Crypto Traders Are Buying These 3 Low-Cap Perp DEX Tokens In Early October

Perp DEX trading volumes are surging to record highs, fueling investor interest in low-cap tokens like ADX, PERP, and BLUE. With whale accumulation and buyback programs in play, these altcoins may see strong rallies in October.

The October market has recorded a series of remarkable milestones in the Perp DEX sector. Several altcoins from Perp DEX platforms, including Hyperliquid (HYPE), Aster (ASTER), and Avantis (AVNT), have posted strong gains. If this trend persists, capital may continue to rotate into smaller-cap altcoins.

On-chain data shows that a few low-cap Perp DEX altcoins are experiencing strong accumulation. This is reflected in whale wallet balances and exchange reserves.

Perp DEX Records Fuel Interest in Low-Cap Altcoins

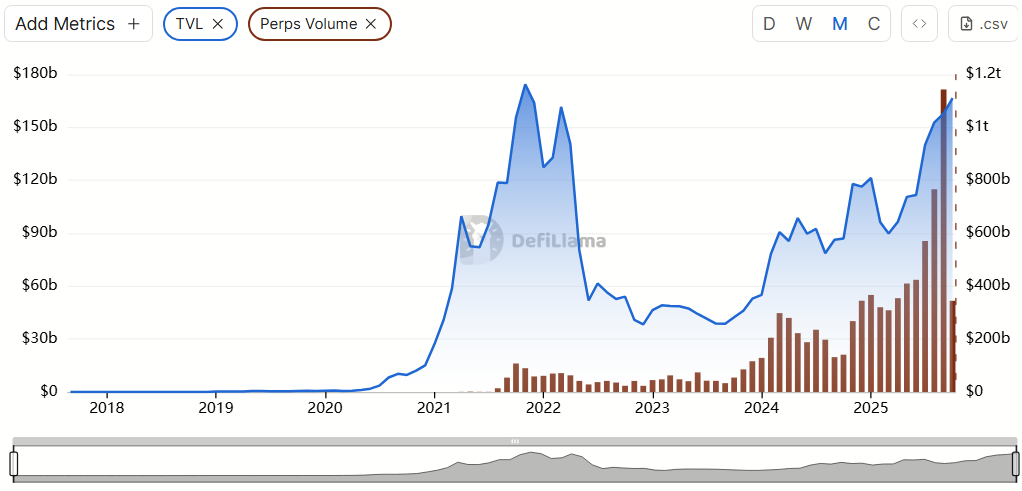

DefiLlama data reveals that Perps trading volume surpassed $1.1 trillion in September, marking the highest level in DeFi history.

Volume has already increased by more than $340 billion in the first three days of October alone. This growth signals the possibility of setting an even higher record this month.

DeFi TVL And Total Perps Volume. Source:

DefiLlama.

DeFi TVL And Total Perps Volume. Source:

DefiLlama.

A large wave of investors has flocked to derivatives trading on DEXs, attracted by airdrop programs and encouragement from industry leaders.

If this trend continues, several low-cap altcoins could see strong price rallies. These tokens have market capitalizations below $50 million and are already showing signs of early accumulation.

1. Adrena (ADX)

Adrena is an open-source, peer-to-peer, decentralized perpetual exchange built on Solana.

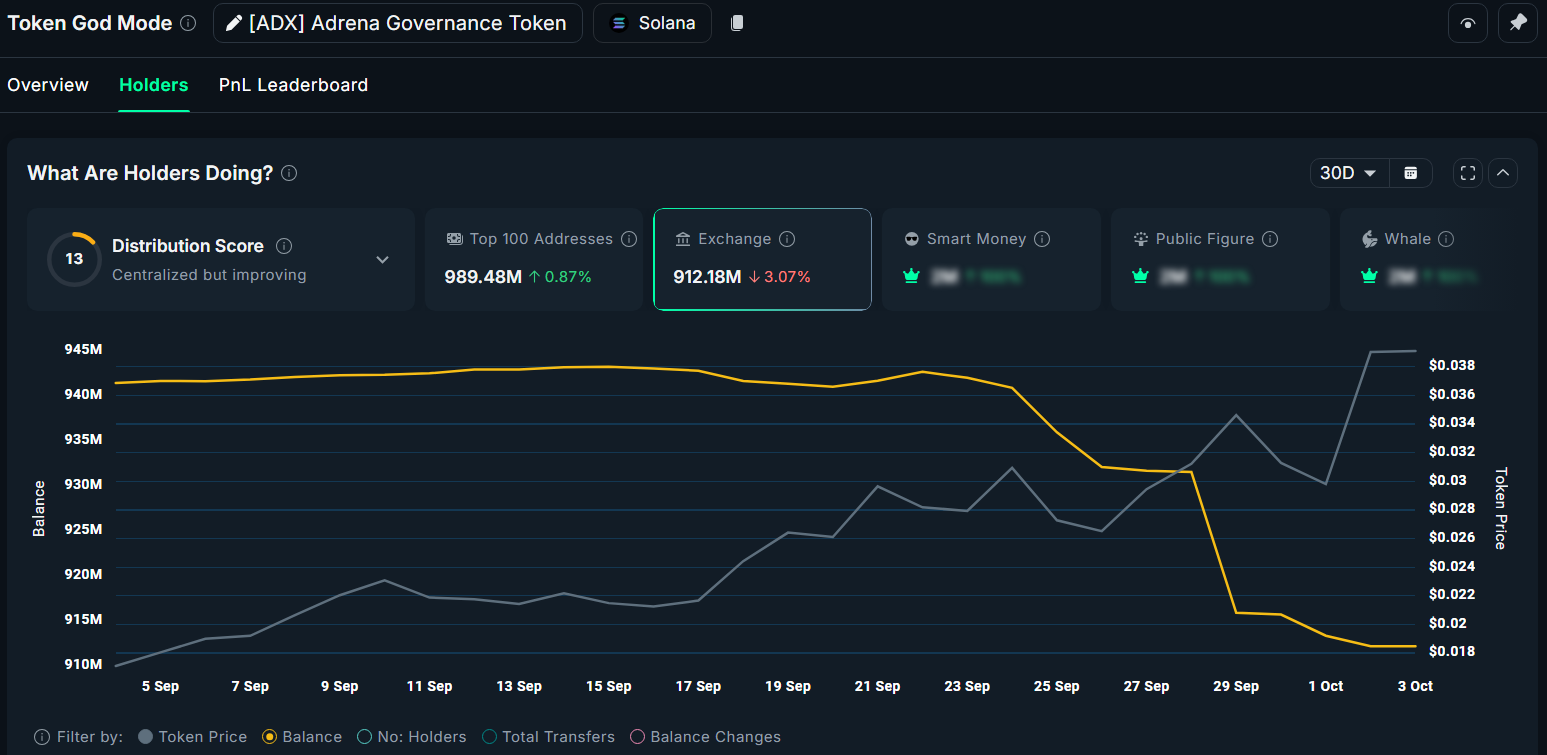

ADX currently holds a market capitalization of under $40 million. Nansen data shows that exchange reserves dropped by more than 3% in the last week of September, while ADX’s price climbed from $0.028 to $0.038. Meanwhile, top whale wallets increased their balances by 0.87%.

Adrena (ADX) Exchanges Reserve. Source:

Nansen

Adrena (ADX) Exchanges Reserve. Source:

Nansen

Although these changes are modest, several factors could support further potential for ADX.

First, DefiLlama data shows that the exchange’s Perps volume recovered to over $600 million in the past month, the highest level since June.

Second, as of October 3, Adrena ranked second in daily trading fees among Solana-based derivative DEXs, only behind Jupiter.

Third, the project appeared on Coingecko’s trending list. These signs suggest Adrena is attracting new traders.

