Despite Losing Share to Aster, Hyperliquid Still ‘Most Investible,’ Analyst Says

While Aster dominates recent volumes, analyst argues Hyperliquid remains the strongest perp DEX bet, backed by revenue, open interest, and ecosystem expansion.

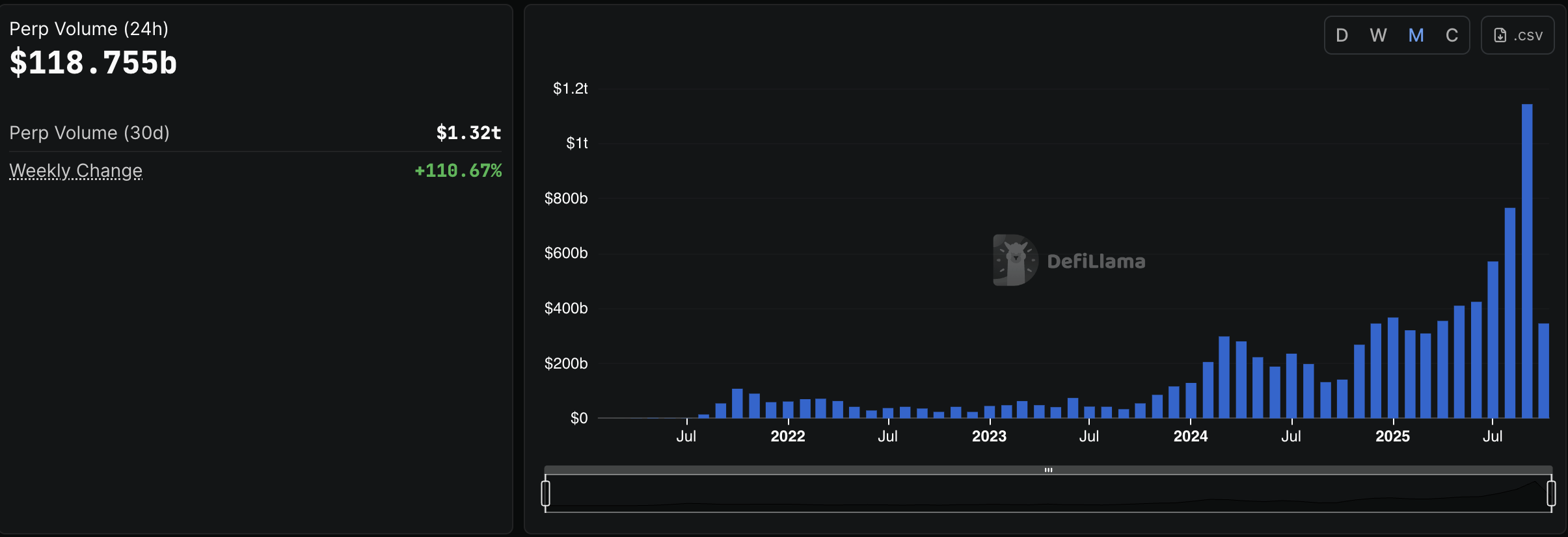

The perpetual futures decentralized exchange (perp DEX) sector has seen unprecedented growth in the past few months, with monthly trading volumes surpassing $1 trillion for the first time in September 2025.

Aster has captured the majority of this activity, even surpassing established players like Hyperliquid. Despite this, one analyst maintains that Hyperliquid remains the ‘most investible’ perp DEX in the market.

Hyperliquid vs. Aster: Why an Expert Still Favors Hyperliquid Despite Market Shift

perpetual futures trading volume surged past $100 billion for the first time on September 28 amid heightened market momentum. Furthermore, data from DefiLlama showed that total monthly volume reached a record high of $1.143 trillion in September. This marked a 49% increase compared to August’s $766 billion.

Perp DEX Monthly Trading Volume. Source:

DefiLlama

Perp DEX Monthly Trading Volume. Source:

DefiLlama

Most of this activity was driven by Aster, which overtook Hyperliquid, the former segment leader. Moreover, on October 2, perp DEXs hit another record, with daily trading volume reaching an all-time high of $118.7 billion.

Yet again, over the 24-hour period, Aster accounted for $81.88 billion, while Hyperliquid managed only $10.28 billion. The shift has dramatically reshaped market dynamics.

Hyperliquid’s share of perp DEX volume has plunged from 45% to just 8%, while Aster’s volume has skyrocketed.

“Over the past few weeks, Hyperliquid’s share of Perp DEX volume has fallen from 45% to 8%. Aster’s volume has grown more than 100X to $300b+ last week. Lighter and edgeX have risen to have comparable volume to Hyperliquid,” DeFi analyst Patrick Scott highlighted.

Still, Scott maintains that despite Aster’s explosive growth, Hyperliquid continues to stand out as the best-positioned perp DEX thanks to its fundamentals.

“Perp DEXs are in a long-term uptrend. As a percent of CEX perps volume, they’ve grown from less than 2% in 2022 to over 20% last month. 10X in 3 years. Hyperliquid has been both the driver and beneficiary of that trend. The challenge recently and why some market participants have questioned Hyperliquid’s is that Binance-related perp DEX Aster has exploded in volume, claiming over 50% market share last week,” he added.

