Memecoins lose their mojo as retail flocks to tokens touting utility

Quick Take The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value. The following is excerpted from The Block’s Data and Insights newsletter.

The GMCI memecoin index has remained relatively stagnant at around 220 over the past several months, representing a significant decline from its peak of 600 reached during the height of last year's speculative fervor when tokens like Fartcoin, BONK, and WIF captured the majority of retail trading attention.

This performance contrasts sharply with broader altcoin indexes, particularly the top 30 tokens, which have established new all-time highs since November, suggesting a clear divergence in investor preferences.

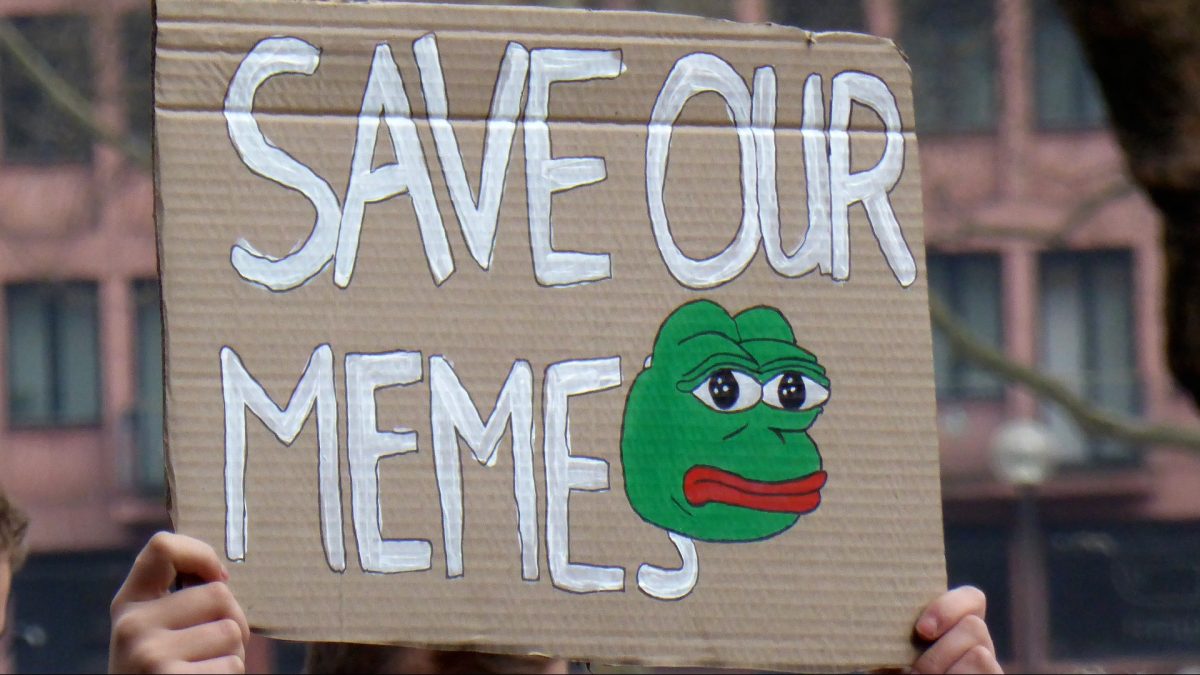

Even established memecoin names such as Dogecoin, Pepe, and Shiba Inu have failed to recapture their previous momentum, indicating the sector's struggles extend beyond newer, more speculative tokens.

The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value rather than purely speculative assets.

Recent project launches such as ASTER and XPL have demonstrated strong market reception, with investors showing preference for tokens associated with actual utility or development roadmaps. This suggests a shift in retail investor behavior, where participants are becoming more discerning about their investments, focusing on a project's ability to drive revenue — a revenue metric, if you will.

While memecoins served as a gateway for new retail participants entering crypto markets last year, the current environment appears to favor projects with clearer value propositions. We're seeing investors increasingly participate in token launches where the project is building tangible products, such as stablecoins, real-world asset tokenization, or DeFi.

This is an excerpt from The Block's Data Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat