$70 billion added to the crypto market in under 30 minutes

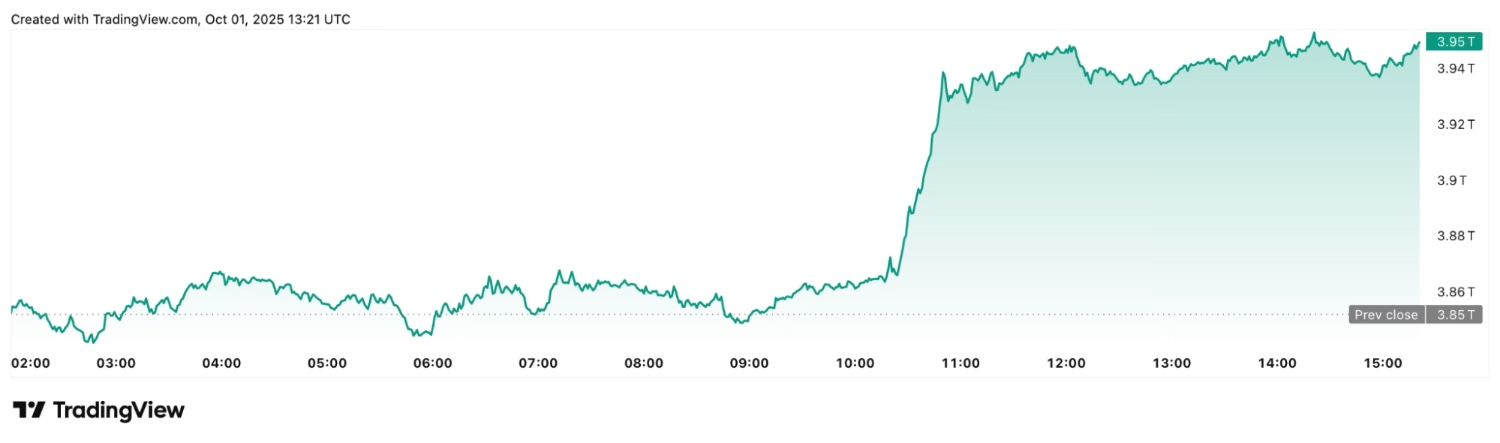

Cryptocurrencies are having an explosive start this month, with $70 billion added to the overall crypto market capitalization in under 30 minutes on Wednesday, October 1.

More precisely, the total value was sat at $3.87 trillion at around 10:25 AM CET (8:25 AM UTC), only to go up to $3.94 trillion at approximately 10:55 AM CET (8:55 AM UTC).

Shortly after, the figure climbed even further, hovering around $3.95 trillion market cap at press time, according to TradingView data retrieved by Finbold.

This marks an approximately $100 billion or 2.5% increase already in ‘Uptober’ from yesterday’s levels, which were around $3.85 trillion.

Among the strongest gainers today in terms of market cap was the privacy coin Zcash (ZEC), which went from the 72nd to the 65th largest crypto in less than 24 hours, being up 40% on the daily chart.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: SGX Addresses Offshore Perp Shortfall as Bitcoin Decline Increases Demand for Hedging

- SGX launched Bitcoin and Ethereum perpetual futures, becoming a first-mover in regulated onshore crypto derivatives to meet institutional demand. - The $187B/year perp market, dominated by Asia, now gains a regulated alternative to offshore platforms with SGX's 22.5-hour trading window. - Perps enable hedging during Bitcoin's 2025 downturn, with SGX's margin-call system prioritizing investor protection over instant liquidations. - Regulatory caution limits access to accredited investors, aligning with gl

Bitcoin News Update: Institutional ETF Adjustments Challenge Key Bitcoin Support Thresholds

- Analysts warn Bitcoin faces 25% drop risk if key support levels fail amid shifting institutional ETF dynamics. - Texas's $5M IBIT purchase highlights growing government interest, but ETFs fall short of direct BTC ownership criteria. - Technical analysis shows Bitcoin trapped in a broadening wedge pattern, with breakdown below $80,000 risking $53k decline. - Institutional rebalancing sees $66M IBIT outflows vs. $171M FBTC inflows, signaling tactical ETF rotation over accumulation. - Abu Dhabi's $238M ETF

XRP News Today: IMF Cautions That Rapid Tokenized Markets Could Intensify Crashes in the Absence of Regulation

- IMF warned tokenized markets like XRP could worsen flash crashes without regulation, citing risks from decentralized systems lacking traditional safeguards. - Report acknowledged tokenization's potential to cut cross-border payment costs but highlighted volatility risks from rapid liquidity loss seen in crypto markets. - SEC's approval of crypto ETFs signals growing institutional acceptance, though regulators emphasize oversight frameworks to mitigate systemic risks. - IMF proposed a global digital marke

Bitcoin News Update: Meme Coins’ Path to Widespread Adoption Depends on ETFs and Clear Regulations

- Meme coins show renewed interest in 2025 as Bitcoin surges toward $90,000 and institutional investors reengage, driven by ETF/ETP launches blurring crypto-mainstream finance lines. - Solana-based BONK and privacy-focused GhostwareOS (GHOST) innovate with ETPs and modular privacy tools, attracting investors through novel value propositions. - Asian market volatility, including South Korea's Upbit hack, and Cardano's declining metrics highlight meme coins' fragility despite short-term technical optimism. -