The analyst noted that, unlike rivals relying on airdrop incentives, it has built a sustainable revenue model. The platform trades at a 12.6x revenue multiple and dominates open interest with a 62% share. Open interest is a key metric for liquidity and shows the stickiness of its user base.

“The fact of the matter is that Hyperliquid has managed to not just maintain, but grow its usage in the 12 months since its HYPE airdrop. This speaks to the loyalty of its users and stickiness of its products. This user retention can’t be replicated by incentive programs; it can only be replicated by better products,” Scott added.

He noted that Hyperliquid’s advantages extend beyond perps. As a Layer 1 blockchain, HyperEVM hosts over 100 protocols with $2 billion in TVL and $3 million in daily app revenue. The ecosystem includes native projects like Kinetiq and Hyperlend, as well as big names such as Pendle, Morpho, and Phantom.

Hyperliquid has also launched USDH, a stablecoin backed by BlackRock and Superstate reserves. Its market cap is around $25 million, and its yield supports ecosystem growth.

Furthermore, Scott pointed out that the upcoming HIP-3 initiative will allow builders to create new perp markets by staking 500,000 HYPE.

“This turns creates another supply sink for HYPE, expands the variety of tradeable assets on Hyperliquid, and turns Hyperliquid into infrastructure for other builders to create businesses on,” he remarked.

Lastly, Scott acknowledged that risks remain. A sustained drop in Hyperliquid’s absolute volume, a fall in open interest, or USDH failing to scale could weaken its position. For now, though, strong revenue, loyal users, and expanding growth channels keep it the most investable perp DEX.

Perp DEX Launches Surge Across Ecosystem

Meanwhile, as debate continues over Hyperliquid’s market position, a wave of recent launches has further intensified the perp DEX space. Lighter launched its perp DEX mainnet.

Moreover, TRON founder Justin Sun unveiled SunPerp, the network’s native perp DEX. It officially went live on October 1 during the Token2049 event.

Revealing BounceBit V3 – Big BankA rebasing BB-token standard, a perpetuals DEX and its liquidity pool built into the core.One chain. One exchange. One big bank.And all roads lead to $BB. pic.twitter.com/Kvsemk2GkL

— BounceBit October 2, 2025

Changpeng Zhao (CZ), founder of Binance, has endorsed this influx. He highlighted the surge of new perpetual DEXs entering the market, pointing out that increased competition will help expand the overall sector.

“More players will grow the market size faster. Rising tide lifts all boats. Long term, the best builders win. DYOR. Perp Dex era!” the post read.

As more perp DEXs enter the market, the coming time will tell whether they can maintain sustained interest and growth—or if the current hype will eventually fade.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum's 60 Million Gas Spike: Major Milestone or Foreshadowing $80,000?

- Ethereum’s gas limit hits 60M, supported by 513K+ validators, boosting scalability ahead of Fusaka. - Vitalik Buterin highlights targeted gas cost hikes for inefficient operations to incentivize smart contract optimization. - zkSync’s Airbender innovation enables faster proof generation, paving the way for future gas limit expansions. - Fusaka upgrade (2025) aims to solidify Ethereum’s economic model, with long-term gas targets up to 150M via EIPs. - Despite $2,859 price, analysts project $80K potential

Australia Connects Conventional and Digital Finance Through Groundbreaking Cryptocurrency Regulations

- Australia introduces 2025 Digital Assets Framework Bill, requiring crypto exchanges and custodians to obtain AFSL and operate under ASIC oversight. - The legislation creates two license types: "digital asset platform" for crypto trading and "tokenized custody platform" for real-world asset tokens, with tailored compliance standards. - Small operators with <$5,000 per customer and <$10M annual volume get lighter requirements, aiming to balance innovation with consumer protection. - Projected to unlock $24

Security Systems Technology and ICP Network Expansion: A Cybersecurity-Focused Path Forward for Decentralized Infrastructure

- ICP's decentralized identity and encryption address cybersecurity gaps, enabling secure financial behavior through blockchain innovations. - Cross-chain interoperability with Bitcoin/Ethereum via Chain Fusion drives DeFi growth, unlocking $B+ liquidity through trustless swaps. - Institutional adoption and 30% 2025 price growth reflect ICP's appeal, bolstered by Azure/Google partnerships and 1.2M active wallets. - Regulatory scrutiny and 11% price volatility highlight risks, though technical resilience an

Why ZEC Is Soaring in Late 2025 and Its Implications for Cryptocurrency Investors

- Zcash (ZEC) surged to $9.24B market cap in late 2025 driven by 1,300% transaction volume spikes and 30% shielded pool adoption. - Institutional investors like Cypherpunk and Reliance allocated significant ZEC holdings, signaling privacy assets' growing institutional acceptance. - Zcash's hybrid privacy model - optional shielded transactions with blockchain compatibility - outperformed Monero as privacy demand rose amid data monetization trends. - Ecosystem expansion through OKX relisting and Solana integ