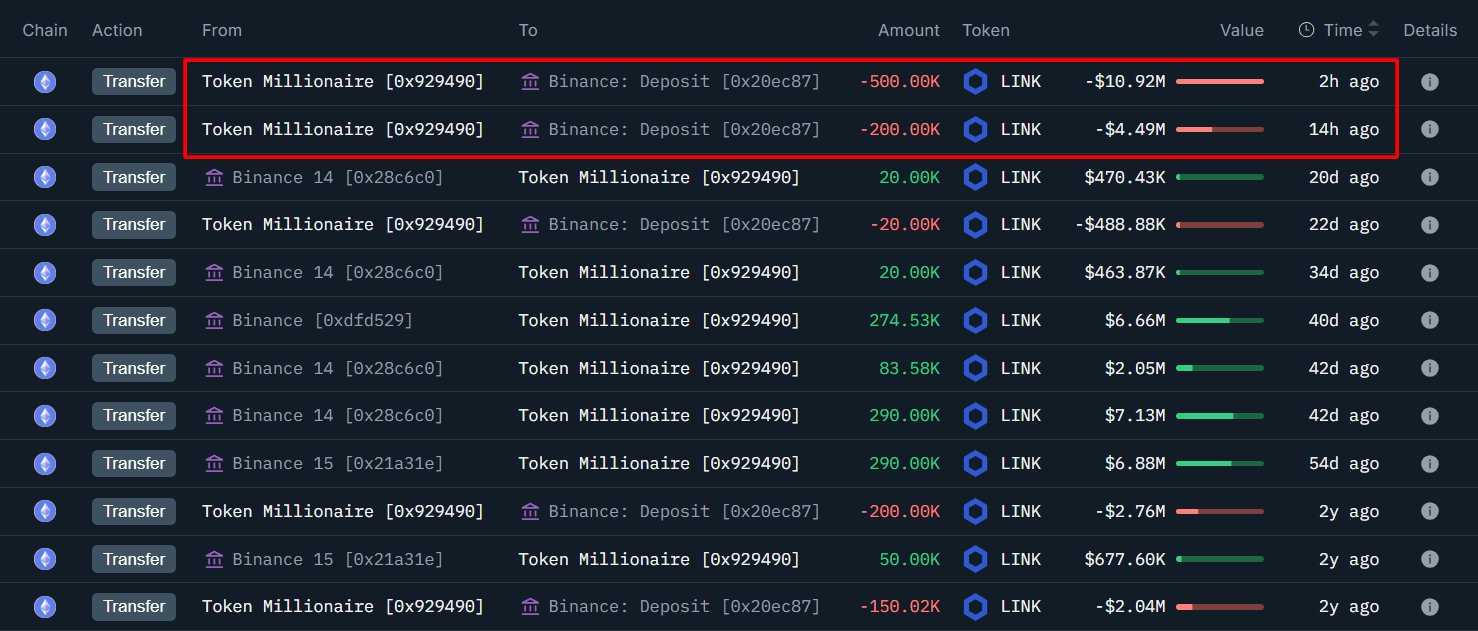

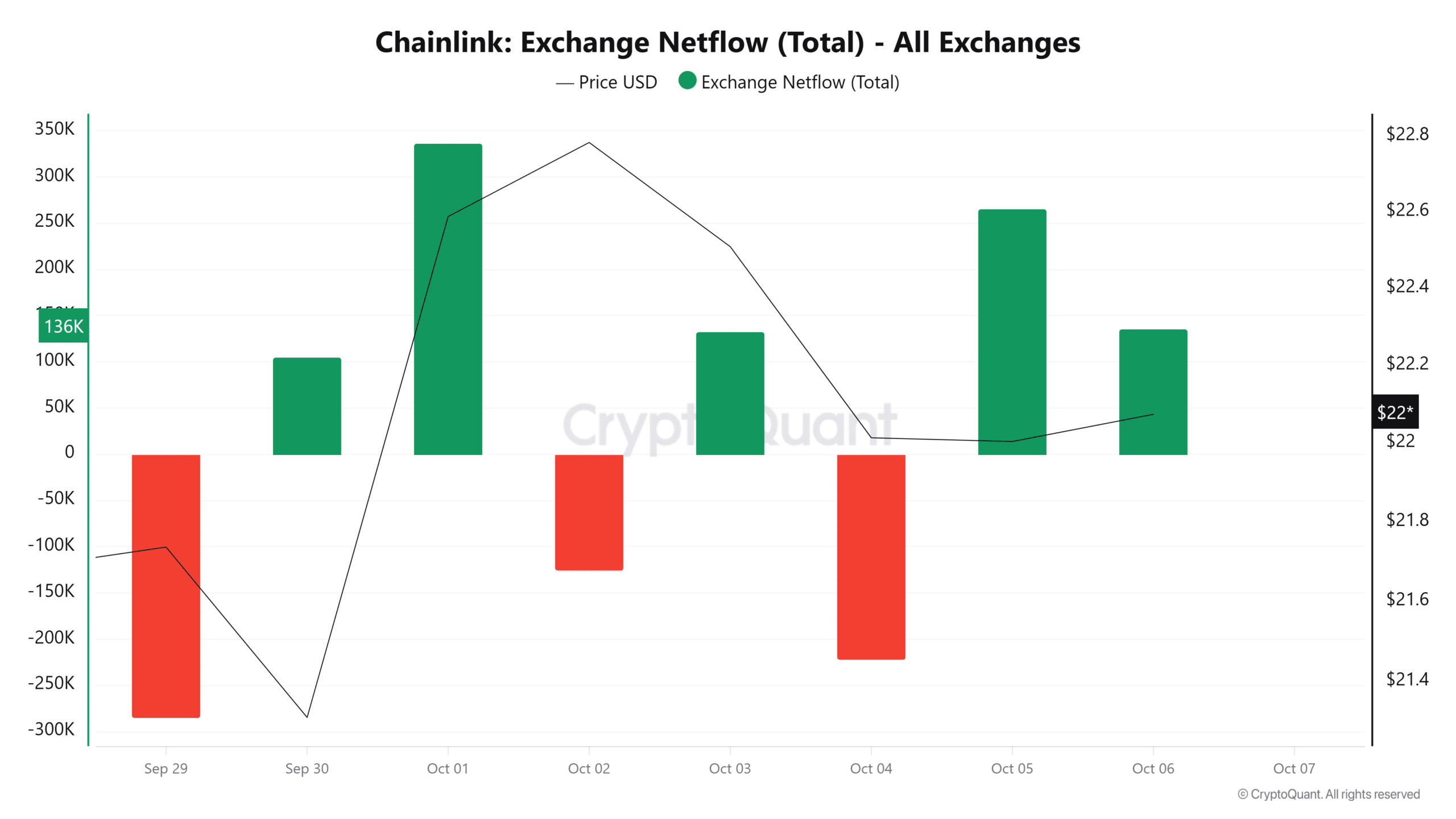

On-chain monitors reported a whale deposit of 700,000 LINK (about $15.52M) to an exchange, recorded at a $2.76M loss. Spot Taker CVD stayed negative for seven days, and Exchange Netflow turned positive for two consecutive days, indicating more tokens moved to exchanges for sale. Such concentrated selling from large holders pressures price and liquidity.

Chainlink whale offloads at a loss

After a brief rebound, sellers re-entered, pushing Chainlink back below its recent resistance. Spot Taker CVD and exchange inflows show sellers dominating order flow for the past week. Large-scale selling by wallets with significant balances often signals lower short-term confidence among major holders.

On-chain Lens reported the deposit; the whale realized an approximate $2.76M loss on the trade. Historically, such loss-taking by whales precedes amplified selling pressure as other market participants react to liquidity changes and realized-loss events.

Why are retail investors contributing to the sell-off?

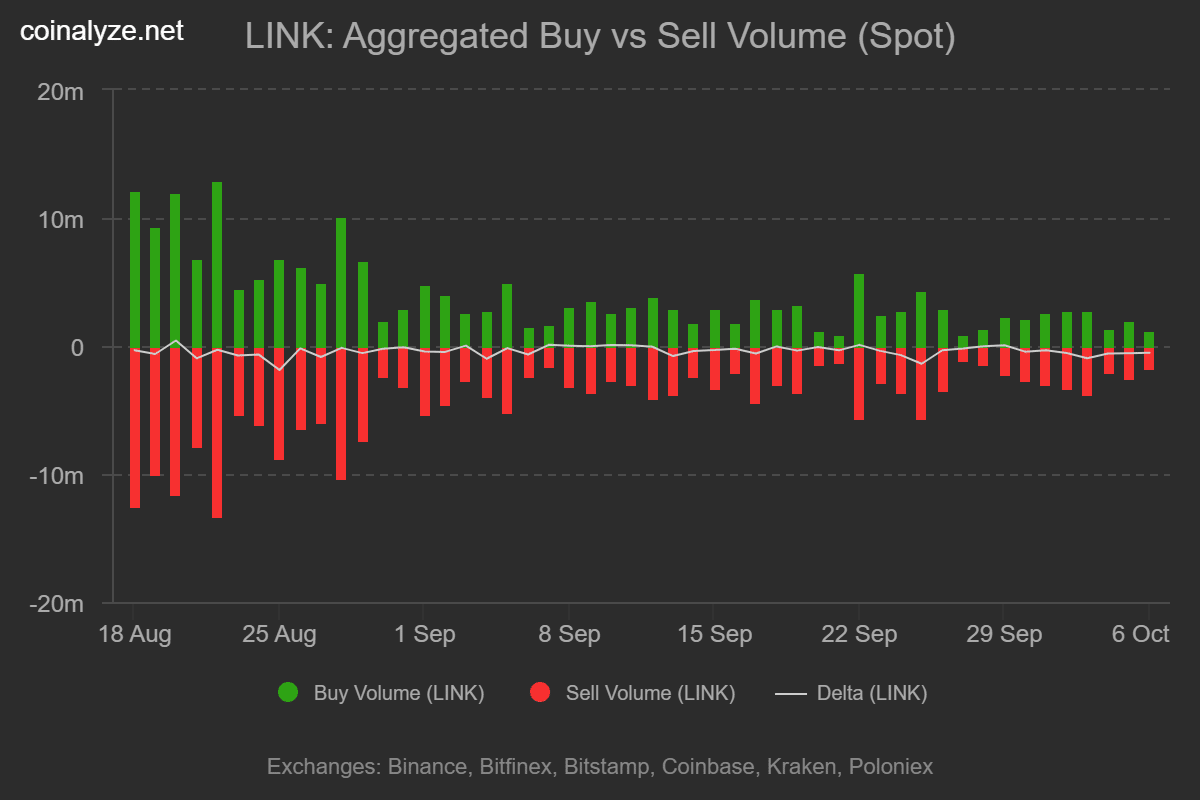

Retail traders have also increased selling: Coinalyze data shows seven days of negative Buy-Sell Delta, with 1.77M in Sell Volume vs 1.25M Buy Volume on October 6. A negative Buy-Sell Delta of -523.7k confirms aggressive spot selling from smaller addresses, compounding pressure from whales.

Exchange deposits rose, with CryptoQuant showing a netflow of ~136k LINK at press time. Elevated exchange inflows typically precede more liquid selling and create short-term supply pressure.

How has on-chain demand changed for LINK?

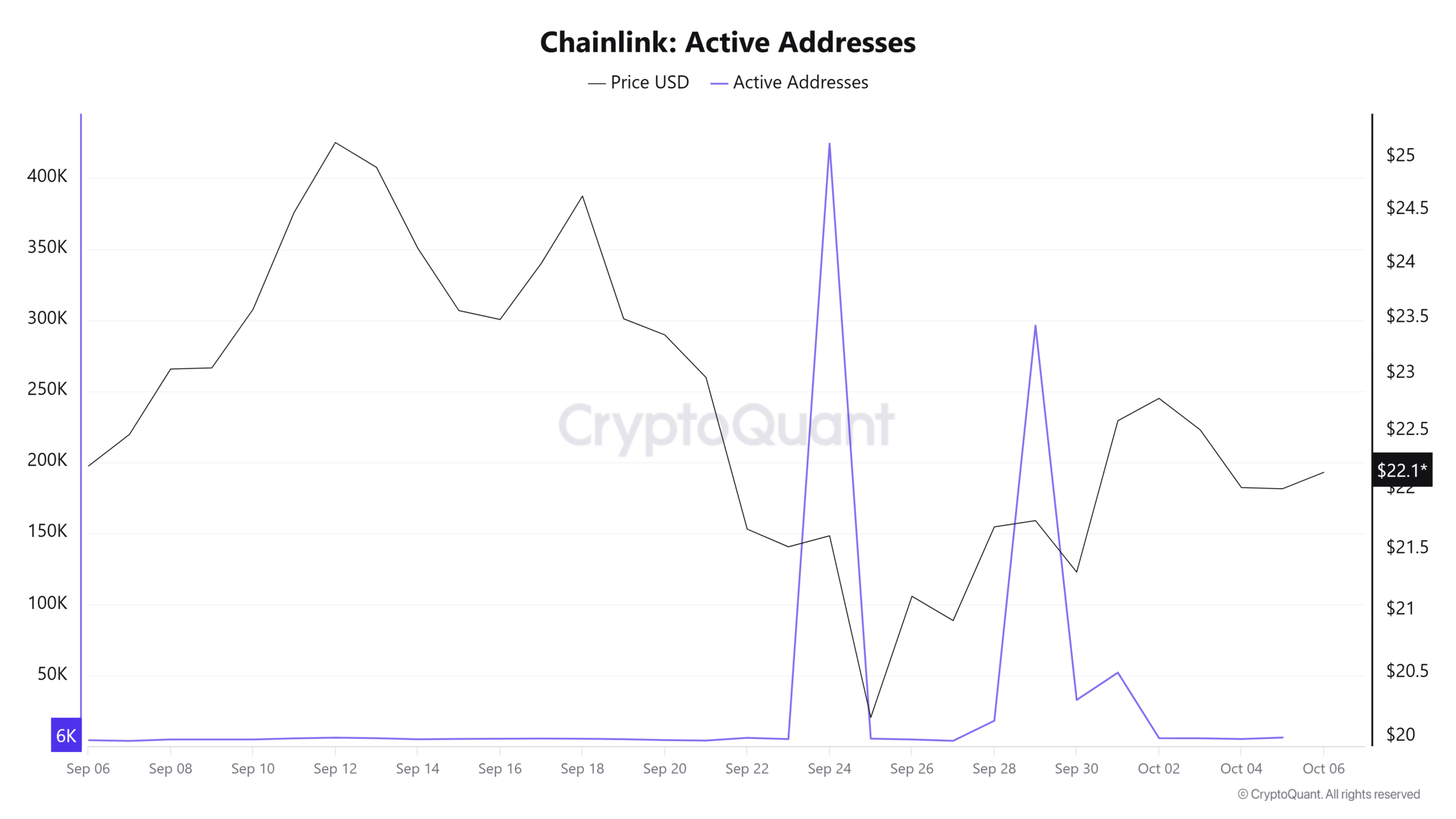

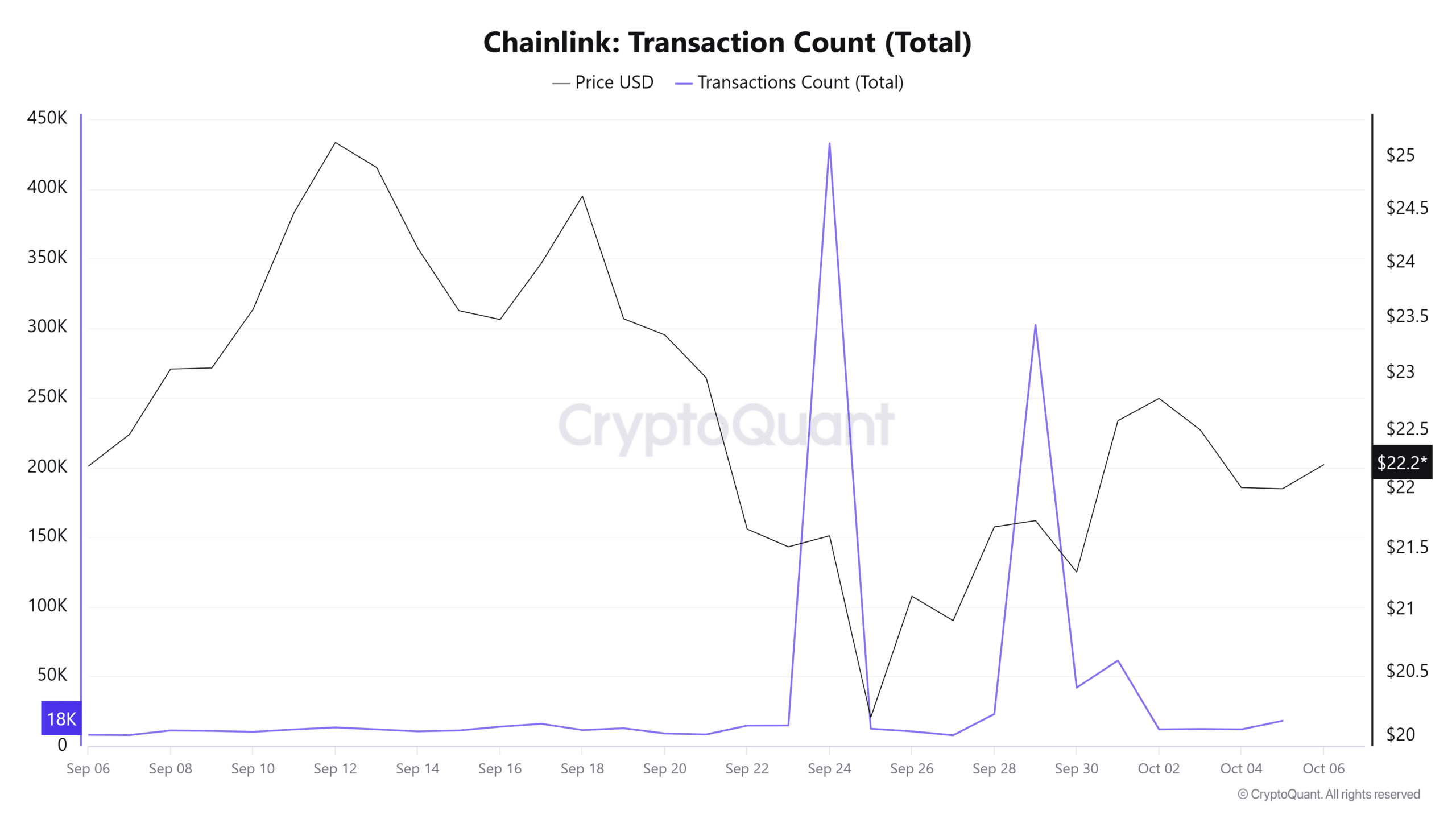

On-chain demand has weakened significantly. CryptoQuant shows Active Addresses at a weekly low (~6k) and Total Transactions collapsed from 432.7k to 18k. Declining unique addresses and transaction counts indicate fewer participants interacting with the network, a bearish signal for short- to medium-term price action.

Is LINK eyeing more losses?

Current indicators place LINK at higher risk of a further decline. If selling pressure and low on-chain activity continue, expect a breach of $22 support and a move toward $20.3. Alternatively, exhaustion of selling and a resurgence in active addresses could enable a rebound above $23.1 toward $24.9.

Frequently Asked Questions

How large was the whale sale and what loss did it trigger?

The whale deposited 700,000 LINK (~$15.52M) to an exchange and reportedly realized a loss of about $2.76M on that position, signalling reduced conviction among large holders.

What on-chain signals should traders watch for a reversal?

Watch for (1) shrinking Exchange Netflow (lower deposits), (2) rising Active Addresses and Total Transactions, and (3) a shift to neutral/positive Buy-Sell Delta; these suggest buyer return and potential price stabilization.

Key Takeaways

- Whale selling: 700,000 LINK deposit and realized loss signaled bearish intent.

- Retail and spot flows: Negative Buy-Sell Delta and positive exchange netflow confirm aggressive selling.

- On-chain demand collapse: Active addresses and transactions down sharply; sustained drops favor further downside to $20.3 unless conditions change.

Conclusion

Chainlink is facing substantive sell pressure driven by a major whale sale and widespread spot selling, while on-chain metrics show lower network engagement. Traders should monitor exchange netflow, Buy-Sell Delta and active addresses for signs of exhaustion or recovery; COINOTAG will update this analysis as new data arrives.