2. Perpetual Protocol (PERP)

Perpetual Protocol is a decentralized futures exchange built on Ethereum. PERP has been listed on Binance since 2020, but its price has dropped nearly 99%. This decline left its market capitalization at just around $22 million.

Renewed investor enthusiasm for Perp DEX narratives has brought attention back to this token.

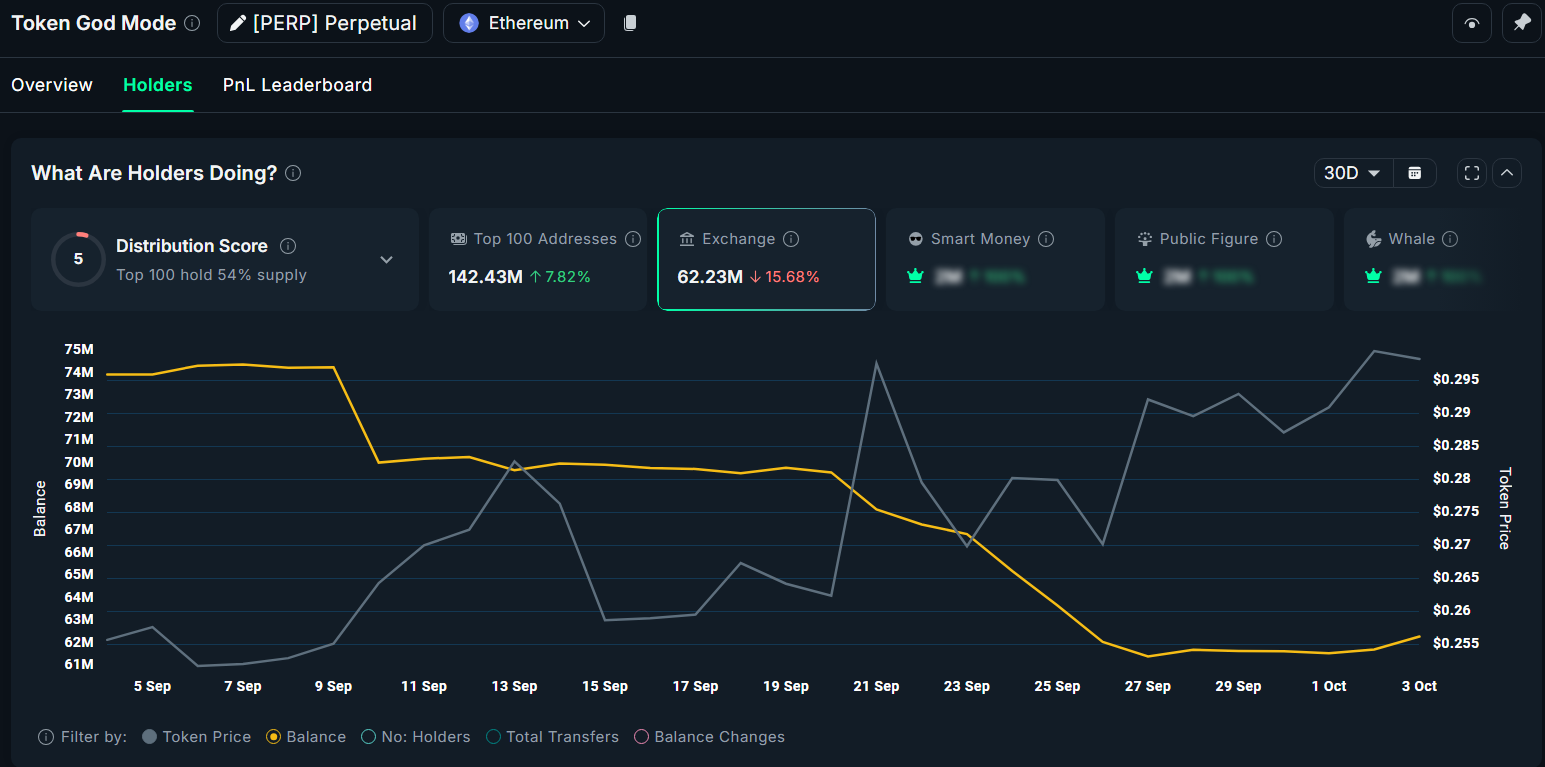

Nansen data shows that PERP’s exchange reserves decreased by more than 15.6% in the past month, while balances in top wallets rose 7.8%.

Perpetual Protocol (PERP) Exchanges Reserve. Source:

Nansen

Perpetual Protocol (PERP) Exchanges Reserve. Source:

Nansen

Some technical analysts highlight PERP’s price structure in 2025. The token is no longer making lower lows and is forming a bullish pattern, suggesting potential gains of more than 130% by year-end.

The combination of on-chain accumulation signals and technical structure could support a bullish scenario for PERP.

3. Bluefin (BLUE)

Bluefin is currently the leading perpetuals platform on Sui. A recent BeInCrypto report pointed to positive signs suggesting the project may attract more investor interest in October.

BLUE’s market capitalization stands at approximately $39 million. DefiLlama data indicates that the DEX generates more than $13.6 million in annual revenue. Bluefin has pledged to use 25% of that revenue, about $3.4 million, to buy back BLUE.

This planned buyback amount equals nearly 10% of the market capitalization. As a result, it could serve as a strong price catalyst and encourage more investors to accumulate BLUE.

Notably, the buyback program began in October. Many analysts expect BLUE’s price to break above $0.20 this month.

$BLUE chart looks really bullish, super clean uptrend with higher highs followed by higher lows.Seems ready for a fresh leg up from here, also because the governance proposal to introduce buyback recently passed, so buybacks will commence today!

— Sjuul | AltCryptoGems (@AltCryptoGems) October 1, 2025

Low-cap altcoins can provide significant profit opportunities but also carry two key risks.

First is liquidity risk. These tokens often have low trading volumes and poor market depth, which can easily lead to large fluctuations.

Second is sentiment risk. If the Perp DEX trend fades, projects lacking real utility may fail to retain users, causing token prices to decline again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia eyes crypto and stablecoins to fight inflation and US dollar shortage

COTI and Houdini Swap Integrate Privacy and Regulatory Compliance to Support Institutional Blockchain Integration

- COTI partners with Houdini Swap to enable confidential cross-chain swaps, preserving user privacy while maintaining regulatory compliance for institutional adoption. - The integration uses non-custodial architecture and split-transaction routing to obscure sender-receiver links while allowing KYT checks on regulated exchanges. - COTI's Garbled Circuits infrastructure supports enterprise-grade privacy, enabling full lifecycle compliance from asset swaps to DeFi interactions without data exposure. - With $

XRP News Update: XRP ETF Momentum and Institutional Interest Face Off Against Technical Challenges in $15.5 Trillion Pursuit

- XRP gains traction via spot ETF approvals and institutional adoption, unlocking a $15.5T market potential as Ripple expands into prime brokerage and cross-border payments. - SEC-approved ETFs from Bitwise, 21Shares, and Grayscale attract $645M in AUM, offering investors regulated access to XRP with fees ranging from 0.34% to 1.89%. - Ripple's $1.25B acquisition of Hidden Road (Ripple Prime) enhances XRP's utility as collateral for $3T in annual settlements, boosting institutional liquidity and adoption.

Bitcoin Leverage Liquidations: Potential Impact on Institutional Involvement in 2025

- 2025 crypto market saw $19B in Bitcoin liquidations after October 10 crash, slashing prices from $126k to $82k amid 70% long-position collapses. - 1,001:1 leverage ratios and 78% perpetual futures dominance created self-reinforcing sell-offs, exposing systemic risks in hyper-leveraged derivatives. - Fed rate hikes and the GENIUS Act's stablecoin rules intensified volatility, forcing institutions to adopt AIFM risk models and RWA diversification. - Post-crisis reforms show $73.59B in crypto-collateralized